Hello, this is Kenji from Hong Kong. We kick off the new year with a fascinating future tech project that links computer chips with human brain cells (The Big Story). Pulling ourselves back to the present, Boyu, a star China tech investor, seems to be struggling to find a balance under President Xi Jinping’s “common prosperity” policy (Mercedes’ top 10). In Shanghai, China Mobile made a homecoming listing after being ejected from the New York Stock Exchange last year and branded part of China’s military-industrial complex (Our take). Electric vehicles are so hot this year that the price of lithium is sizzling (Smart data). Take care and see you next week.

The Big Story

Human brain cells incorporated into a computer chip have learned to play an arcade game. An Australian start-up is providing proof that neuron-silicon hybrid computing chips could pave the way for smarter, more efficient artificial intelligence systems, according to this article in Nikkei Asia.

Key development: When connected to a computer, the human brain cells on a chip — called DishBrain, from Cortical Labs in Melbourne — learned to play Pong, a game that simulates table tennis. What’s more, the neurons improved their performance after receiving feedback on their play.

“DishBrain is a breakthrough technology that allows us to investigate the intelligent properties of living neurons outside of a body and in a Petri dish,” Hon Weng Chong, Cortical Labs’ co-founder, told Nikkei Asia.

Such devices could also help scientists understand the mysteries of the brain and develop drugs to treat neurological diseases.

Upshot: Brains-on-a-chip have “attractions on many levels”, said Karl Friston, a theoretical neurophysicist at University College London, who is collaborating with Cortical Labs. “In the broader context of the human journey of discovery, to create artificial sentience is clearly a challenge that many people cannot resist.”

Mercedes’ top 10

-

Exclusive: Japan’s Toyota is developing its own automotive software operating system to compete with Tesla, Volkswagen and others. (Nikkei Asia)

-

US scholars propose that Taiwan’s chip giant TSMC be destroyed in the event of a Chinese invasion to render the island “unwantable”. (Nikkei Asia)

-

A Japanese breakthrough predicts bugs’ flight paths to zap them with lasers. (Nikkei Asia)

-

Star China tech investment firm Boyu is figuring out how to navigate Xi Jinping’s crackdown on the sector. (FT)

-

Telenor, the Norwegian telecommunications operator, is selling its stake in Wave Money, one of Myanmar’s biggest mobile payment services. (Nikkei Asia)

-

Shares of SenseTime, China’s leading AI company, surged on its debut in spite of a US blacklisting, puzzling observers. (Nikkei Asia)

-

Meanwhile, losses at Didi Chuxing, the New York-listed Chinese ride-hailing company, are mounting as the company suffers a regulatory squeeze. (FT)

-

China’s Tencent has taken a stake in Monzo, joining an international funding round that valued the UK digital bank at $4.5bn. (FT)

-

A host of south-east Asian tech companies, including Indonesia’s Bukalapak and Singapore-based Grab, are set to invest in Allo Bank, marking the sector’s latest embrace of finance. (Nikkei Asia)

-

Cambodia’s digital currency has reached almost half the population. (Nikkei Asia)

Our take

China Mobile, the largest telecom operator in the world by subscribers, has made its debut on the Shanghai Stock Exchange, raising $7.6bn in one of the biggest-ever listings on mainland markets.

Apart from its size, the listing’s significance resides in the fact that it represents another “homecoming” A-share listing. The company, like its peer China Telecom, was forcibly delisted from the New York Stock Exchange in May, following a designation by Washington as part of Beijing’s military-industrial complex.

The main objective of the new listing is not so much fundraising — China Mobile was sitting on $43bn in cash reserves as of June — but to provide a new trading platform.

“The homecoming to A-shares is to implement a national strategy, and an important realisation of political responsibility, fulfilling an economic responsibility and putting into effect social responsibility,” said Wang Sheng, head of investment banking at China International Capital Corporation.

Moreover, China Mobile seems to have learned a few hard lessons from China Telecom’s flotation in August. The latter’s share price rose 44 per cent during the first day of trading, a cap set by mainland bourses, but collapsed from the following day and has mostly traded at below its listing price since.

China Mobile’s price was set at 12 times its 2020 net profit, versus Telecom’s 20 times, while the size of the new share issuance was reduced to 4.5 per cent of the expanded shareholder base, compared with more than 11 per cent for Telecom. The securities regulator also made sure that no other shares would be listed before China Mobile this week in Shanghai and Shenzhen. The stage is set for success, but let’s see if it materialises.

— Kenji

Smart data

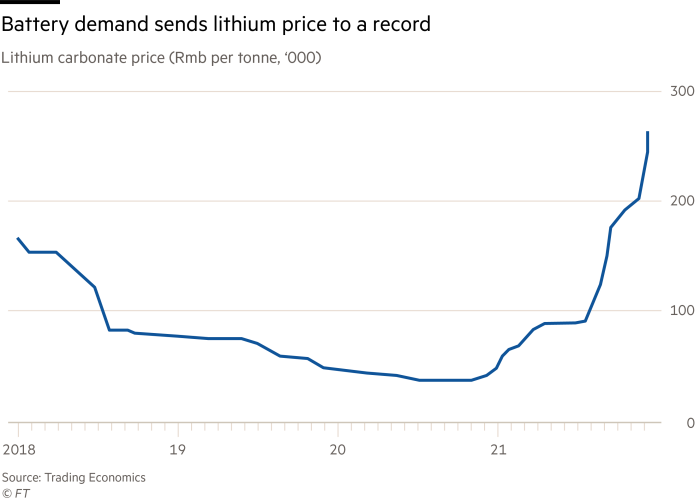

The price of batteries for electric vehicles looks set to rise in 2022 after a decade of declines as supplies of lithium and other raw materials fail to keep up with ballooning demand.

Benchmark prices of lithium carbonate ended 2021 at records. In China, the biggest battery-producing country, the price was Rmb261,500 ($41,000) a tonne, more than five times higher than last January.

Global electric car sales are estimated to have reached 5.6m vehicles in 2021, up from 3.1m in 2020, thanks to brisk sales in China. Further demand growth in 2022 will lead to a lithium deficit this year, as use of the material outstrips production and depletes stockpiles, according to a December report from S&P Global.

Spotlight

Dan Schulman is on a mission in Asia. The PayPal chief executive is leading the US cashless payments company to expand its footprint in Japan and beyond.

In an interview with Nikkei, Schulman hinted at future deals similar to last year’s acquisition of Japanese “buy now, pay later” start-up Paidy for about $2.7bn.

For markets in which PayPal wants to “double down and play an important role”, Schulman said, it will “need to invest organically. We need to invest through partnerships, and we need to keep an open mind to acquisitions as well.”

Founded in 1998, PayPal is used by websites, smartphone apps and bricks-and-mortar stores in markets such as the US and UK. Its total payment volume has doubled over two years to about $1.25tn in 2021, with growth accelerating dramatically from the 20 years it took for the platform to achieve its first $600bn.

It has a market capitalisation of about $225bn, outpacing banks such as Citigroup and Wells Fargo. Coronavirus has accelerated the global transition toward a digital economy “by anywhere between three and five years”, Schulman said.

When sages speak

-

This report from the Harvard Kennedy School titled “The Great Tech Rivalry: China vs the US” is a great resource, full of crucial context and focusing on varying aspects. Authors are Graham Allison, Kevin Klyman, Karina Barbesino and Hugo Yen.

-

African governments are among the top customers for Chinese surveillance tools, from “smart cities” to media monitoring. Jili Bulelani, a fellow at Merics, takes a detailed look at what is happening in this podcast.

-

Also from the team at Merics, this report on “Recalibrating the EU’s research and innovation engagement with China” addresses an important topic that may feature strongly in 2022. Rebecca Arcesati, Irène Hors and Sylvia Schwaag Serger are the authors.