Europe’s largest chipmaker Infineon has raised its forecast for revenues, underlining the German group’s status as one of the winners from the global shortage of semiconductors.

The company, whose biggest customers are carmakers, revised up its prediction for demand after sales in the last three months of 2021 jumped by a fifth. Revenues for its current fiscal year will now be €13bn, roughly €300mn more than its previous projection.

“The December quarter was the first one in a while where we did not experience [supply] disruptions and the numbers are clearly showing it,” outgoing chief executive Reinhard Ploss said, referring to power cuts at its own plant in Dresden and coronavirus or weather-related shutdowns in Asia and the US that have hit most semiconductor manufacturers.

But the company said that Covid-19 risks remained, and that if China were to implement further lockdowns it could harm Infineon’s contractors, and have a knock-on effect on its own production.

For the three months to the end of December, profits came in at €457mn, up from €256mn in the same period in 2020, but slightly lower than the €464mn made in the previous quarter.

The company cited significantly higher tax expenses, partially deferred from earlier in the year, for the drop.

“Utilisation of our manufacturing capacities is very high and we are expanding them step by step,” Ploss said. But he warned that “supply limitations are far from over and will persist well into 2022”.

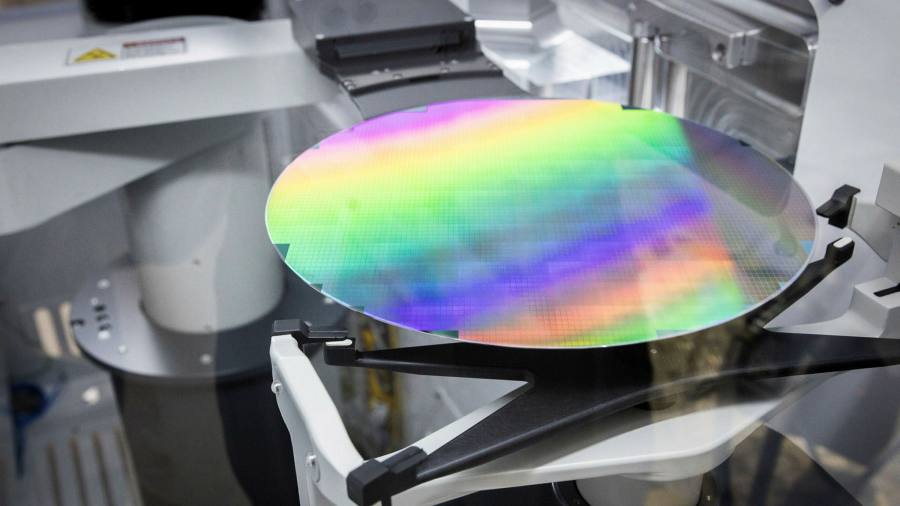

Infineon opened a new plant in Villach, Austria, last year after advances in automation lowered the cost of operating on the continent compared with Asia. The Munich-based company said it would spend a further €2.4bn on expanding operations to meet demand.

The company’s factories “are basically running at full levels,” Ploss told analysts, despite 10mn fewer cars sold being sold in 2021, in comparison with pre-pandemic levels.

Ploss warned last year that it was impossible to ascertain the true level of demand as many auto customers in particular were stockpiling to avoid further bottlenecks to supplies.

Analysts have raised concerns that the industry as a whole, which relies on running factories at near capacity to achieve economies of scale, could end up having to idle production once the current crisis subsides.

Ploss, who leaves Infineon in March after 10 years at the helm, has emphasised that growth in the semiconductor industry will outlast current supply constraints, due to the components being required for ever more sophisticated devices.

Infineon, whose main business is everyday power and sensor chips, also makes radiation-hardened power parts for Nasa and other agencies, most recently for the James Webb space telescope.