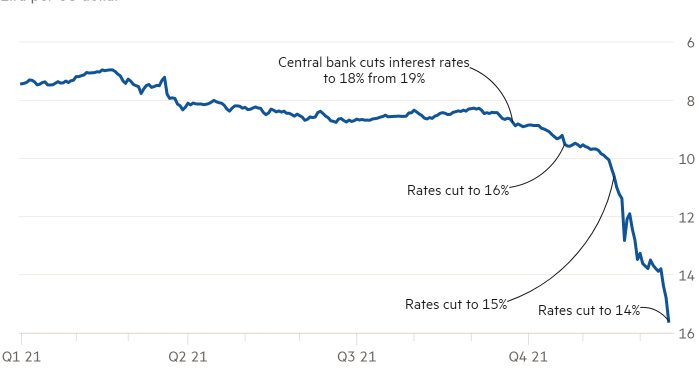

Turkey’s president Recep Tayyip Erdogan pushed on with his risky economic “experiment” as the central bank cut interest rates for the fourth month in a row despite rising inflation.

The bank lowered its benchmark lending rate by 1 percentage point to 14 per cent even as official data showed that annual inflation was running at 21 per cent in November.

The country’s deeply negative real interest rates have put huge pressure on the Turkish lira, which is down more than 40 per cent against the dollar since the central bank began cutting rates in September.

The lira hit a record low following Thursday’s decision, plunging as much as 5.2 per cent to 15.595 against the US dollar, according to Refinitiv data.

Erdogan, who rejects the established economic orthodoxy that high interest rates curb inflation, has argued that slashing the cost of borrowing will lead to a surge in exports, investment and employment that will ultimately stabilise the currency and bring down inflation.

Economists say the president’s plan is likely to result in runaway price rises, further eroding the living standards of a population that is already suffering from rising poverty.

“If it were not for the pain and suffering inflicted on 84 million people, this would be a fascinating economics experiment,” said Refet Gurkaynak, a professor of economics at Ankara’s Bilkent University.

“It shows that economists actually have a very good understanding of the fundamentals of monetary policy. We knew this would be the result — and it is.”

Charlie Robertson, chief economist at the investment bank Renaissance Capital, said Erdogan’s approach had no precedent. “I can’t think of another leader who has pushed this weird policy mix before,” he said. “A medieval policy on usury doesn’t work in a floating currency world.”

Erdogan, whose ruling party has suffered an erosion of support in the polls amid the economic turbulence, is expected to announce a huge increase in the minimum wage on Thursday in an effort to offset the impact of the sliding currency on the public. Pro-government media reported that the increase was expected to be about 35 to 40 per cent.

The president, who earlier this month appointed a new finance minister after the resignation of his former economy chief, announced a further shake-up in the economic team early on Thursday.

He removed Sakir Ercan Gul and Mehmet Hamdi Yildirim, two deputy finance ministers, according to a decree published in the official gazette.

He replaced them with Yunus Elitas, a bureaucrat, and Mahmut Gurcan. Gurcan is a former ruling party official who, like the family of Nureddin Nebati, the new finance minister, also has a textiles business.