Alibaba has reported its slowest quarterly sales growth since its 2014 public listing, as the Chinese ecommerce giant was hit by Beijing’s regulatory crackdown on technology groups and rising competition.

The group said on Thursday total revenue grew by only 10 per cent to Rmb243bn ($38bn) in the final three months of last year, with the slowdown at its core ecommerce business deepening.

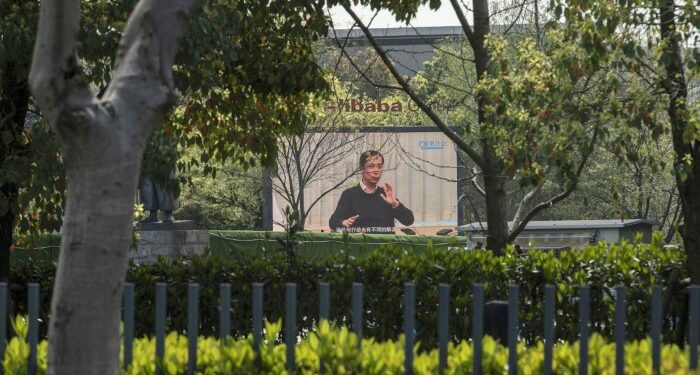

Alibaba chief executive Daniel Zhang blamed China’s slowing economic growth and sliding retail sales because of Covid-19 as well as increasing competition from other tech groups.

Its results come as China’s long reigning ecommerce giant faces tougher competition from traditional ecommerce groups such as Pinduoduo and JD.com as well as newer upstarts like ByteDance, which hawks goods through livestreaming and short video.

Alibaba’s operating income plunged 86 per cent from a year earlier, when including a goodwill impairment charge. Excluding the charge, operating income was down 34 per cent year on year to Rmb32bn.

Alibaba’s Hong Kong shares fell 7 per cent on Thursday amid a broad market sell off ahead of the results. The company had last year already cut its sales forecast for 2022 blaming “softer market conditions”.

Maggie Wu, chief financial officer at Alibaba, said the company had repurchased about $1.4bn worth of shares in the quarter, as the group’s share price plumbed to lows not seen in several years.

Profits from Jack Ma’s Ant Group continued to flatter Alibaba’s bottom line, with the fintech group contributing Rmb5.8bn in income for the quarter. But Alibaba said the increasing profits were mainly due to Ant’s investment gains.

Alibaba’s results come as Chinese authorities step up scrutiny of Ant. Last month, the company was implicated in a corruption scandal, while a state-owned asset manager also unexpectedly pulled out of a deal to invest in its lending arm, a setback to its government-led restructuring.

Chinese regulators have also been questioning private and state-owned companies about links to Ant, including demanding information from companies that have taken money from the group, according to two people briefed on the matter. Bloomberg News was first to report the checks.

Ant declined to comment.