Turkey’s foreign currency reserves have tumbled by billions of dollars since the start of the week, suggesting that aggressive interventions have aided the lira’s bounce back from record lows.

The lira had fallen significantly following the latest series of interest rate cuts, but it turned sharply higher on Tuesday after President Recep Tayyip Erdogan unveiled a new savings scheme aimed at incentivising local residents to hold lira deposits.

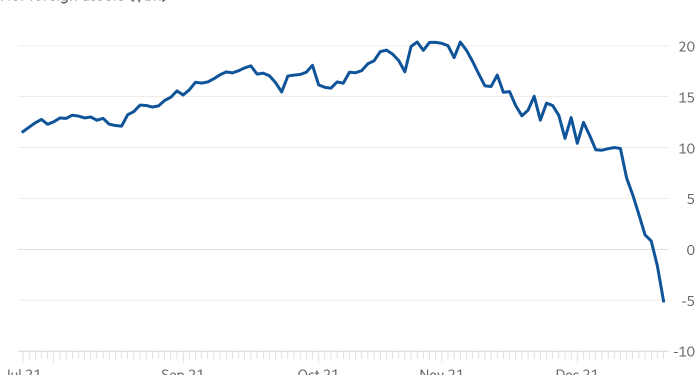

But at the same time, the country’s net foreign assets fell by $5.9bn in the first two days of this week to minus $5.1bn, according to Financial Times calculations based on central bank data.

The Turkish central bank has not announced any official interventions this week and declined to comment on whether it had sold dollars to prop up the lira in recent days. But the erosion of its foreign assets suggests that this has played a significant role in the lira’s recovery.

Ugur Gurses, a former central bank official, said the 50 per cent rally in the currency from Monday’s nadir was explained at least in part by a large “backdoor intervention”.

A London-based analyst, who asked not to be named, said he had calculated an intervention of $6.9bn on the same days — estimates range from $5.5bn to $7bn. Turkish bankers reported a “very concerted and aggressive effort to make Erdogan’s announcement look good”, he said.

Turkey’s lira hit a record low of 18.4 to the US dollar on Monday, down by 60 per cent over the year, but posted a massive rebound after Ankara announced a pair of schemes, backed by the country’s Treasury and central bank, to protect lira savings and underpin the currency by indexing them to foreign currency.

Erdogan declared on Wednesday that Turkey was winning its financial battle. “We are battling against the oppression of our people with inflation and interest,” he said in a televised speech. “This time, we will achieve the results we want.”

Analysts estimate that the powerful intervention at the start of the week brings total interventions by the central bank this month to between $15bn and $17bn.

The scale is likely to reignite alarm among analysts about the health of Turkey’s foreign currency reserves.

The bank’s war chest had recovered earlier this year after plummeting to a 20-year low after a previous attempt to defend the lira while cutting interest rates burnt through more than $100bn.

The rating agency Fitch, which earlier this month changed its outlook on Turkey to “negative”, voiced concern over an announcement at the start of December that the central bank would resume interventions to support the lira. The agency warned that, if sustained, the policy “risks further undermining the already weak central bank international reserves’ composition”.

Concerns about Turkey’s reserves came as analysts warned that the new savings schemes announced by the president risked further fuelling the country’s already sky-high inflation, which stood at an official rate of 21 per cent in November.

Some analysts argued that the new plan amounted to a clandestine interest rate increase or currency peg and that the central bank might be compelled to print more money to cover its new obligations.

The government had “thrown in the towel” on inflation and was adopting a semi-fixed exchange rate, Hakan Kara, who was chief economist at the central bank before he was fired in 2019, wrote on Twitter.

“For 10 years, the demand for [low] interest rates has required pulling different instruments out of the hat,” he said. “We still don’t have a stabilising monetary policy. This system too will necessitate revision.”

“You won’t have the exchange rate and inflation rate spiral that was there before, but it will still be very difficult to bring inflation back into single digits,” said Kieran Curtis, an emerging market debt manager at Aberdeen Standard Investments in London. The big difference in inflation between Turkey and the US and eurozone would weaken the lira and add to fiscal costs, he said.

Investors might be encouraged to buy Turkish assets as the scheme makes capital controls less likely in the immediate future, but the amounts would be small, Curtis added. Aberdeen sold its exposure to Turkish debt in March and has not bought any since.

Erdogan said those worried the lira could resume its downward march were “soft in the brain” and that regulators were pursuing legal cases against those who try to weaken the lira by encouraging people to buy foreign currency.

Additional reporting by Jonathan Wheatley in London