Long-time Alphaville readers will remember that back in 2018, after a certain cabinet minister — then a mere disgraced Tory MP — resigned from two appointments related to blockchain technology when we discovered a secret crypto pay deal, we saw it fit to initiate a series called “What’s the Tory crypto story?” (This title will resonate if you happen to be over the age of about 30 and British.)

After that slight embarrassment for now Transport Secretary Michael Green Grant Shapps, the Tory crypto train has kept on chugging merrily along. There was the spectacular flop of Tory Baroness Mone’s crypto project, EQUI; there was then-chancellor Philip “Spreadsheet” Hammond promoting blockchain as an easy solution for the Irish Border problem; more recently there was chair of the UK foreign affairs committee Tom Tugendhat preaching the virtues of crypto by deploying unforgettable syntax such as “when the queen’s head leaves the coin and goes on to the blockchain”. And before any of them, of course, there was David Cameron — a man known for his impeccable taste in all things financial.

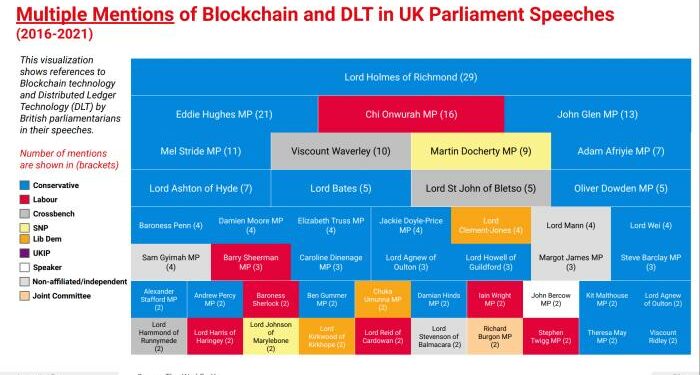

It’s not just crypto; it’s blockchain too. In a November report entitled “Blockchain Industry in the UK Landscape Overview 2021” by “Innovation Eye” and the “Big Innovation Centre”, the ruling party’s love affair with all things related to the distributed dream ledger over the past five years is charted. It’s a nice and politically informative chart:

Just look at that sea of blue! If you’re wondering about the block of red in the second line, well that’s Chi Onwurah, Labour MP for Newcastle Upon Tyne Central, who has a background in technology. But when she mentions blockchain, it’s to say things like: “For some, blockchain is a way of avoiding government”, and that the “libertarian idea that technology is the answer to everything has driven our regulatory approach for too long”. Music to our luddite lugholes, tbh.

Over on the other side of the chamber, though, there’s a new crypto playa in town. And the new pusher of virtual currencies is none other than king of virtual tears himself, Mr Matthew Hancock, a former cabinet minster and now mere disgraced Tory MP (you might notice a theme).

Getting into bed with crypto is “vital”

Having resigned from his job as health secretary following an affair with an aide, it seems our Matt has turned his sights towards loftier things. So lofty in fact, one might say he is heading to da moon — the MP for West Suffolk’s current pinned tweet is the following:

That’s right. According to Hancock, Britain should not just embrace the famously above-board and stable world of cryptocurrencies but actually become “home” to them, whatever that might mean.

From his piece:

Yeah come on regulators! Why would you try to protect people from losing all their money? There are adverts on the tube, OK? This stuff must be legit!

He continues:

Um, is it just us or does the final sentence there rather contradict the previous paragraph? How can Hancock be pressing for a regulatory regime that protects people and guards against systemic risk while simultaneously be pressing for a less risk-averse regulatory framework for fintech?

In his comments on crypto and fintech in parliament a few days earlier, Hancock had gone even further, declaring:

Now, we have to be honest: cutting fraud and financial crime are not *quite* the first things that come to mind when we think about crypto and fintech, but we guess we should give this man the benefit of the doubt.

But all this crypto and fintech and blockchain shilling — he told the Express last week that blockchain had “a wide range of uses, in terms of secure contracts and greater transparency” — did get us wondering what was going on. Was Hancock just proving his techy credentials before gearing up for a run at the leadership in a post-Boris future? Was he eyeing up one of those cushy crypto jobs that Hammond recently landed? Or was there something else to it?

Blockchain brothers

In our quest for an answer, we stumbled across the Linkedin profile of Matt’s brother, Chris. It turns out that he’s the founder and CEO of a fintech firm called Crowd2Fund, a peer-to-peer lending company that claims to offer “a new generation of investments to pioneer a cultural shift away from the traditional banking systems”. The Guardian has written about this company before, back in 2019, reporting that:

Hancock’s urging, according to Hansard, was in October 2013. According to Chris Hancock’s LinkedIn and Companies House records, Crowd2Fund was founded just a few months later.

And Crowd2Fund isn’t Chris Hancock’s only venture into the world of fintech — he has his finger in the blockchain pie too. He has a company called Finblocks, a “global, security, compliance, deposit and payments system” that “allows clients to leverage the benefits of blockchain simply, easily and in a compliant way”.

Last April, Matt Hancock was accused of “cronyism” by Labour, after he declared that he owned a 15 per cent stake in Topwood Limited, an approved supplier to NHS England. Hancock’s sister, Emily Gilruth, is named as a director of the company on Companies House.

We asked Matt Hancock whether he thought there was any conflict of interest in his advocating for barriers to be removed for the fintech industry and for crypto and blockchain projects, given his brother’s work. We also asked if he had any comment on the timing of Crowd2Fund’s founding.

A spokesman for the MP told us:

We were then sent two updated versions of the comment that took out the “embarrassing” bit and the “unfounded speculation bit”, and added that Hancock is a “champion of fintech”, but we preferred the original.

We understand that Matt Hancock has no investment in crypto nor any financial interest in his brother’s fintech companies.