Two things to start:

-

Don’t miss Derek’s story on President Joe Biden’s shift from fossil fuel critic to reluctant champion.

-

Excelerate Energy, which runs a global fleet of floating gas import terminals, soared in its first day of trading yesterday in the latest sign that the energy crisis has rekindled investor interest in fossil fuels.

Welcome back to another Energy Source.

We have a bumper issue today. In our first note, I look at a dire warning that a European embargo of Russian oil and gas could lead to a global recession. Myles has the latest data on the Permian’s oil drilling boom, and Amanda reports on Google’s warning that efforts to decarbonise the grid are poised to fail. Finally, Data Drill focuses on a big drop in Russian oil supply as sanctions on the country bite.

Thanks for reading! A note to readers, we’re taking a short break next Tuesday, but we’ll be back in your inboxes Thursday April 20. In the meantime sign up for our sister newsletter Moral Money covering the latest on environment, social and governance trends.

Justin

PS Join us May 7 for our inaugural US edition of the FTWeekend Festival in Washington DC, where FT writers and editors will be joined by leading authors, scientists, politicians including Henry Kissinger, Chimamanda Ngozi Adichie, William J Burns, and more. Claim 50 per cent off your registration with the code FTNewslettersxFTWF22.

Russian fossil fuel: To sanction or not to sanction?

A sudden halt to Europe’s imports of Russian energy would force governments to ration supplies and threaten to tip the global economy into recession.

That dire warning yesterday from Moody’s, the credit rating agency, comes as the continent’s political leaders are under increasing pressure to place an embargo on Russian energy supplies to punish Moscow for its invasion of Ukraine.

Europe’s leaders have a high-stakes choice to make: continue sending about €1bn a day to Moscow to fortify the continent’s energy supply, or risk economic and humanitarian catastrophe at home and beyond.

Moody’s analyst Laura Perez wrote in her report that suddenly cutting off Russian oil and gas would fuel inflation, send commodity prices soaring towards record highs, force rationing that could shut down large swaths of European manufacturing, and prove politically destabilising.

For now, European leaders are resisting the calls to immediately sanction Russian oil and gas. Instead, they’re focused on weaning their countries off of fuel from Russia in the coming years by increasing purchases of liquefied natural gas from the US, Qatar, Algeria and elsewhere.

Emily Haber, Germany’s ambassador to the United States, took to Twitter on Wednesday to defend the stance, arguing that “going cold turkey on fossil fuels from Russia would cause a massive, instant disruption”.

She echoed warnings that the economic and political fallout would not be limited to Europe.

“You cannot turn modern industrial plants on and off like a light switch. The knock-on effects would be felt beyond Germany, the EU’s economic engine and fourth-largest economy in the world,” she said.

A report from some of Berlin’s top economic research groups warned that a wide embargo on Russian oil and gas would cause the economy to shrink by 2.2 per cent next year and wipe out more than 400,000 jobs. Economists warned a ban on Moscow’s energy over the next two years could have a greater impact on the German economy than the pandemic.

Haber argued in a Twitter thread that undermining Germany’s economic might would ultimately prove self-defeating in combating Russian aggression.

(Justin Jacobs)

Are Permian operators setting up for an output surge?

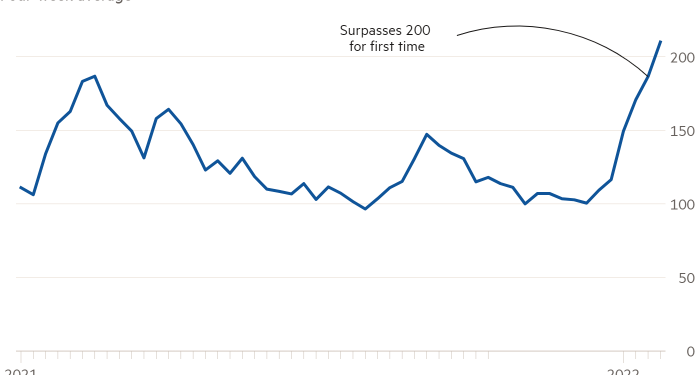

The number of permit approvals in the Permian Basin hit record levels last month, the clearest indication yet that operators are laying the groundwork to ratchet up production.

America’s most-prolific shale field awarded 904 permits in March, according to data from consultancy Rystad Energy — well above the monthly average of 400-500.

“This is a clear signal that operators in the basin are kicking into high gear on their development plans, positioning for a significant ramp-up of activity level and an acceleration in the speed of output expansion over the next few months once supply chain bottlenecks ease,” said Artem Abramov, Rystad Energy’s head of shale research.

Whether the permit pile-up translates into a production surge depends on how many are drilled and how quickly. Some permits never lead to actual drilling, and operators often sit on licenses for extended periods.

Baker Hughes said 332 rigs were operating in the Permian last week, up almost 50 per cent since this time last year, but still well below a peak of more than 550 at the height of the shale boom in 2014.

Meanwhile, 152 frac fleets were in action, according to data provider Primary Vision, well above the average of recent years. However, that figure will struggle to climb much higher in the near term because of supply chain constraints, the company warned.

Abramov said the permitting increase sets up a rig count jump in the second half of the year, which would foreshadow a “significant increase” in supply next year.

Operators have repeatedly cautioned that shortages of everything from labour to sand prevent an immediate boost in production. The bigger public drillers have also insisted they cannot return to growth mode until they get the green light from Wall Street, which is insisting on shareholder returns rather than a reversion to the profligate drilling binges of previous years.

The bulk of the new permits — about 500 — were in the hands of privately held operators, which face less scrutiny, but some of their larger public counterparts were stocking up too. Diamondback Energy stashed an “unusually high” 59 permits, according to Rystad, while Pioneer Natural Resources, the basin’s biggest shale driller, was awarded a record 99. (Myles McCormick)

Google calls for policy reboot to decarbonise the grid

The Biden administration’s plans to clean up America’s power grid are doomed to fail unless policy is overhauled, according to Google.

As the White House struggles to push its climate agenda through an uncooperative Congress, the tech giant has weighed in with its own strategies for decarbonisation, focused on cleantech deployment and a reboot of power markets.

“We will not decarbonise the grid under the current structure,” said Caroline Golin, Google’s global head of energy and climate policy, as the company launched a “policy road map” calling for faster legislative action and a greater voice for corporations in the clean energy debate.

The tech giant sucks in massive amounts of power to keep its data centres humming. In 2020, it announced a “24/7” carbon-free energy goal, aiming to run entirely on clean energy by the end of the decade. At least 64 companies including Microsoft and have made similar pledges.

The Biden administration wants to remove carbon from the grid entirely by 2035. But Google argued this goal can’t be met under current legislation. The company on Thursday urged lawmakers to quickly pass policies to drive investment in new technologies, expand markets, and convince consumers to move to clean energy.

At the heart of the tech group’s policy plan is an overhaul of wholesale power markets to make them more competitive, and make it easier for companies to buy clean energy directly.

Google shied away from commenting on the congressional logjam of climate legislation and what the failure of President Joe Biden’s Build Back Better bill has meant for the decarbonisation drive — insisting it was approaching the issue from a politically neutral stance.

“We don’t really think about federal energy policy from the left or from the right,” said Golin. “We think about it as impact.” (Amanda Chu)

Data Drill

Russia may be underestimating its drop in oil production, says a new analysis by OilX, an analytics firm. Last week, Alexander Novak, the deputy prime minister, said oil production may decline by 4-5 per cent from March to April because of problems with insurance and usage of vessels. The country currently averages 9.8 mb/d, down from March’s average production of 11 mb/d.

But a new forecast from OilX expects the drop in oil production to be much greater than Russia’s predictions. According to OilX, oil production in the country is expected to average 9.5 mb/d in April, about a million barrels per day less than Novak’s prediction.

The International Energy Agency predicted a similarly larger decline in its monthly oil report. The agency expected a combination of international sanctions and refinery cuts will lead to average losses of 1.5 mb/d in April and nearly 3 mb/d from May onwards.

Russia is the third-largest oil producer and the largest oil products exporter. While the EU faces calls from western countries to ban Moscow’s oil, some member states are resisting the move over fears of economic disruption. (Amanda Chu)

Power Points

-

Oil companies are drilling among giraffes in Uganda and testing the water for oil development in the age of net zero.

-

South Korea is set to reverse its nuclear phaseout plan to bring down energy prices and emissions.

-

Soaring energy prices are curbing the production of metals such as zinc and aluminium.

-

Lloyd’s of London, the world’s largest insurance marketplace, shut its headquarters after fossil fuel protests.

-

China’s strict Covid-19 measures are hurting its solar industry. (Bloomberg)