The biggest US investment banks have taken a $4.6bn revenue hit from the freeze in equity raisings because of recent market volatility, a sharp slowdown for Wall Street which raked in record profits from stock sales last year.

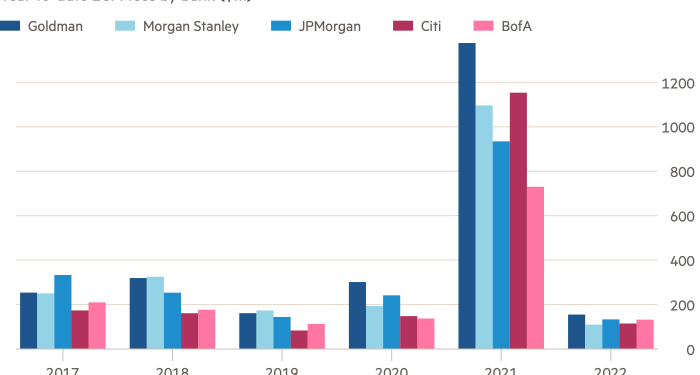

Morgan Stanley, JPMorgan Chase, Bank of America, Goldman Sachs and Citigroup have generated a cumulative $645mn from equity capital market (ECM) fees so far this year, according to data provider Dealogic, compared with $5.3bn in the same period in 2021. Industry-wide ECM fees are down more than 75 per cent year on year at $2.7bn.

The feast-to-famine swing underscores the unpredictable nature of investment banking, a crucial reason why large investors value these stocks at a discount to more predictable industries, often to the frustration of bank executives.

There was not a single traditional initial public offering in the US between February 17 and March 14, the longest drought outside of a holiday season since 2017, according to Dealogic data. One small company broke the streak with a $16mn listing on Tuesday, but bankers expect that it will be some time before larger deals return.

Volumes of follow-on share sales and convertible bond issuance have also slowed dramatically, and the dry spell is set to cause a sharp reduction in first-quarter revenues at banks that benefited from a deluge of deals early last year.

“The right advice [to companies] is to get ready and be nimble because windows may open and close in a much shorter timeframe than we’ve been used to in the last 12 to 18 months,” said Daniel Burton-Morgan, head of Americas syndicate for ECM at Bank of America.

Bankers were prepared for a slowdown in activity after a record-breaking 2021, not least because the first three months of last year were notable for the boom in IPOs of special purpose acquisition companies and that has since slowed dramatically.

Many nevertheless started the year optimistic about a strong pipeline of potential IPO candidates such as Reddit, Instacart and Stripe.

However, rising interest rate expectations, market volatility caused by the war in Ukraine, and dreadful post-listing performances by many of last year’s highest-profile listings, such as electric vehicle maker Rivian, have combined to put most activity on hold.

“People were probably thinking it might be down 30 to 50 per cent but I don’t think anybody had modelled down 75 per cent,” said Chris Kotowski, banks analyst at Oppenheimer & Co.

Only one company — private equity firm TPG — has raised more than $250mn in an IPO this year, compared with 43 in the first 13 weeks of last year, excluding Spacs. The nine-week gap since that deal is the longest period without a $250mn IPO since 2016.

Several senior bankers stressed that there was a strong backlog of companies keen to raise capital, but said stock markets would need to calm down for a sustained period before activity could bounce back, particularly for IPOs which require a longer marketing period.

“We need more stability in the market for investors to feel comfortable,” said one senior ECM executive. “If we were so fortunate [as] to get positive news out of Ukraine, people are ready and poised to come to market, but nobody has a crystal ball right now to know when that’s going to happen.”

The downturn has caused US and European banks to tumble down global ECM league tables. Chinese banks account for six of the top 10 ECM bookrunners by proceeds so far this year, according to Refinitiv data, compared with just one at the same point last year.