Hello, Ken here from Tokyo. It is sad to see Japan shut its doors to foreign travellers in a panicked reaction to the new Covid-19 variant. This week, we have plenty of scoops and originals. Our Big Story reveals how global supply chain troubles are forcing Apple to slow down iPhone production in the middle of the holiday shopping season. Meanwhile, Mercedes’ top 10 features another restriction on private-sector companies by Chinese authorities as well as Japan’s new rules on “stablecoins”. See you next week!

The Big Story — Exclusive

The festive season is turning into a nightmare for Apple. Shortages of chips and other components have bedevilled production schedules, leaving Apple millions of units short of iPhones and iPads as Christmas shopping revs up, according to this Nikkei Asia exclusive.

Of course, Apple is not alone in grappling with supply shortages. Many smaller peers are even more badly affected.

Key implications: For the first time in more than a decade, assembly of iPhones and iPads was halted for several days due to supply chain constraints and restrictions on the use of power in China, multiple sources with knowledge of the situation told Nikkei.

“Due to limited components and chips, it made no sense to work overtime on holidays and give extra pay for front-line workers,” a supply chain manager involved told Nikkei Asia. “That has never happened before. The Chinese golden holiday in the past was always the most hustling time when all of the assemblers were gearing up for production.”

Apple is one of the world’s most impressive manufacturers. It makes more than 200m iPhones, 20m MacBooks, 50m iPads and 70m pairs of AirPods annually.

Upshot: In many countries, it is now too late for consumers to buy some Apple products in time to give as holiday gifts.

Mercedes’ top 10

-

Exclusive: China is planning a blacklist that will prohibit companies in sensitive sectors from going public overseas through a legal mechanism that has allowed domestic tech giants to raise billions of dollars from international investors. (FT)

-

SenseTime, the Chinese artificial intelligence company, is seeking a valuation of up to $17bn in a Hong Kong IPO. (FT)

-

Exclusive: Japan is imposing restrictions on issuers of “stablecoin” cryptocurrencies as a way to lower risk for digital currency users. (Nikkei Asia)

-

Hong Kong’s online finance group WeLab will buy a Jakarta bank to spearhead its online banking foray into Indonesia. (Nikkei Asia)

-

Japan has doubled its number of tech and science start-ups worth more than $881m this year, to a total of six. (Nikkei Asia)

-

South Korean electronics group Samsung is reshuffling its management for the first time in four years as it tries to gain an edge over Apple in consumer electronics. (FT)

-

Passengers will have to wait until China’s borders reopen to ride a new high-speed train to Laos, which opened last week and cost $6bn — or one-third of Laos’s GDP. (Nikkei Asia)

-

A new Japanese camera can “see in the dark”. (Nikkei Asia)

-

Japan’s Toyota has picked North Carolina as the site of its $1.3bn electric vehicle battery plant in the US. (Nikkei Asia)

-

The FT’s Siddharth Venkataramakrishnan argues that business schools should teach how regulation can help drive technological innovation.

Our take

The absence in Japan of homegrown global tech giants such as Google or Facebook has nurtured shades of an inferiority complex.

Some complain that the nation is short of investors willing to take risks and fund start-ups’ growth. Others have argued it is partly because Japanese people value hardware more than software even in the internet age, which basically runs on software. In fact, computer vendors used to have a hard time charging fair fees for software when they sold systems to companies.

Now, they are hearing good news. A recent Nikkei survey of 175 venture capital-backed Japanese start-ups with a valuation of more than ¥1.7bn ($15m) showed that a majority of VC-funded start-ups today were software-based. Led by Preferred Networks, which develops deep-learning AI platforms and applications and is valued at $3.15bn, AI, cloud services and other software start-ups are thriving.

On another positive note, global venture capital firms such as Sequoia and Bain have started investing in Japanese software-based start-ups. These investors tend to encourage portfolio companies to pursue growth beyond domestic markets while remaining privately owned. As better start-ups tend to choose such global backers, the trend may lead Japanese VCs to change a bad habit of pressuring their portfolio companies to go public prematurely.

One obstacle, however, may be talent. Many Japanese parents have preferred their children to work at old but stable corporations rather than starting or joining start-ups. But this perception may also be changing as they repeatedly see executives of big corporations apologise at televised news conferences for scandals from safety-inspection frauds to system failures. In that sense, big corporations’ poor management may prove an impetus behind the refreshing of Japan’s tech industry.

— Ken

Smart data

Hong Kong had a lacklustre year for new stock listings in 2021, hampered by uncertainty over the future of China’s tech groups and whether they will get the green light to sell shares in the territory.

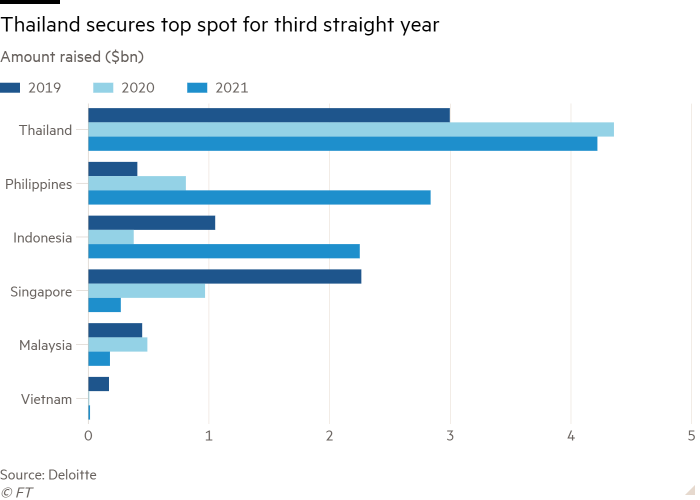

But it has not all been gloomy for Asia’s capital markets, as Masayuki Yuda of Nikkei Asia finds in a deep dive of south-east Asian initial public offerings. Companies in the region have raised more than $10bn from IPOs this year, the highest figure since 2017.

But that combined figure for Thailand, the Philippines, Indonesia, Singapore, Malaysia and Vietnam remains far below the $26bn raised in Hong Kong as of last week (which was nonetheless down 10 per cent year on year for the territory).

Still, the rapid growth of listings in the Philippines and Indonesia in particular — where the amount raised through IPOs has increased threefold and sixfold, respectively — underscores the trend of investors turning to equity investments in fast-growing markets.

Spotlight

Toby Xu has been appointed Alibaba’s new chief financial officer, as the ecommerce group seeks to reverse slowing growth in the face of lagging momentum in the Chinese economy and intense competition from domestic rivals.

Xu replaces Maggie Wu, the longstanding finance chief, who guided the group through three public listings and is known among analysts for her calm demeanour and for subtle jabs at spendthrift competitors.

Like Wu, Xu moved to Alibaba from one of the Big Four accounting firms, joining the group three years ago from PwC. He initially joined as special assistant to Alibaba’s chief executive, familiarising himself with the group’s sprawling business before taking on the role of deputy finance chief in 2019, leading several partnership deals, including with Starbucks.

Xu’s appointment comes at a pivotal moment for Alibaba, with government regulatory action breaking up its once monopolistic grip on China’s ecommerce market. Last month, the group slashed its growth prospects in response to sharply lower growth in Chinese consumer spending and increasingly fierce competition from established rivals such as JD.com and Pinduoduo as well as new entrants ByteDance and Kuaishou.

When Xu takes up the role in April 2022, he is expected to carry on with Wu’s plans of pursuing investments that will increase Alibaba’s ecommerce market share in China’s lower-tier cities and in grocery shopping.

Art of the deal

Nvidia’s planned acquisition of SoftBank Group-owned chip designer Arm has suffered another setback in the US after regulators filed a lawsuit to block the deal, saying it would stifle innovation in next-generation technologies.

Singaporean super app Grab failed to woo investors on its first day of trading in the US last week after going public through a merger with an already-listed special purpose acquisition company. The backdrop of the Omicron coronavirus variant and Grab’s increasingly competitive environment in south-east Asia clouded investor sentiment.

ExxonMobil plans to build a network of carbon capture and storage facilities across south-east Asia to store carbon emitted from Singapore’s power stations and factories.