Elon Musk displays an almost anarchic disregard for the rigid rules and regulations that bind other business leaders of his stature. The Tesla boss, who has clashed with regulators before, has come under scrutiny for recent tweets about his proposed acquisition of Twitter. These had the effect of moving the markets to his advantage by wiping billions off the social media company’s value.

Legal experts are now debating whether Musk’s tweets, which followed an unusual pattern of disclosures to the Securities and Exchange Commission, could be regarded as a ploy to sweeten the deal in his favour (‘tweeteners’, anybody?). For Karen Yeung, an interdisciplinary professor at Birmingham University, the SEC’s current light-touch approach, ostensibly to protect Tesla’s shareholders, is just one facet of a worrying phenomenon she labels “digital enchantment”.

Companies such as Uber, Meta and Twitter may turn the cogs of our modern data-driven digital age but Yeung, who has advised the EU and other public bodies on digital governance, contends that many governments and regulators are too in thrall to them. As such, they accord those companies and their innovators a regulatory latitude not given to other sectors. “We have disclosure rules in relation to the market and I cannot think of a principled objection to exclude Musk from those rules,” she says, citing this as a form of digital exceptionalism that goes hand-in-hand with digital enchantment. Meta CEO Mark Zuckerberg has long proved adept at sidestepping regulators, though he has softened his stance of late.

She adds: “If the head of a big pharma company were a rogue player, you would know that investing in that company might bring you very high returns but also that it’s going to be volatile and you may have to take a hit. Why doesn’t that reasoning also apply to the tech space? Why is Tesla too big or important to fail?”

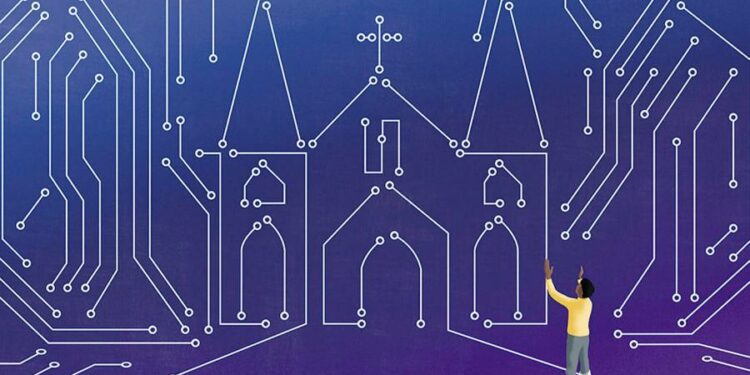

Yeung coined the phrase “digital enchantment” to describe the fairytale narrative commonly attached to digital innovation: that technological advances will solve all of society’s problems while simultaneously creating untold wealth and not impinging on individual rights or privacy.

The spell, she says, is maintained by three illusory tenets: digital solutionism, or a belief that networked digital technologies can immediately fulfil any societal need and solve any problem even in the absence of evidence; the no-ill-effects doctrine, in which the benefits are emphasised and the disadvantages downplayed or ignored; and unfettered innovation as a basic right. This last point encourages society to cultivate a near-romantic devotion to the idea of genius mavericks unrestrained by pesky rule books.

It is the third tenet that brings Musk to mind, with Yeung’s characterisation of the (usually male) private entrepreneur hero who “despite the occasional flaw, courageously risks his labour, capital and energy in the noble quest to solve problems . . . [but] must contend with many villains who seek to obstruct his path, ranging from policymaker, academic expert or civil society activist, all of whom are enemies of progress”.

In this digital free-for-all, norm-breaking is venerated, dissenting voices are condemned as Luddites and the market becomes the ultimate arbiter of success. Public institutions are sidelined, despite being nominal guardians of the public interest. The image of the swaggering digital innovator battling to spring free of archaic regulation is now mirrored in cryptocurrency discussions, which minimise or exclude the roles of central banks and legal courts.

The Online Safety bill, which the UK government introduced to parliament in March, is one attempt to counter the no-ill-effects doctrine. The bill will make tech companies accountable for illegal content such as child pornography, and for harmful (but legal) material that goes against moderation policies, such as cyberbullying.

Whether the legislation will work in practice without threatening free speech is debatable but, in any case, it plucks only at the low-hanging fruit in the orchard of digital harms. Other adverse outcomes, such as biased algorithmic decision-making, are much less visible. It may also become harder to challenge the other tenets that Yeung describes — digital solutionism and the right to unfettered innovation — as the UK forges its own path outside the EU in the hope of becoming a flourishing tech nation.

The route map is, essentially, deregulation with a back-seat regard for democracy, privacy and data protection. There is a critical balance to be struck between allowing future Musks the freedom to push boundaries while grasping that those boundaries, and many other regulations, exist for a reason.