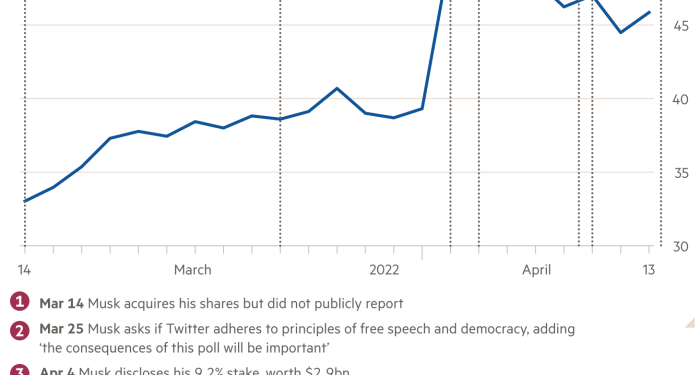

Elon Musk has offered to buy Twitter for $54.20 a share, a bid that values the company at $43.4bn.

The move caps a dramatic few days in which the Tesla chief announced he had taken a 9 per cent stake in the company to become its largest shareholder but then rejected an invitation to join its board.

Musk does appear genuinely passionate about Twitter’s future. He has had plenty to say about what direction it should go in, tweeting out a series of suggestions over the past few weeks about changes the company should make. He is an avid user and proponent of free speech who argues the company is too heavy-handed in its moderating of content.

He can afford to buy the company, although getting the cash might be tricky. His personal wealth is estimated to exceed $200bn but that is largely tied up in Tesla stock and his ownership of SpaceX, a private company.

And Musk also has a history of not following through. In 2018, he used Twitter to announce his intentions to take Tesla private. The proposal was abandoned several weeks later after discussions with shareholders. His tweet was found to flout US securities law, resulting in Musk’s social media posting about the electric car company needing to be preapproved by lawyers.

There’s also the question of where Twitter would fit in his broader portfolio. Musk has previously been accused of stretching himself too thin — and some might see this as a vanity project for a disgruntled tweeter to promote his own agenda.

In a letter to Twitter’s board attached to the filing he made to the US Securities and Exchange Commission, he leaves room for a quick exit strategy.

“If the deal doesn’t work, given that I don’t have confidence in management nor do I believe I can drive the necessary change in the public market, I would need to reconsider my position as a shareholder,” Musk wrote.

That comment is also a damning verdict on Twitter chief Parag Agrawal’s leadership, a judgment made following weeks of conversations between him and Musk over joining the company’s board.

That same board must now determine if the price Musk is offering is reasonable and if a takeover by a man who has not endeared himself to Twitter’s own staff is in the company’s best interest and all shareholders.

Musk’s offer may represent a 54 per cent premium to where Twitter stock traded in January when he quietly started buying up shares in the company, but Twitter shares previously peaked at $77 in early 2021. The board can offer this as a reason to reject the sale, but will activist shareholders like Elliott Management decide selling out now to be an offer too good to refuse?

The Internet of (Six) Things

1. House-flipping algorithms are coming to your neighbourhood

If you thought getting on the housing ladder was hard enough when bidding against other humans, you better hope an iBuyer doesn’t show up in your town. Zillow’s “instant buying” business may have folded, but here’s why that’s only a bump in the road for tech companies seeking to disrupt the property market.

2. Amazon hits US sellers with surcharge to offset inflation and fuel costs

Third-party sellers on Amazon who use the company’s logistics network, Fulfillment by Amazon, to deliver products will have to pay a 5% surcharge on all deliveries. Amazon attributed the rise to increasing fuel costs and inflation.

3. Prepare for Armageddon: Ukraine’s tactic against Russian hackers

Why has Ukraine not been harder hit by cyber attacks? Perhaps because it is well prepared. One example is a small and disparate Ukrainian team that has been monitoring one of Russia’s most prolific hacking groups — Armageddon — to learn its signature moves.

4. One year in, Meta’s civil rights team still needs a win

Roy Austin Jr. is vice-president of civil rights and deputy general counsel at Facebook. If he can prove his team can make more than incremental changes inside Meta, they could offer a model for the rest of Silicon Valley to follow.

5. The torturous route of Toshiba’s path to auction

It should be Japan’s most significant take-private deal in history, but internal resistance has considerably complicated things.

6. A day in the life of (almost) every vending machine in the world

The vending machine industry has come a long way from its humble origins in Wakefield, England.

Tech tools — Vespa Elettrica

The meteoric rise of the electric bike is now trickling over into consumer mopeds: zero emissions bikes for riders keen to avoid the petrol pumps and congestion charges. Wired have put several to the test here, including the Vespa Elettrica “that feels like a regular Vespa in the best possible way”. The styling matches the brand’s classic Primavera model, but it has none of the noise that comes from a petrol engine.

Correction: Microsoft 365 was wrongly referred to as Windows 365 in the previous edition of this newsletter. Apologies.

#techFT is taking an Easter break and will return on Tuesday.