Some of the few Russian shares still trading on a global exchange are changing hands at a blistering pace in Hong Kong, but traders say US banks refuse to touch them.

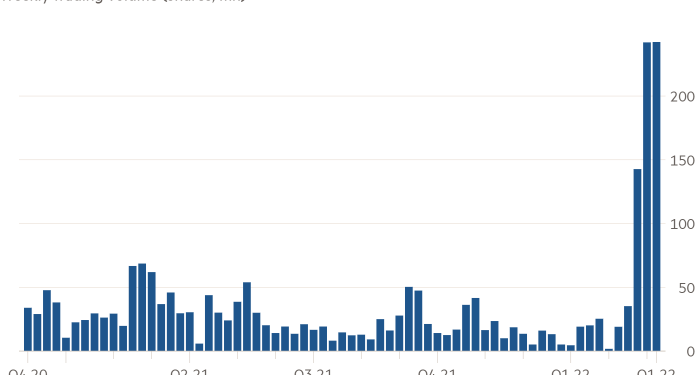

Unlike most big Russian companies, aluminium producer Rusal is not on international sanctions lists. Weekly trading volumes in its shares have shot up by almost 600 per cent in Hong Kong since Russian president Vladimir Putin launched his invasion of Ukraine.

Market participants said US lenders in the city, including Goldman Sachs and Citigroup, are declining to participate in transactions involving the stock, echoing the self-imposed sanctions that have unsettled the global oil market and highlighting the difficulties Russian companies could face in accessing western capital markets even if US and European sanctions are lifted. Both banks declined to comment.

But the brisk turnover in Rusal’s shares, facilitated by local brokers, reflects Hong Kong’s role as a refuge for companies facing geopolitical pressure from the west.

“The American banks won’t trade it,” said a Hong Kong-based trader at one Chinese investment bank. “But at the moment, we would.”

Since the day prior to Russia’s invasion of Ukraine, Rusal’s Hong Kong-listed shares have fallen 45 per cent — wiping more than $6bn off the company’s market value. Russia’s central bank, which has repeatedly suspended markets in the name of financial stability since the war began, has halted all stock trading in Moscow for at least another week, leaving the benchmark Moex index frozen with an almost 35 per cent loss for the year to date.

On February 28, the New York Stock Exchange and Nasdaq halted all trading in Russian equities after sanctions were imposed on Russian financial institutions by the US and Europe. The NYSE said its trading halts were due to “regulatory concern”.

The London Stock Exchange followed suit days later, suspending trading in 27 companies linked to Russia, including the lender Sberbank and energy group Gazprom.

That leaves Rusal shares as one of the few remaining ways to place trades relating to Russia.

An executive at one Wall Street bank said US lenders were avoiding Rusal over concerns that trading in its Hong Kong-listed shares could be halted without warning, as had happened to the company’s global depositary receipts in London.

“That was done without any notice and so there were a bunch of trades caught unsettled,” the executive said, adding that here was “a fair amount of client exposure” as a result.

Hong Kong Exchanges and Clearing declined to say whether it was considering a trading halt for Rusal, adding that it did not comment on individual companies. But a person familiar with the exchange’s thinking said as long as issuers made adequate disclosures “there’s no reason these companies need to be suspended”.

That approach has allowed Hong Kong to provide a venue for state-run Chinese issuers hit by US sanctions over alleged military ties, such as China Mobile and China Telecom. Both companies still trade freely in the Asian financial hub despite being forced off Wall Street last year.

Louis Tse, managing director of Hong Kong-based Wealthy Securities, said Rusal shares had been trading “quite heavily” in recent weeks thanks to “bottom-fishing by short-term traders”.

“They don’t care which bank is trading the stock,” Tse added. “They like to buy them at rock bottom prices, ride the short term rebound and dump the shares.”