Hello, this is Kenji from Hong Kong with your final #techAsia edition of 2021. Chip shortages have been a big theme this year, but now there are predictions of a serious glut (The Big Story). Another favourite topic was digital currencies, and the head of UK intelligence tells the FT of risks related to China’s digital renminbi (Mercedes’ top 10). We cannot leave the US-China tech rivalry, where the latest victim is SenseTime, alleged to be part of Beijing’s military-civil fusion strategy (Our Take). Wishing you all a Merry Christmas, Happy New Year and see you again on January 5!

The Big Story

A vast increase in semiconductor production capacity centred on Asia is raising fears that the current unprecedented global chip shortage may evolve into a big glut, according to this Nikkei Asia analysis.

Key developments: Industry organisation SEMI estimated in June that construction on almost 30 fabs will start by the end of 2022. These are being built all over the world, but in Asia the concentration is greatest, with Taiwan, Japan, South Korea and Malaysia all building big projects (see Art of the deal).

SEMI predicted that global semiconductor equipment investment for front-end fabs, where the silicon wafers are processed, will be almost $100bn next year after topping $90bn in 2021 — both records. That would mark a “rare three consecutive years of growth that began in 2020, bucking the historical cyclical trend of a one- or two-year expansion followed by a year or two of tepid growth or decline”, SEMI said.

Veteran industry watcher Akira Minamikawa is one of several analysts who foresees a glut. “I’ve never seen this level of government money poured into the semiconductor sector,” he said. At some point, “there will be an imbalance between the supply and demand for sure, and it’s a matter of when that is the question”.

Upshot: The chip industry has always been highly cyclical. Research group IDC warned of potential overcapacity in 2023 as large-scale capacity comes on stream toward the end of next year.

Mercedes’ top 10

-

Exclusive: China’s digital renminbi could become a tool to surveil users and exert control over currency transactions, the UK’s spy chief has warned. (FT)

-

Exclusive: The US will place eight Chinese companies, including dronemaker DJI, on its investment blacklist. (FT)

-

Japan’s Panasonic will drastically scale back its television business as it shifts production to Chinese manufacturer TCL. (Nikkei Asia)

-

South Korea is creating a team of researchers to ensure supplies of critical industrial materials as the US and China decouple. (Nikkei Asia)

-

Exclusive: China is preparing a blacklist that will restrict tech start-ups from using a popular mechanism to list overseas. (FT)

-

Japan’s SoftBank is closing in on its first Spac merger by taking public a Walmart-backed artificial intelligence company in a deal worth $5.5bn. (FT)

-

China’s app shock: regulators have removed 106 apps from domestic app stores for “excessive collection of personal information”. (Nikkei Asia)

-

China’s SenseTime, one of the world’s leading AI companies, has postponed its $767m IPO in Hong Kong after a US blacklisting (see Our take). (FT)

-

Amazon does not favour merchants that use its shipping service, said the company’s director in Vietnam, in response to accusations of preferential treatment. (Nikkei Asia)

-

Binance, the operator of one of the world’s largest cryptocurrency portals, said it will close its digital token exchange in Singapore. (Nikkei Asia)

Our take

Chinese artificial intelligence software developer SenseTime’s decision to pull the plug on its Hong Kong IPO on Monday was triggered by the US allegation that it was part of the country’s military-civil fusion, or MCF, strategy. Despite a denial from the company, that is how the US Treasury department classified it. Hence, the $767m deal has been held up.

So what is the difference between MCF and the military-industrial complex, as in the US? Jacqueline Deal, chief executive of Washington-based defence consultancy Long Term Strategy Group, said the Chinese concept was “very different” from a similar one in the west.

Speaking at an online forum hosted by the University of Tokyo last week, she explained that MCF is about “how the party-state should organise its economy, society and its defence industry, or wealth and power, broadly. It’s based on the notion of how these two — wealth and power — get produced and go together in a way that is mutually reinforcing.”

What motivated Washington was a belief that Beijing was taking advantage of an “asymmetric” relationship with the west, under which it is “exploiting or determined to use its access to our system to make [itself] more competitive”, according to Deal.

“MCF should be seen as an ambitious, new type of industrial policy,” said Lim Jaehwan, professor at Aoyama Gakuin University in Tokyo. He added that the main goal for Beijing was “to enhance the innovative capacity of high-tech industries and also of strategic industries”.

As alert levels rise in the west, one of China’s answers is to call their companies back to its shores. China’s securities regulator has approved the homecoming Shanghai listing of its largest telecom operator China Mobile after it was earlier kicked out of New York.

— Kenji

Smart data

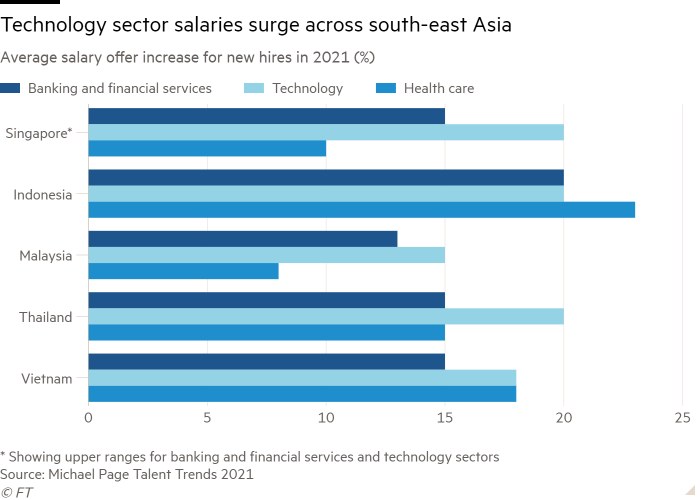

South-east Asia’s tech take-off is creating an environment in which global giants, ambitious start-ups and emerging unicorns are competing for talent.

The result is unsurprising. Job switchers can command salary increases of 15 to 20 per cent in Indonesia, Malaysia, Singapore, Thailand and Vietnam, according to data from recruitment agency Michael Page.

Fintech is one industry in which a pronounced talent shortage has taken hold. “Most fintech professionals typically have a tenure of less than five years, with the majority leaving after one to two years, while over a third change jobs after three to five years,” said Nesan Govender, managing director for talent and organisation at Accenture Southeast Asia.

Spotlight

Park Kwan-ho is a pioneer in cryptocurrency-based games. And since his company, Wemade, launched Legend of Mir 4 in August, its stock price has risen more than 400 per cent. Wemade is now capitalised at about $4.5bn, making a billionaire of Park, who owns 45 per cent of the company.

Players of Legend of Mir 4 earn items that can be exchanged for cryptocurrency. The MMORPG (massively multiplayer online role-playing game) has been released in 170 countries and has garnered 2m monthly active users.

It is also making waves in cryptocurrency markets. Wemix, a token issued by Wemade, has become one of the most actively traded on some South Korean exchanges. Rival game developers are racing to launch crypto-based games of their own.

Art of the deal

US chip giant Intel is set to invest $7.1bn to establish a state of the art semiconductor production facility in Malaysia. The plant will be based in Bayan Lepas, near an international airport in the northern state of Penang.

There were sparse details available about the planned investment as this newsletter went to press on Wednesday. The decision came against a backdrop of semiconductor shortages across the region, and Intel already relies on Malaysia for some of its chip packaging operations.

Other recently announced chip investments include Samsung Electronics’ $17bn plan to build a chip factory in Texas. Taiwan Semiconductor Manufacturing Company, meanwhile, said in June that it had started construction on a $12bn chip plant in Arizona.

In Asia, US chip material maker Entegris said this month that it planned to more than double its investment in Taiwan and build its biggest manufacturing site on the island. The company will invest $500m in Taiwan over the next three years, up from previous plans of $200m.