Fintech has been in a funk this year and the mood of start-ups must have darkened further on Monday’s news that Apple was getting into the buy-now-pay-later business.

Sebastian Siemiatkowski, boss of the leading BNPL pure-play Klarna, was putting on a brave face: “It is a great win for consumers worldwide that Apple is now embracing a better form of consumer credit,” he tweeted magnanimously.

But Sid Venkataramakrishnan and Tim Bradshaw report the arrival of a Big Tech player with a pre-existing payments infrastructure could only mean more competition for a sector already facing the threat of a recession, the likelihood of higher defaults and the promise of tighter regulation.

Before Pay Later, Apple was already building a formidable array of financial services, with its Apple Card credit card, and Apple Pay enabling millions of contactless payments. It also previewed its tap-and-pay iPhone-to-iPhone service on Monday, which can remove the need for merchants’ payment terminals.

It’s not only Big Tech that is encroaching on the BNPL specialists. Digital bank Zopa said today it was launching a service in the UK for “BNPL 2.0”, an evolution of BNPL that is set to be regulated. Zopa will run credit checks and affordability tests for all its users and focus on big-ticket items costing between £250 and £30,000.

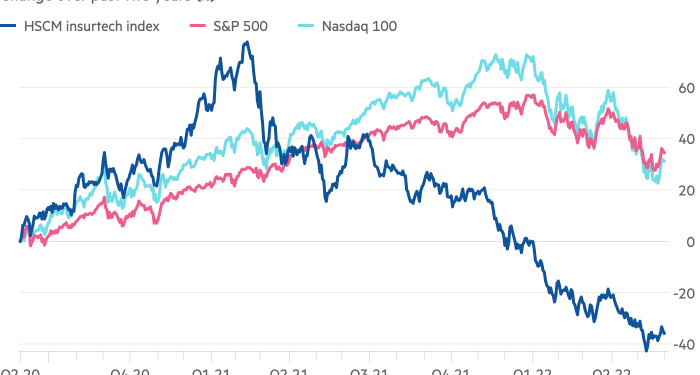

Elsewhere. insurtech has been the hardest hit subsector of fintech, with Lemonade, Hippo and Root among the biggest casualties of the rout in tech stocks, reports our Insurance correspondent Ian Smith. All three’s shares are down more than 85 per cent since listing, after they booked net losses of $1.1bn between them last year.

This week’s #fintechFT newsletter says that after record-breaking figures for fintech fundraising in Europe in the first quarter, investors are expecting a downturn in valuations and funding rounds. Deals in blockchain and Web3 companies have been boosting the numbers, but the crypto market crash is even dampening interest in this hot fintech fashion.

The Internet of (Five) Things

1. Netflix de-Faanged but still spending

Talking of underperforming tech shares, Netflix is down 71 per cent from its high point last year. That eclipses the sell-off at Apple, Alphabet, Facebook/Meta and Amazon — aka the other Faang stocks. Lex says paring its content budget should help, but that risks an even heavier loss of subscribers.

2. Top TikTok exec replaced after culture clash

The TikTok executive at the centre of a culture clash with employees at the viral video company’s UK operation has been replaced in his role after making comments that he “didn’t believe” in maternity leave. Joshua Ma, a senior executive at Chinese owner ByteDance, will “take some time off” following an FT investigation, which revealed Ma’s comments at a dinner with employees of TikTok’s London ecommerce team.

3. Saudis embrace Embracer, Leo seeks PS5

Saudi Arabia’s sovereign wealth fund has spent $1bn on a stake in Swedish gaming company Embracer Group as it deepens its push into the global games market. It earlier acquired Modern Times Group’s esports division for $1bn, along with the competitive multiplayer tech platform Faceit. Meanwhile, Leo Lewis is desperately trying to acquire a PlayStation 5.

4. Making Toshiba great again

Leo has also been relating the Toshiba saga in an FT video and, with Kana Inagaki, interviewing CEO Taro Shimada on his search for a deal that “makes the company great” again.

5. Creditors pushed NSO to keep selling spyware

Credit Suisse was among creditors pushing for NSO Group to keep selling its Pegasus spyware to new customers, just weeks after the US blacklisted the Israeli company, an FT investigation has discovered.

Tech tools — Blink video doorbell

I was a Ring video doorbell customer and Blink security camera user before they were bought by Amazon and have watched with interest as the company has failed to merge the two and instead allowed them to trespass on each other’s territory. So today we have the UK launch of the first Blink video doorbell. I actually replaced my battery-powered Ring with a wired version yesterday, so am interested in how Blink’s product differs.

First off, it allows you to run it off batteries (Blink’s strength has always been its frugal battery use) or to wire it into your system, rather than offering separate products. The Blink is cheaper than most of Ring’s bells but at £50, it is the same price as the Ring wired version. It lacks a key accessory for me — a plug-in chime that I use upstairs to hear the doorbell better (although Blink says you can use its Mini camera as a plug-in chime).

Other than that, features are similar — two-way audio, HD video, motion and chime app alerts and Alexa enabled. Tom’s Guide reviewed it when it first became available in the US and found some limitations.