US stocks and bonds fell on Thursday, partially reversing a strong rally in the previous session, as investors assessed the future direction of monetary policy.

The S&P 500 dropped 1.2 per cent in early trades, after the equity benchmark closed 3 per cent higher on Wednesday in its best one-day performance since May 2020. The technology-heavy Nasdaq Composite fell 1.7 per cent.

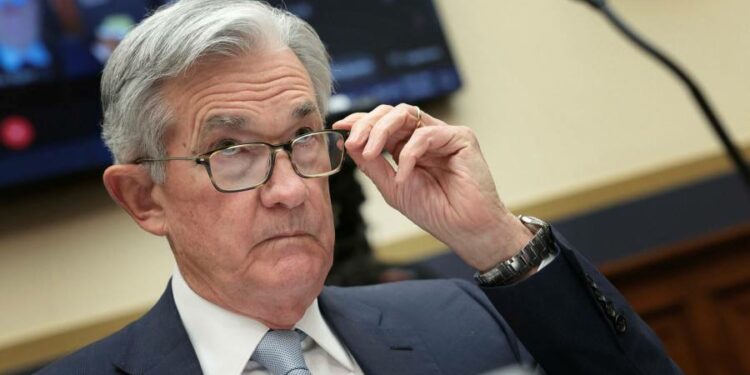

The US central bank on Wednesday announced its first 0.5 percentage point interest rate rise in more than 20 years, in a widely telegraphed move, while Fed chair Jay Powell also appeared to rule out 0.75 percentage point increases at upcoming meetings.

“It was not a really a dovish signal, but market sentiment is beaten up, the most pessimistic its been in decades, so it wasn’t surprising to see a bounce from such levels of pessimism,” said Trevor Greetham, head of multi-asset at Royal London.

“But you’ve still got a nasty backdrop, where central banks are not your friend.”

The S&P has fallen more than a tenth so far this year as prospects of higher borrowing costs and sustained high inflation have threatened corporate profits. The technology-focused Nasdaq Composite is down almost 19 per cent.

The yield on the 10-year US Treasury note, which investors use as a yardstick for valuing many other financial assets, jumped 0.09 percentage points to just over 3 per cent. Yields on Treasury bonds, which move inversely to prices, have been highly volatile in recent weeks as the uncertain path of inflation and interest rates complicates the investment case for the fixed income-paying securities.

Powell said on Wednesday a neutral monetary policy position, which neither speeds up nor slows the economy, was “not something we can identify with any precision”.

The Fed chair also “sounded very determined to raise rates until he sees progress on inflation”, said Rose Ouahba, head of fixed income at Carmignac. “And [he] did not give a sense of where the Fed needs to stop.”

The annual pace of consumer price increases in the US hit 8.5 per cent in March.

The dollar index, which measures the US currency against six others, rose 0.7 per cent, holding close to a 20-year high.

In the UK, sterling fell as much as 2.1 per cent against the dollar to just under $1.24, its weakest level since mid-2020, after the Bank of England said the nation’s economy may enter a recession later this year.

The UK central bank raised its main borrowing rate on Thursday by a quarter point to 1 per cent, marking its fourth consecutive increase, but also sparked fears about stagflation by forecasting the annual rate of consumer price increases would rise above 10 per cent.

“This is really the sum of all our fears” about the UK economy, said Roger Lee, head of UK equity strategy at Investec. “Growth forecasts have been downgraded, inflation expectations have been upgraded and interest rates are still going up.”

UK gilts rallied as traders speculated the BoE would maintain relatively low borrowing costs to safeguard the economy, despite intense inflationary pressures. The two-year gilt yield, which tracks monetary policy expectations, fell 0.16 percentage points to 1.5 per cent. The 10-year gilt yield dropped 0.07 percentage points to 1.89 per cent.

European equities mirrored gains on Wall Street overnight, with the regional Stoxx 600 adding 0.6 per cent. The UK’s FTSE 100, which is stacked with exporters whose reported revenues are boosted by a weaker pound, rose 1.2 per cent.