For all Silicon Valley’s tech dominance, the US has lagged Europe for much of this century in advances in mobile phone networks and payment systems.

Crystal-clear voice calls and contactless payments came to the continent long before their widespread availability in America. Chip-and-pin credit cards had only arrived a decade after their adoption in Europe, while New York’s subway system just moved in 2021 to express contactless payments at barriers with your phone.

I returned on Monday from three weeks in the US, where I was struck by how far payments have come since my last visit five years ago. A Covid aversion to keypads, combined with tech from the likes of Square and Apple Pay meant there was contactless everywhere I went.

While it was useful for flashing my phone at ticket barriers rather than buying a MetroCard in New York, there was the irritation of swivel-screen terminals at Californian coffee shops, where you were pressured to add a 15%/20%/25% tip for the person who had only put a muffin in a bag for you.

The convenience is wonderful though and Apple aims to simplify the experience even further with a Tap to Pay option that will just be iPhone to iPhone and removes the need for a terminal.

With Big Tech now taking a sizeable piece of payments, Europe is becoming alarmed at the US’s newfound ascendancy through the efforts of a handful of companies.

On Monday, EU regulators charged Apple with breaking competition law by abusing its dominant position in mobile payments to limit rivals’ access to contactless technology.

It accused it of preventing competitors from accessing the near-field communication (NFC) chips that enable contactless, while its own Apple Pay system benefited. Margrethe Vestager, the commission’s executive vice-president in charge of competition policy, said Brussels had “indications that Apple restricted third-party access to key technology necessary to develop rival mobile wallet solutions on Apple’s devices”.

The findings of the investigation added: “Apple Pay is the only mobile wallet solution that may access the necessary NFC input on iOS. Apple does not make it available to third-party app developers of mobile wallets.”

Apple denied this, saying: “Apple Pay is only one of many options available to European consumers for making payments, and has ensured equal access to NFC while setting industry-leading standards for privacy and security.”

The company is certainly industry-leading in taking a big slice of the market. Even if the EU prevails and enforces changes, Apple Pay will take some catching on contactless, as it becomes the preferred way of paying in the real world.

The Internet of (Five) Things

1. UK set to step back from getting tough on Big Tech

The UK is poised to shelve plans to empower a new tech regulator, in a blow to global efforts to curb Big Tech. The government’s new legislative programme is not expected to include a bill to provide statutory underpinning to the digital markets unit that is based within the Competition and Markets Authority. Without the legislation, it would not be able to set rules for leading internet companies and impose fines on them for breaking those rules.

2. BoJo lobbies SoftBank on London IPO

The UK prime minister has joined a final push to convince chip designer Arm to list in London. Boris Johnson and the London Stock Exchange have launched a charm offensive to persuade Arm’s Japanese owner SoftBank to rethink its strong preference for listing in New York. Arm is close to regaining control of its renegade China joint venture, which has been an obstacle to an IPO.

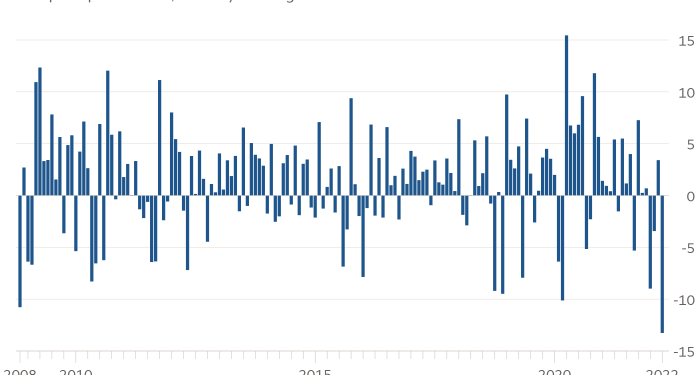

3. Tech shares volatile after quarterly earnings

First-quarter revenues at Apple, Alphabet, Microsoft, Amazon and Meta collectively rose nearly $38bn from a year ago — an average gain of 13 per cent. Still, the tech-heavy Nasdaq index came under pressure, recording in April its worst monthly drop since the 2008 financial crisis as investors reassessed lofty valuations.

4. Alibaba and Xiaomi shares fall

Alibaba shares fell as much as 9 per cent on Tuesday following a Chinese state media report that an individual surnamed “Ma” had been detained. They recovered later, after the report was changed to indicate the individual was not Alibaba’s billionaire founder Jack Ma. Xiaomi shares fell sharply after Indian authorities accused the world’s second-largest smartphone vendor of making “illegal remittances” and seized about $730mn. Lex says India is just getting started in restricting Chinese tech groups.

5. Yuga Labs sells $285mn worth of virtual land

The creators of the Bored Ape Yacht Club generated $285mn worth of crypto in “metaverse” land sales at the weekend. Yuga Labs apologised for the congestion caused in the frenzy to snap up 55,000 plots of virtual land in the Otherside, its forthcoming game.

Tech tools — Apple’s iDIY

IPhone owners now have an official way to extend personally the life of their handsets, with Apple launching its Self Service Repair Store last week. The company has been under pressure for years to make its products easier to repair and its new scheme provides manuals and more than 200 genuine Apple parts and tools through the store. The service is available only in the US initially, with plans to expand it to Europe later this year. Repairs are covered for the iPhone 12 and iPhone 13 line-ups and iPhone SE (third generation), including for the display, battery, and camera. Apple will send $49 tool rental kits to customers that need them, with free shipping. Manuals, parts and tools to perform repairs on Mac computers with Apple chips will follow.