The FTSE 100 index hit its highest level since February 2020 on Christmas Eve, buoyed by a recent global stock rally as some of the concerns over the Omicron coronavirus variant ebb from markets.

The UK’s main stock benchmark advanced as much as 0.4 per cent to 7,403.65, the highest point since the coronavirus-induced market ructions in early 2020. Friday’s gains, made during a holiday-shortened trading session, later fizzled, leaving the index flat from its previous close.

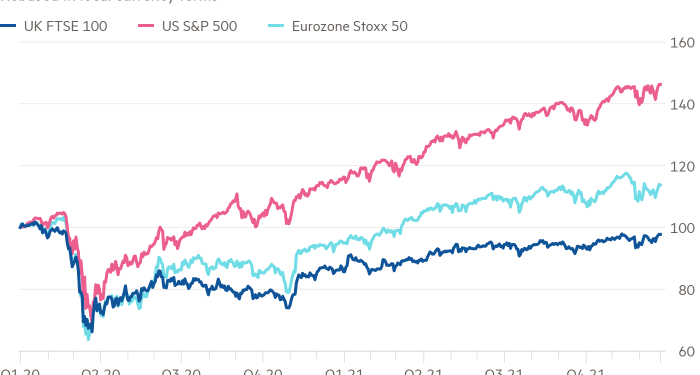

The recovery of UK equities from the pandemic lows has been relatively sluggish. Unlike most other major global indices, the FTSE 100 is yet to return to its highs of early 2020, and is even further shy of the all-time peak of 7,903.50 it touched in 2018. By contrast, the S&P 500 clawed back its pandemic losses by August last year and has struck a series of records ever since. The eurozone Stoxx 50 and Japan’s Nikkei 225 have also blasted past their pre-Covid peaks in recent months.

The UK’s underwhelming performance is partly due to a lack of the kind of high-growth technology companies that have powered the relentless rise of US stocks. Instead, the FTSE — which is dominated by miners, oil companies, and banks — is more focused on so-called “value” sectors, which tend to perform well at times of robust global growth.

The persistent threat from coronavirus, most recently in the form of Omicron, has held back value stocks, according to Luca Paolini, chief strategist at Pictet Asset Management.

“Next year, if you have a period of global growth surprising on the upside, then value will come back,” Paolini said. “That means the UK comes back.”

The FTSE’s upbeat end to the year — it rose 1.4 per cent this week — follows a period of choppy trading. The index slumped in late November after the discovery of Omicron and has swung back and forth as the variant quickly spread in the UK and elsewhere.

The recent rally suggests that investors believe the latest Covid-19 resurgence — which did not deter the Bank of England from raising interest rates for the first time since the pandemic started earlier this month — will not derail the economic recovery.