The sky is the limit for the tech aspirations of satellite communications companies. Their shareholders have more mundane priorities, such as cash flow and dividends.

That would explain the market’s reaction to reports that France’s Eutelsat plans to merge with privately held OneWeb. The shares plunged 17 per cent. The deal would make strategic sense. But Eutelsat investors are dismayed by a rumoured allocation of half the shares in the combined business to shareholders in smaller partner OneWeb.

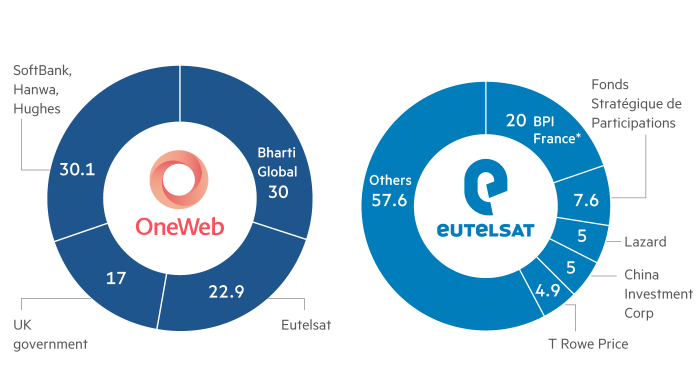

The all-share deal could be worth at least $3.1bn. The French group already holds a 23 per cent stake.

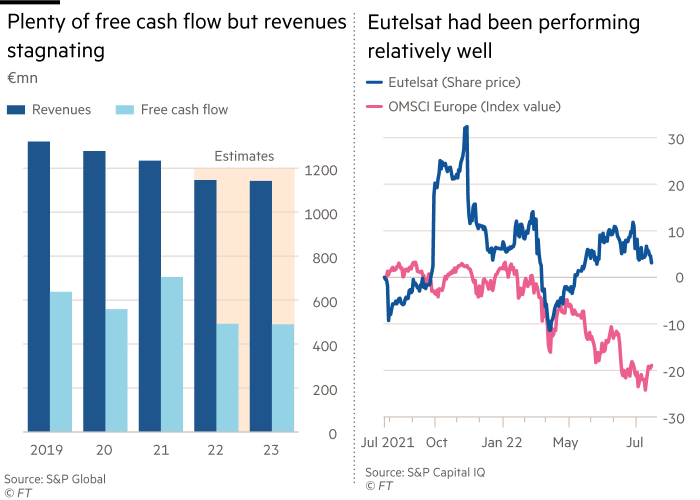

Eutelsat lacks growth but has the finances to pay for some with OneWeb. About three-quarters of the former’s top line comes from TV broadcasting and other video content using geostationary satellites. Revenues to June are forecast at €1.1bn, down 13 per cent over three years.

OneWeb is an early adopter of low-earth orbit technology. It aims to provide seamless data connections using constellations of satellites. It should be able to launch its service earlier than most rivals. Currently lossmaking, it generates little revenue.

The UK government has put money into OneWeb alongside Eutelsat and owns 17 per cent. Analysts expect only a handful of LOE projects, including OneWeb’s, to complete. It has some deep-pocketed rivals, including Elon Musk’s Starlink and Project Kuiper from Jeff Bezos.

Eutelsat has the resources to help. Analysts forecast free cash flow will dip below the recent €600mn annual average. But the figure is still hefty compared with a €2bn market value, supporting a dividend yield of more than 10 per cent.

OneWeb’s investment needs will reduce that. Eutelsat will also have to keep a mix of private and state investors happy. The French state, through investment arm BPI, currently owns a fifth of Eutelsat. Bharti Global, with 30 per cent of OneWeb, should remain top shareholder of the combined group.

Eutelsat needs a new growth strategy. If deal terms are as expected, it would appear to need a new investor relations strategy too. This would involve jettisoning yield-hungry minority investors in favour of starry-eyed risk seekers.