US stocks hovered in a tight range on Monday as traders prepared for a flurry of Big Tech earnings reports, delivered against a backdrop of elevated inflation and signs of impending monetary policy tightening.

The blue-chip S&P 500 index edged down 0.1 per cent while the technology-focused Nasdaq Composite was little changed.

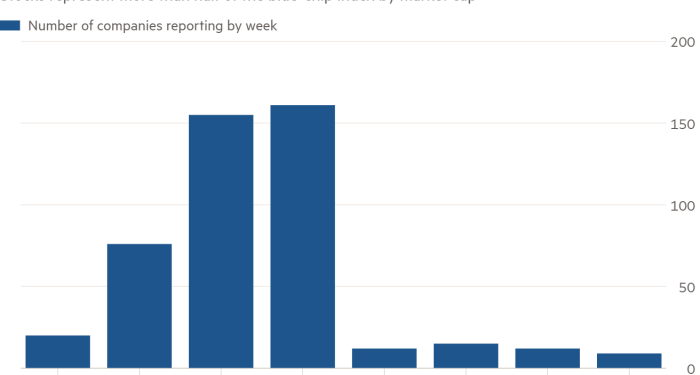

Monday will bring fresh quarterly numbers from social media giant Facebook, with figures due later in the week from peers including Microsoft and Apple. Earnings season is now well under way, with 316 companies on Wall Street’s blue-chip index reporting in the next fortnight — equivalent to 59 per cent of the S&P 500’s market value, according to analysis from Credit Suisse.

Those anticipated corporate updates come after shares in social media platform Snap slid more than a quarter on Friday in response to the company warning of reduced advertising revenues. Other tech bellwethers, including Facebook, suffered knock-on losses in the wake of Snap’s report.

Facebook was also in focus early on Monday after leaked internal documents showed the group’s senior executives interfered to allow US politicians and celebrities to post whatever they wanted on its social network, overriding rules designed to curb misinformation and harmful content.

The muted performance at the start of the week in US markets came as European equities were also little changed on Monday. Europe’s region-wide Stoxx 600 index was flat in mid-afternoon trading, while London’s FTSE 100 index was up 0.3 per cent.

In Asia, Hong Kong’s Hang Seng closed roughly flat as improvements in healthcare and industrial stocks were tempered by a drop in real estate shares after Beijing said at the weekend it would expand trials for a property tax.

China’s property sector, long seen as the engine of the country’s economic growth, has been knocked in recent months by a crackdown on real estate speculation and a liquidity crisis at developer Evergrande.

In government debt markets, yields on the 10-year US Treasury note and the equivalent UK gilt were both broadly flat at 1.65 per cent and 1.16 per cent respectively.

Central banks around the world are contemplating how to react to widespread inflationary pressures. Huw Pill, the Bank of England’s chief economist, told the Financial Times last week that the headline rate of UK inflation could exceed 5 per cent next year.

The European Central Bank is due to meet on Thursday, with meetings lined up in early November for America’s Federal Reserve and the Bank of England.

“We do believe that central banks will have to bring clarity to . . . market pricing in their upcoming meetings,” said Samy Chaar, chief economist at Lombard Odier, noting that increases were priced in for “close to now in the UK”, for the second or third quarter of next year in the US, and “even a lift-off from the ECB by the end of 2022”.

“Are they going to do sooner, aggressive and therefore not so high at the peak of the cycle,” Chaar asked, “or are they going to try to push back against this market pricing for a delayed lift-off, and eventually a slow start?”

US economic growth data are due out this Thursday and economists are forecasting GDP expansion of 3.2 per cent on an annualised basis in the July to September quarter, compared with a 6.7 per cent expansion in the second quarter.

Global oil prices hit fresh highs as supply concerns persisted, in a continuation of a widening energy rally that has fuelled elevated natural gas prices across Europe. Brent crude, the international benchmark, hit a new three-year high, topping $86 a barrel on Monday. West Texas Intermediate, the US oil marker, topped $85 a barrel for the first time since 2014.