President Recep Tayyip Erdogan’s savings scheme has revived the lira. The Turkish currency is up a third against the dollar this week, trading at TL12.4 to the greenback on Wednesday following his proposal to compensate savers for any forex losses, a plan dubbed by some as an interest rate rise in all but name.

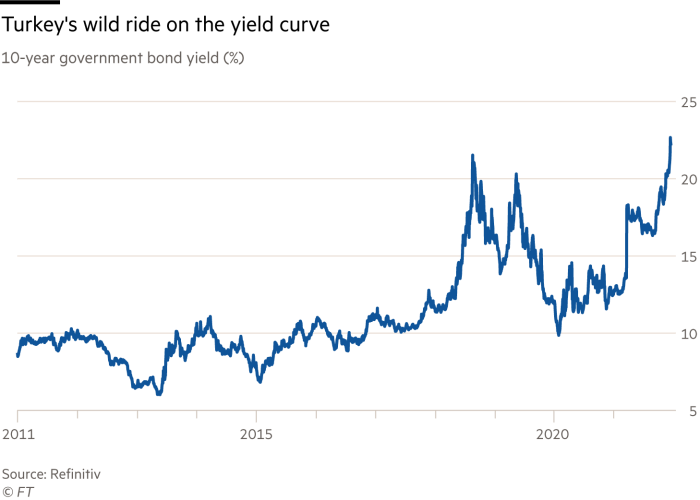

That was enough to lure domestic money back from dollars and gold. Foreign funds will be harder to win over. Volatility, which has dogged the lira and sovereign bonds for years, is not going away. Too many risks remain; not least the president’s obtuse economic beliefs and a central bank that looks to be comfortably in his pocket. Elevated rates for 5-years CDS suggest jitters remain.

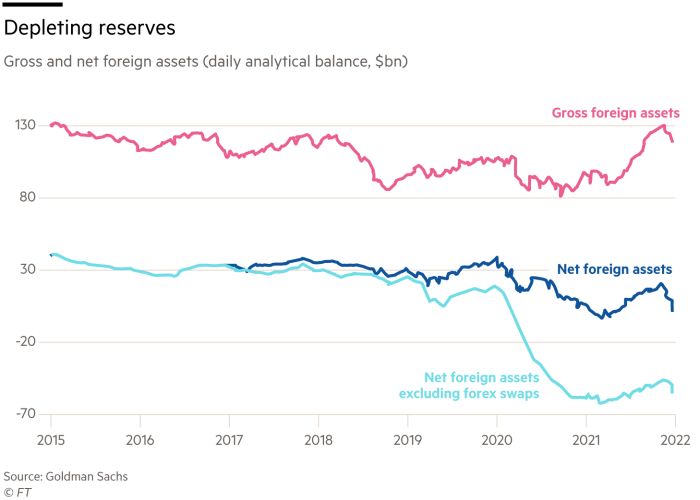

Supporting the lira has proved a costly exercise, accounting for — according to Erdogan — $165bn over 2018 and 2019. This year saw a hiatus in depletion of reserves — at least until December. Including substantial interventions this week, analysts put the tally for the month to date at $15bn-$17bn.

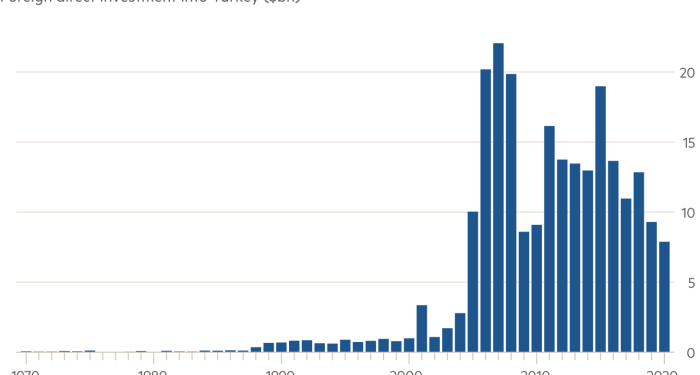

Investment has also suffered. Foreign direct investment has been falling in the past couple of years, receiving further discouragement from the deteriorating rule of law and economic mismanagement as Erdogan sought to strengthen his position in the wake of the abortive coup that failed to unseat his government. That sits uneasily with the government’s goal of securing a 1.5 per cent share of global foreign direct investment by 2023, or almost double last year’s take and higher than even the record levels of 2006.

There is little to entice foreign investors. Erdogan’s refusal to raise rates — instead there have been a series of rate cuts — is fuelling inflation. Bond yields are whipsawing. Risks stalk the equity market too. Banks, often the medium for monetary policy, bear refinancing risks, deteriorating asset quality and eroded capital ratios.

Some of that is already rippling out to swashbuckling foreign investors such as BBVA. The Spanish bank’s share price has slumped since unveiling its takeover bid for Garanti Bank, of which it already owns half, last month. Others will take that as a warning to steer clear.

The Lex team is interested in hearing more from readers. Please tell us what you think of Turkey’s economic woes in the comments section below.