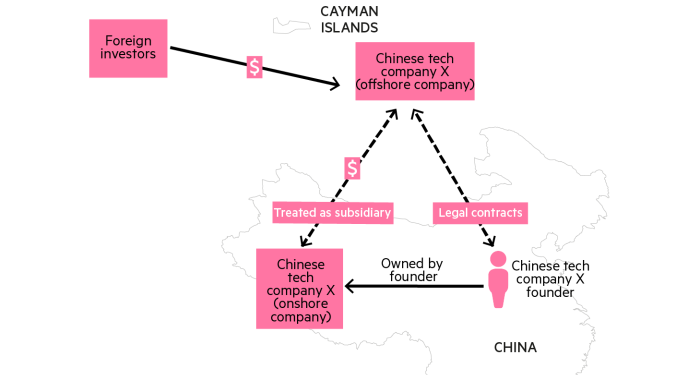

Alibaba filing for its IPO in New York seven years ago gave many investors their first taste of a variable interest entity (VIE), which got around Beijing’s prohibition of foreign ownership of internet assets.

Since the first Chinese internet IPO in 2000, start-ups wanting to list abroad had set up VIE offshore companies. They were domiciled mainly in the Cayman Islands and had a series of contracts that “simulated” ownership in the Chinese company.

Alibaba’s prospective investors had qualms at the time about what they would actually be owning and whether they could be wiped out on the whim of Chinese regulators changing the rules.

That has never happened, but regulators do appear to be bent on closing the VIE loophole from now on, by blacklisting the use of VIEs for companies in sectors that are data-intensive or involve national security concerns.

The list is being formulated by authorities including the state planner, commerce ministry, securities regulator and central bank, report Ryan McMorrow and Sun Yu, and could be published as early as this month. “VIEs are not dead entirely, but essentially they are [for future purposes],” said one source.

This change is taking place amid a wider tech sector crackdown over the past year, which culminated in an announcement last week by ride-hailing group Didi Chuxing that it would delist from the New York Stock Exchange.

The new move could actually be reassuring for foreign investors in existing VIEs, as this may no longer be a grey area. A blacklist that also grandfathered existing structures could help to fully legitimise the VIE legal contracts governing hundreds of Chinese tech companies, said lawyers.

While foreign investors will miss out on new opportunities, China’s own tech industry could end up suffering the most, says Lex. Beijing has aggressively pushed for self-sufficiency in Big Data, but the effort is being driven by private, early-stage companies that could use plenty of funding from international investors. Unless the government steps in with substantial financial support of its own, its tech ambitions could take much longer to be fulfilled.

The Internet of (Five) Things

1. AWS outage irks Adele fans

An outage at Amazon Web Services, the cloud arm of Amazon, rippled through the online economy on Tuesday, crippling services used by millions of people. Among the most distraught were fans of the British singer Adele who had been hoping to snap up the first tickets on Ticketmaster to her upcoming Las Vegas residency. Richard Waters’ latest column looks at how AWS’s new innovations could make every business a cloud company.

2. Apple reaches quiet truce on data use

Apple has allowed app developers to collect data from its 1bn iPhone users for targeted advertising, in an unacknowledged shift that lets companies follow a much looser interpretation of its controversial privacy policy, reports Patrick McGee. This week’s #techAsia newsletter says the festive season is turning into a nightmare for Apple, with a lack of parts leaving it millions of units short of iPhones and iPads.

3. Smart cars will fuel chip shortages

The auto industry’s move to electric and autonomous driving is set to collide with tech’s need for the same high-end chips, writes June Yoon. From behind the wheel of the latest electric models, FT reporters talk about the cars, the technology and the companies and countries that will come out on top.

4. Facebook removes Myanmar army-linked biz pages

Meta, the company that owns Facebook and Instagram, has removed pages, groups and accounts representing businesses controlled by Myanmar’s military, which seized power in February. The move came a day after groups representing Muslim Rohingya refugees in the US and the UK filed a lawsuit seeking $150bn from the company.

5. Monzo back on track after Covid blow

British digital bank Monzo’s valuation has surged to $4.5bn, an increase of more than 200 per cent since the start of the year, as thousands of new customers helped double revenues. The rising valuation follows a $500m funding round, led by Abu Dhabi Growth Fund.

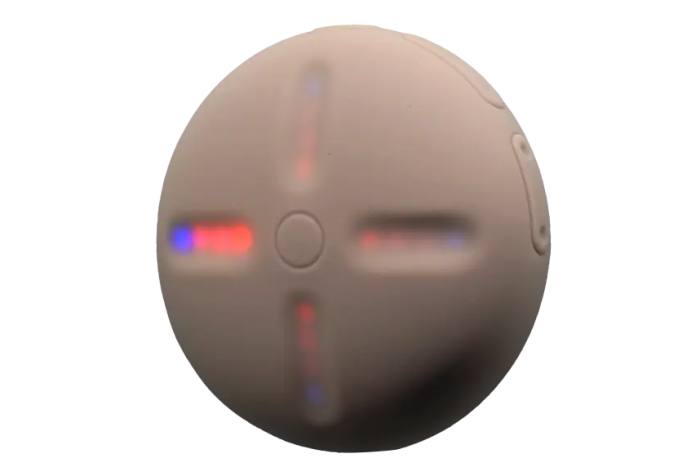

Tech tools — Kanye and Kano’s Stem Player

This soft, skin-toned silicon device allows you to remix music in real time. It comes loaded with Donda, the latest album by Ye (formerly known as Kanye West), writes Cristina Criddle.

The musician has launched the pebble-shaped mixer with London-based computing start-up Kano. On the player, you can adjust four different stems, or tracks, of a song. For example, one stem might have the bass, another vocals and another might have drums or sound effects. You can change the volume, speed, reverse them, create loops or add effects. The lines are lit up by colours, handpicked by Ye, and respond to touch with a little vibration.

When you’ve finished tinkering, you can lock the stems and record your new track into the device to download through its website (stemplayer.com or kanyewest.com).

You can also upload your own songs to the player, which will split the audio into four stems. The player struggled a little with this when we tried it out, either not isolating the tracks or not uploading the MP3.

This is fun and creative to play with, and you can see budding musicians and producers getting excited. But at $200, it is still a high price for a beige computer with a few glitches.