Might Big Tech enjoy state-subsidised bond market borrowing costs? An analysis by the IMF’s Nordine Abidi and the ECB’s Ixart Miquel-Flores suggests investors demand an artificially low risk premium from the likes of Amazon and Alphabet on the assumption that no sane government would allow them to fail.

This isn’t just mildly annoying given how expertly such companies minimise the taxes they pay. The fact that the bond market is implicitly acknowledging that Big Tech has become too big fail should set regulatory alarm bells ringing. But first to the findings summary:

On the macro side, the paper suggests that largest tech companies experience a funding advantage — of about 30bps on average — from 2014 to 2021. Our estimates suggest that the (implicit) subsidy amounts to around $2bn per year and has been steadily increasing for most of the observed time covered, especially in the wake of the COVID-19 pandemic. Although the magnitudes of the estimates remain contained, we find that expectations of government support seem to be embedded in the option-adjusted yields of bonds issued by large US tech institutions. In other words, we find that bondholders of BigTech institutions appear to have an expectation that the government will (possibly) shield them from losses in the event of a ”tech failure” and, as a result, they do not accurately price risk. This expectation of government support constitutes an implicit discount of large tech institutions, allowing them to borrow at subsidized rates.

Abidi and Miquel-Flores stress that there are plenty of other reasons why bonds issued by companies considered TBTF might trade at such competitive spreads.

The largest firms in most industries receive a bond funding advantage relative to smaller firms. They also benefit from economies of scale, easier access to funding and more liquid bonds, the pair write. Yet they still found a “substantial size funding advantage exists for tech firms even after controlling for the effect of size on credit spreads for non-tech firms”.

Companies like Alphabet and Apple aren’t the first to have enjoyed de facto subsidies. Abidi and Miquel-Flores argue that Big Tech is as structurally important today as the biggest banks were pre-2008 — though the size of the funding advantage they experienced back then remains up for debate.

One paper found that “implicit government guarantees“ lead to funding advantages of up to 1.21 percentage points for the very biggest banks. Less dramatic in its conclusions is a 2013 report from Goldman Sachs:

Within the universe of bond-issuing US banks, the six largest banks did indeed experience a slight funding advantage — of just 6bp on average — from 1999 until the financial crisis began in mid 2007. The advantage widened sharply during the crisis, but then reversed to a significant funding disadvantage for most of 2011 and 2012. Today, the bonds of these six banks still trade at a roughly 10bp disadvantage to the bonds of other banks.

Either way, institutions deemed too big to fail have a nasty habit of testing the theory. The term might even be self-fulfilling. As a boss, you’re more like to take on risk if you suspect the government would fly to your rescue. Implicit guarantees, Abidi and Miquel-Flores say, could also “create competitive distortions, reduce market discipline and thus further increase the odds of economic stress in the future”.

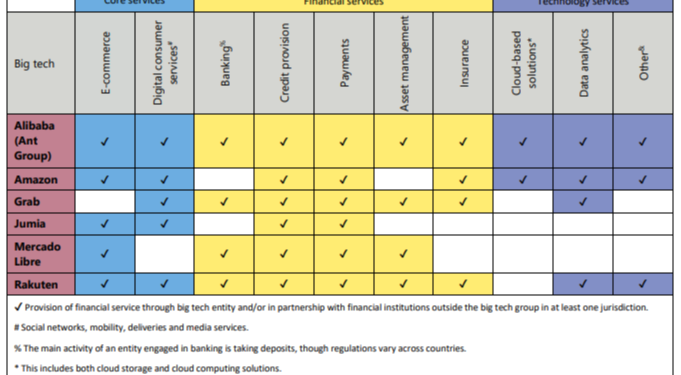

It therefore makes sense to plan for a “tech crash” — even if we don’t know what one might look like. Potential triggers include cyber attacks targeting finance’s growing reliance on Big Tech cloud computing software.

Any tech crash would “significantly affect global foreign exchange, financial markets and integrity of data,” Abidi and Miquel-Flores said. “The collapse or service failure of a single Big Tech could potentially pose a serious threat for the continuity of the provision of financial services, together with a negative impact on markets, consumers, financial stability and the economy as a whole.”

That and the fact we’re all potentially paying $2bn a year towards Big Tech’s R&D budget seems like reason enough for regulators to tighten the screw.