The Biden administration has insisted western sanctions against Russia are working despite a rebound in the value of the rouble against the US dollar.

Speaking to reporters, a senior US Treasury official said the administration believed the real value of the rouble was deeply impaired, citing Russia’s skyrocketing inflation and the depreciated exchange rate for the currency on the black market.

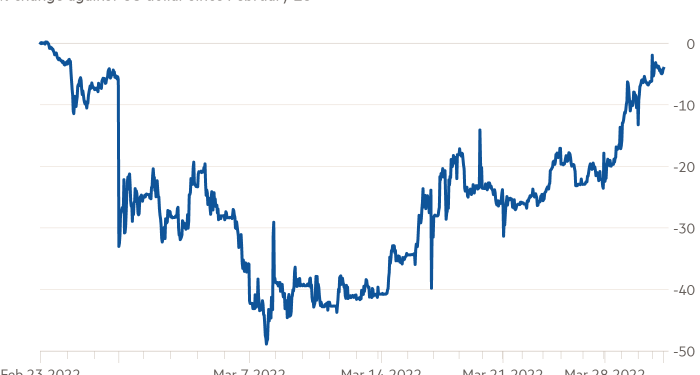

The rouble on Friday was trading at roughly 86 to the US dollar in the interbank market after plunging to as much as 150 to the dollar in early March. Its current value against the dollar is not far from the level on February 23, the day before Vladimir Putin, Russia’s president, launched the invasion of Ukraine.

However, the rouble is not functioning as a convertible currency, after sanctions resulted in a collapse in goods and services imports with businesses and consumers largely unable to buy products on international markets or travel outside of the country.

Economists have attributed the rebound on interbank markets to Moscow’s stringent currency controls, which have prevented Russians from moving money to foreign bank accounts or taking significant amounts of cash out of the country.

Moscow has also temporarily banned banks and brokers from operating cash-based foreign exchanges for dollars and euros.

The Treasury official noted inflation in Russia had jumped 6 per cent over the past three weeks, while western central bank sanctions had prevented the country from accessing half of its foreign currency reserves, cutting off access to a cushion it had been building to lessen the blow of punitive measures.

Karl Schamotta, chief market strategist at Corpay, said: “The information content in the exchange rate right now is not the same as it is in any other major economy. The fact is that we have created a one-way valve: money is flowing into Russia but not out. And that is going to force the exchange rate up over time,” he said.

“The black market is quoting anywhere between 110 and 140 on dollar/rouble transactions. So citizens who are looking to purchase dollars or euro are paying a much higher cost than we’re seeing on the interbank market.”

Schamotta added: “Clearly the sanctions that have been applied have been taking a toll on the real economy, on the non-energy, non-commodity economy and are imposing enormous costs on households.”

In the call with reporters, the Treasury official said the US believed it still had the ability to expand sanctions in the future, as the EU continued to reduce its reliance on Russian energy imports and other raw materials.

The official said the US had designed the sanctions to maximise the disruption to Russia’s military invasion of Ukraine, while simultaneously trying to minimise the negative impact on the global supply chains and the EU in particular.

As such it was more important for the US, EU and UK to be united on sanctions, making it harder for Russia to circumvent the restrictions, rather than Washington imposing the harshest measures possible, the official said.