The Biden administration’s leading international energy adviser has called on India not to go “too far” as it increases imports of discounted Russian crude that has lost buyers in Europe.

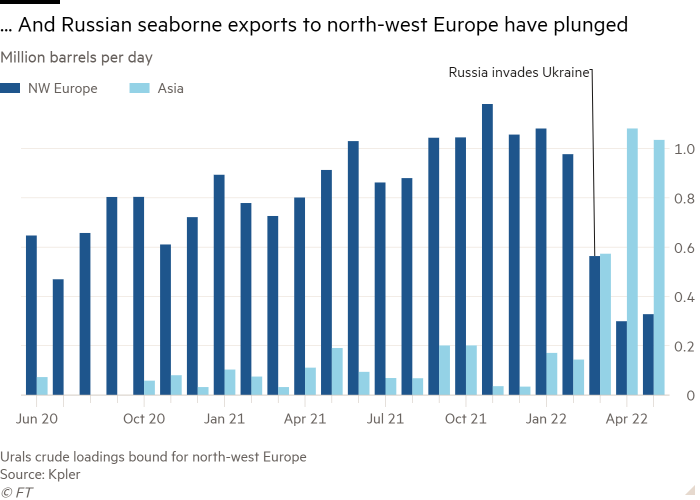

Indian purchases of seaborne Russian oil have surged as exporters slash prices for Urals, the country’s main crude export stream, after European refineries began shunning the cargoes and the EU moved to end its dependence on Russian energy following Moscow’s invasion of Ukraine.

The deals are causing frustration in western countries, which are paying higher prices for oil in part due to efforts to restrict Russian export revenue that is being used to wage war.

Amos Hochstein, the US state department’s senior energy security adviser, said he had urged India not to profit from the discounted Russian oil while western consumers pay record fuel prices.

“I’ve said, ‘Look, we don’t have secondary sanctions that can ban your purchases from Russia’,” Hochstein told a Senate committee hearing on Thursday.

“I would ask two things: ‘One, don’t go too far. Don’t look like you’re taking advantage of the pain that is being felt in European households and the United States. Second, make sure you negotiate well, because if you don’t buy [the oil], nobody else is.’”

Exports of Urals have sold in recent weeks for almost $30 a barrel less than Brent crude, the international benchmark.

But Russian export volumes have remained stable despite the widening western embargo on its oil, while Brent has risen by almost 60 per cent since the start of year to settle at $123.07 a barrel on Thursday, delivering a windfall to the Kremlin.

“Russia is actually in a better position, revenue-wise . . . at this stage in the war than they were at the start of the war,” said Ron Johnson, a Republican senator from Wisconsin, referring to Russia’s oil-export income.

“If you look at it narrowly, just on the price they get per barrel sold, then I would agree with you on that,” Hochstein said, but added that the “broader picture was that they have a harder time getting the money back into Russia”, as western financial sanctions tighten on Moscow.

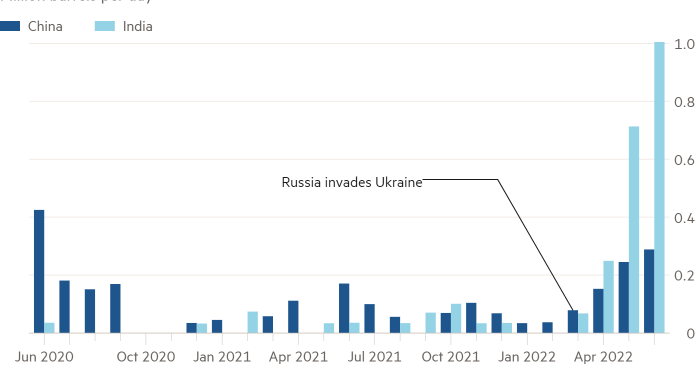

India’s Urals imports are expected to hit more than 1mn barrels a day in June compared with zero before the invasion in January and February, according to data provider Kpler. Chinese oil imports have risen more marginally due to Beijing’s recent lockdowns to control Covid-19, which have curbed demand.

India’s strategy came under fire from other US politicians on Thursday. Chris Murphy, a Democratic senator from Connecticut, suggested it could change “our willingness to look the other way, as they have more deeply integrated themselves with both Russian energy sources and Russian military equipment”.

Chris Van Hollen, a Democratic senator from Maryland, did not name India but described countries that had increased imports of Russian oil at discounted prices as “essentially war profiteering”.

India’s embassy in Washington did not immediately respond to a request for comment.