Gemini, the digital asset exchange owned by the billionaire Winklevoss twins, plans to lay off about a tenth of its staff in the latest sign of how the powerful drop in crypto markets has disrupted the industry’s rapid growth.

The announcement on Thursday comes as the value of the digital asset market has tumbled by around $2tn from the peak in November 2021 to $1.3tn, according to data collated by the Financial Times.

“This is where we are now, in the contraction phase that is settling into a period of stasis — what our industry refers to as ‘crypto winter’,” said Cameron and Tyler Winklevoss in a note to employees, which was first reported by Bloomberg.

Bitcoin has fallen by more than 50 per cent from its November high, while other smaller coins have faced much more severe losses. At the same time, the crash last month of the once popular luna and terra tokens has shaken traders’ faith in crypto lending programmes such as “staking”, which had provided lucrative returns.

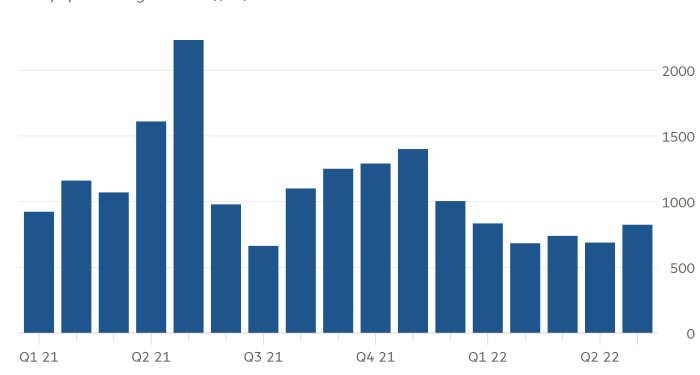

Crypto traders tend to more actively bet on the market when it is rising, analysts and exchange executives have said. Given the breadth and severity of the bear market, crypto trading volumes have pulled back sharply.

Spot trading volumes across leading exchanges has averaged about $750bn a month this year, compared with $1.2tn in 2021, according to data from The Block Crypto. Lower volumes cut down on the fees exchanges earn from facilitating transactions.

The Winklevoss brothers said in their note to employees that the troubles for the crypto market had “been further compounded by the current macroeconomic and geopolitical turmoil”.

The crypto industry boomed when central banks and governments poured liquidity into the global economy and people around the world were stuck at home during rolling lockdowns. However, investors have been racing away from speculative assets this year, with shares in unprofitable tech companies and other risky bets also coming under heavy pressure as global central banks act to fight inflation.

Some investors are betting that the crypto downturn will be temporary and that innovations like blockchain digital ledger technology will reshape finance. Venture capital firm Andreessen Horowitz earlier this month launched a $4.5bn cryptocurrency fund as it said the crypto industry was reaching a new “golden era” in which “new talent, viable infrastructure, and community knowledge” would spur rapid innovation.

Echoing that sentiment, the Winklevoss brothers told employees that the “crypto revolution is well under way” and that “its impact will continue to be profound”. However, they also noted that the gloom that has descended on the crypto market is unlikely to lift any time soon.

“We have asked team leaders to ensure that they are focused only on products that are critical to our mission and assess whether their teams are right-sized for the current, turbulent market conditions that are likely to persist for some time,” they said.