At moments in early 2021, Silicon Valley was awash with talk that live audio discussion app Clubhouse would be the future of social media.

After gaining some traction towards the end of last year, it exploded in 2021 as the fastest-growing social media app in history. It aimed to popularise audio rather than text or pictures as the next big social medium as people looked for ways to communicate in lockdowns, and drew comparisons to Snap or TikTok.

But as the end of the year approaches, Clubhouse’s bubble appears to have burst, as the mania around the app subsided, downloads fell dramatically and the company faced an onslaught of competing products from larger technology groups, such as Meta and Twitter.

Its fast-talking chief executive, Paul Davison, remains adamant that the lull is just part of the typical peak-and-trough lifecycle of a social start-up, and that copycat features from deep-pocketed rivals have not impacted the company “in any real way”.

Indeed, Davison is confident that making money is not a pressing concern, despite relying on repeat investors such as venture capital group Andreessen Horowitz to raise about $310m over several funding rounds. At its most recent funding round in June, the company was valued at $4bn.

“In the future, as we launch more services that allow creators to monetise, I imagine we’ll take some fees there to fund the business,” he said in an interview with the Financial Times. “But we haven’t figured out all of the specifics of that.”

Whether Clubhouse, which Davison says is “well capitalised right now”, can achieve longer-term growth and prove itself as more than a pandemic fad is unclear.

The plan is not to diversify beyond the medium of audio, he said, rather to specialise in it “as an independent company”. Davison is quick to reel off more than a dozen activities that he hopes the platform can support, including “radio and dating and dinner parties and company earnings calls and comedy shows and music festivals”.

He declined to comment on whether the company had been approached by rivals or whether he would be open to a sale.

The 42-year-old former head of cryptocurrency exchange Coinlist built Clubhouse alongside fellow Stanford university graduate Rohan Seth, launching it on Apple’s app store in March 2020 from his basement as the pandemic began to take hold.

“It’s been quite a year,” Davison said. “We’ve had to move really fast. To scale the team, to scale the company, to scale the infrastructure,” he added, noting that Clubhouse has increased the number of employees from about nine in January to 90 today.

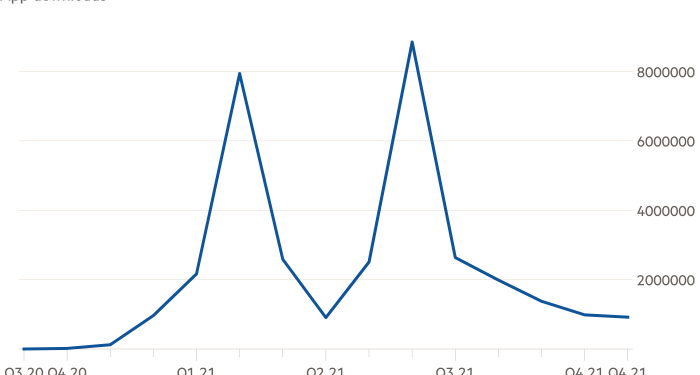

But after topping the app store rankings in multiple countries, in June — a month after it first launched on Android — Clubhouse peaked at nearly 9m downloads, according to data from App Annie. In November, the number fell to 920,000 downloads.

“I can’t point to many brands who have seen such incredible growth and then such incredible shrinkage so close to one another,” said Pete Boyle, a marketing strategist, adding that he had not heard anybody in his professional network talk about the app in the past three months.

Ahead of publication, Clubhouse disputed the App Annie figures, which do not include downloads to tablet devices and do not include re-installs or app updates. Clubhouse said its own data shows 1.8m downloads in November. It declined to share download figures for other months. It also declined to share an active user number.

Davison remains unconcerned. “We’ve gone from a single community of beta testers last year to a global network of many different communities,” he said, pointing to recent growth in geographies such as Thailand. “It’s a big graph now with different clusters that are growing at different times.”

He added that over the course of summer alone, the number of conversation “rooms” created a day more than doubled from 300,000 to 700,000, driven by a rise in the number of private groups in particular.

After he declined to share a more up-to-date figure, the company later said this was “700,000+” rooms per day, adding that there was an “acceleration in growth in recent weeks”.

Despite this, Davison denied ever seeking out Clubhouse’s dizzying rise in the first place, citing the decision to make the app invite-only at first, until July this year. “We’ve never tried to grow. We’ve only tried to not grow,” he said. “I think that when you scale online communities, if you go too quickly, things can break.”

Outside experts, however, recall the company as embodying the Silicon Valley trend of ‘growth hacking’ — deliberately driving explosive growth through cheap, experimental digital marketing.

Andreessen, which led all three of the company’s funding rounds, played a hand in raising its profile, hosting regular sessions and bringing in famous athletes and musicians who had become investors in the firm.

“Some of this activity was directly catalysed by a16z,” Andrew Chen, a partner at the investment firm who is on Clubhouse’s board, wrote in his book The Cold Start Problem.

Meanwhile, early users of the app experienced a barrage of home screen alerts unless they disabled notifications. Clubhouse also initially forced users to grant access to their phone’s address books to invite others to the app before discontinuing the practice.

Concerns about Clubhouse’s data collection, including of address books, has already sparked regulatory scrutiny. French regulators opened an investigation into the company’s compliance with European privacy rules in March, and regulators in Germany have asked for more information on its data collection practices.

Clubhouse said it welcomed conversations with regulators, adding that data protection was a “top priority”. It said that it did not sell user data and only “collects data we need to make the service work for users”.

In the short term, the company is focused on bolstering its new creator monetisation features — funnelling money to the people who host talks on the app via in-room tipping, paywalled private rooms and subscriptions.

In April, Clubhouse announced a partnership with payments company Stripe as part of the push. Davison said the app may eventually begin taking a cut of those transactions, on top of the processing fee earned by Stripe.

As the former chief executive of a cryptocurrency exchange and a proponent of decentralisation, Davison indicates that he may also explore ways to integrate digital assets and much-hyped non-fungible tokens into the app.

“I think that the principles of control and ownership and collaboration, they’re very much in line with how we run the company,” he said. “I’m very bullish.”