Dear reader,

City minister John Glen told the Association of British Insurers what they already knew at the organisation’s annual dinner this week. That EU rules still in place under Solvency II regulations are not working for Britain. Attendees know this partly because the EU has already put its own reforms to the same rules in writing.

Even so, the UK’s Conservative government is trying to talk up insurance deregulation as part of a putative “Brexit dividend”. Customers and shareholders of the UK’s big life insurers such as Aviva and Legal & General should benefit when rules are phased in over the coming years.

The goal of UK and EU regulators is broadly the same. Promote the pool of permanent capital in the insurance industry to finance assets that are less liquid than corporate and government bonds. Low interest rates and the search for yield mean this has been happening anyway.

Infrastructure investments keep everyone happy. These generate the long-term returns that match the liabilities of insurers. The government, meanwhile, gets private sector capital to pay for new things such as green power generation.

The first step for the UK in unlocking this treasure trove is to lower capital requirements for life insurers. This will be accomplished by cutting the risk margin by up to 70 per cent. This buffer represents the capital a third party would require to keep the business a going concern if a one in 200-year event arose.

The risk margin is good in theory. But it is needlessly big in the low rate environment. A 100 basis point fall in the risk-free rate, for example, results in a 27 per cent increase in the risk margin, according to the Prudential Regulation Authority (PRA). That means too much idle capital. EU proposals to cut the risk margin will free up at least €50bn of capital for similar purposes.

In the UK, the potential reduction in required capital could be as much as 10 to 15 per cent, thinks Glen, or about £17bn based on total capital at the end of 2020. In reality, the impact is likely to be lower as new rules are still being phased in. Solvency II which started in 2016 allowed up to 16 years in some cases for the transition.

Lower capital requirements should translate into lower prices for customers: specifically lower annuity prices. “The headline reforms [to Solvency II] are positive for pension schemes, who can reasonably expect lower premiums, therefore bolstering the bulk annuity demand in years to come,” said Mandeep Jagpal of RBC Capital Markets.

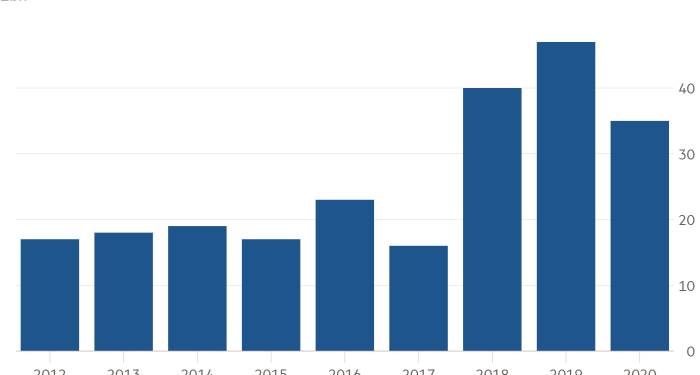

Bulk annuities have been one of the biggest sources of growth for UK insurers, with more than £100bn of deals completed since 2018. The prospect of lower prices is one positive. Rising interest rates should also spur demand as corporate pension schemes move into surplus and qualify for transfer to insurers.

Infrastructure investments will be encouraged with changes to the matching adjustment. This mechanism attempts to match long-term assets with the long-term risks of annuity providers. Rules at present favour bonds, with proposed changes less strict on alternative assets. When guidelines were first conceived in 2014 about 85 per cent of annuity-related assets were in bonds. Low rates and the search for yield means that figure has fallen to about 55 per cent today.

Portfolios have expanded to include alternatives such as property, infrastructure and other asset-backed financings. Tweaks to the matching adjustment should free up capital to allow greater investments in these asset types.

What remains unclear is what the PRA will do to offset these capital gains for what it believes is an understatement of credit risk through the fundamental spread mechanism.

The result will still very likely be lower net capital in the system. That ultimately increases the risks for policyholders — and for their ultimate backstop, the UK government.

Enjoy the rest of your week,

Andrew Whiffin

Lex writer