The UK wants to become a hub for fintech. Adverts for obscure, dog-themed cryptos on the sides of London buses are not what ministers and regulators have in mind. Their plans to curb promotions and withhold compensation from aggrieved crypto investors are a pragmatic response.

A crackdown by the Treasury and Financial Conduct Authority should prevent new advertising of the kind that puffed Floki Inu tokens last year. The FCA is also grasping the nettle of crypto regulation. About time. Most crypto buyers and wrongly believe it has already done so.

The FCA’s sensible aim is to neutralise moral hazard by taking distinctly limited responsibility for overseeing these volatile assets. Regulated firms could only sell crypto assets to the wealthy and financially sophisticated. They are the few remaining retail investors to whom caveat emptor still really seems to apply in the UK.

These crypto buyers would most likely lack access to the Financial Services Compensation Scheme. That way, prudent pension savers would not end up bailing out reckless purchasers of bitcoin’s latest imitator. The costs of the scheme have already doubled over a decade to £717m.

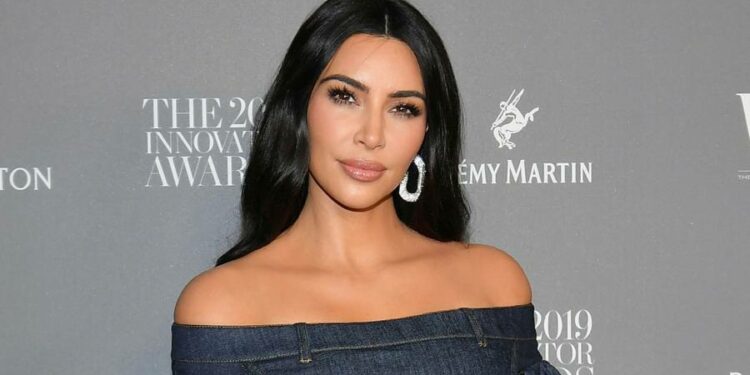

Promotions have helped spawn a retail investment phenomenon also puffed up by cheap money. An Instagram plug for a new digital token by reality TV star Kim Kardashian might have had the biggest audience reach in the history of any financial promotion, says FCA chair Charles Randell. Allegations it was a “pump and dump” scheme are the subject of a US class-action lawsuit.

The UK crackdown would extend to promotions on social media. That will not stop people buying in response to word-of-mouth recommendations or online chatter. Nor will it cover all types of crypto assets. Non-fungible tokens, viewed as digital collectors items, fall outside the new rules.

There is a paradox in all this finger-wagging from the financial authorities. They are implicitly recognising that some crypto investment is acceptable, even though it is not advisable. Specialist crypto investment businesses should be pleased with this modest improvement in their official status. City investment banks, most of which now employ crypto specialists, will have their own beady eye on the opportunities created.

Politicians and regulators must have privately hoped bitcoin, the flagship crypto, would collapse, cutting their regulatory dilemma down to size. At about $42,000 it is only a third below its all-time high. For the UK financial authorities, stalling is no longer an option.

The Lex team is interested in hearing more from readers. Please tell us what you think of the FCA’s plans in the comments section below.