Turkey’s lira rallied in the second day of chaotic trading after President Recep Tayyip Erdogan unveiled a new savings scheme that analysts described as a backdoor interest rate rise that could erode the public finances.

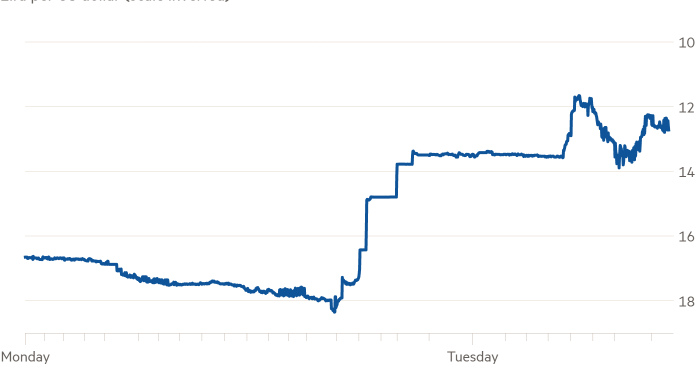

The gains on Tuesday leave the currency up roughly 50 per cent from a record low struck in the previous trading session.

The intense volatility was triggered by a new plan by Erdogan to lure Turkish savers away from the dollar and gold by compensating them for exchange rate losses if they held their money in lira.

The currency was recently trading at roughly TL12.6 against the US dollar, having struck a record low of TL18.4 on Monday before dramatically reversing course. The swings on Monday were the biggest on Refinitiv records stretching back to the early 1990s.

Refet Gurkaynak, a professor of economics at Ankara’s Bilkent University, described the new scheme as “in effect, a powerful interest rate hike”. He said that it could bring stability to the currency but warned that it could also have “dangerous consequences”.

That was echoed by Wolfango Piccoli, a Turkey analyst at the consultancy Teneo, who said that the move amounted to a “stealthy rate hike” — and one that would be solely determined by the exchange rate.

“This huge exchange-rate-indexed interest rate hike means that taxpayers will be financing the wealthy so that they will not lose on the [foreign exchange] front,” he wrote in a note to clients, adding that the scheme would place nearly all of the currency risk on the state.

Erdogan, a staunch opponent of high interest rates, has ordered a succession of rate cuts in recent months despite double-digit inflation.

While the Turkish president has claimed that his “new economic model” will boost exports, investments and job creation, it has put huge pressure on the Turkish lira. The currency had lost around 50 per cent of its value against the dollar in the three months before Erdogan’s announcement.

An exodus of foreign investors from Turkey in recent years has meant that the pressure on the lira has been driven in large part by Turkish citizens and businesses.

Reluctant to save money in lira, whose value has been eroded by soaring inflation and negative real interest rates, they have flocked instead to the dollar and gold. That in turn has put further pressure on the currency.

In a bid to reverse the “dollarisation” trend, Erdogan announced late on Monday that his government would offer “a new financial alternative to citizens” that he said would alleviate their concerns about the impact of the plunging lira on their savings.

The government would compensate savers, he said, for any losses if the decline in the exchange rate exceeded the interest rate offered by banks.

“From now on, there will no longer be any need for any of our citizens to switch their savings from lira to foreign currency because they are concerned that the exchange rate may rise,” the Turkish president said.

The Turkish Treasury said that the scheme would be open only to individuals, not businesses, and that they would be required to commit to locking their money away for a minimum of three months to benefit from the exchange rate guarantee.

While it provided no details about how the initiative would be funded, analysts voiced concern that the Turkish Treasury would bear the risk of compensating savers for any exchange rate losses.

While Turkey’s public finances remain strong compared with many other emerging markets, the foreign exchange component of central government debt reached 60 per cent of the total in October, up from 39 per cent in 2017. That means that, each time the lira has slid against the dollar, it has become more expensive for the government to service its debt burden.

Citigroup said that, from the standpoint of the Treasury, the new scheme “may turn out to be a more costly alternative to a tighter monetary policy stance in the event that lira deposit rates fall short of a depreciation of the currency and thus adversely affecting fiscal performance”.

“We believe these measures can bring temporary relief while the government tries to further implement its new economic model agenda,” said Luis Costa, a currency strategist at Citi, adding that the bank was scrapping its recommendation to bet on further lira declines.

However, the scheme will do little to discourage Turkish savers from seeking non-lira assets as a hedge against rising prices, he added. “We do not see how that can fix the local currency asset issues in Turkey which arise from the [currency-led] inflation,” Costa said.