Wall Street stock futures rose and US government bonds were muted on Friday as traders assessed data showing America’s inflation rate quickened last month to the highest level in nearly four decades.

Contracts that bet on the direction of the blue-chip S&P 500 index rose 0.6 per cent while those on the technology-focused Nasdaq 100 gained the same amount.

The yield on the two-year US Treasury note, which moves inversely to the price of the government debt instrument and closely tracks monetary policy expectations, was steady at 0.69 per cent.

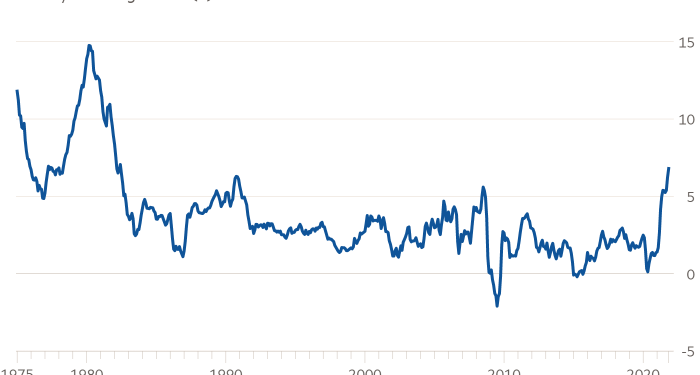

The labour department said US consumer prices rose 6.8 per cent in November from the same month in 2020, the highest rate since June 1982. The previous month’s inflation rate was 6.2 per cent.

The data release came after a report on Thursday that showed US first-time filings for unemployment benefits last month fell to their lowest level since 1969, although many investors expect inflation to now have peaked and the Federal Reserve to keep borrowing costs relatively low.

“The US economy is in a reasonably healthy place,” said Paul Jackson, head of asset allocation research at fund manager Invesco. “If the Fed does not pull back some of its support now and start to normalise monetary policy, they’ll have very little ammunition when we do get into the next recession.”

“The bond market is telling us inflation is not going to run out of control for long,” said Guillaume Paillat, multi-asset portfolio manager at Aviva Investors.

The Fed has bought about $120bn of government and mortgage-backed bonds a month through the pandemic, lowering borrowing costs and boosting stock market sentiment.

A rapid wind-down of this programme could be completed by March, in a precursor to the world’s most influential central bank raising interest rates from their current record low, leading economists surveyed for the Financial Times have said.

“We expect inflation at close to 4 per cent on average next year,” said Christophe Donay, head of asset allocation at Pictet. He added that markets had “a lot of faith in the Fed and other central banks and governments moving to support the economic cycle” if Omicron or other new variants of coronavirus caused long-term disruption for consumers and businesses.

“When risks are rising, markets consider the Fed will slow down its tightening,” he said.

In Asia, Hong Kong’s Hang Seng index fell 1.1 per cent, mirroring falls on Wall Street in the previous session. The Nikkei 225 in Tokyo closed 1 per cent lower. A FTSE index of emerging market stocks fell 0.6 per cent.

In currencies, the dollar index, which tracks the performance of the US currency against six others, inched 0.1 per cent higher. Sterling was down 0.2 per cent against the dollar to just under $1.32.