Good morning. Ethan here. Rob is on hiatus and, after today, so is Unhedged. Regular service resumes September 5, when Rob will make his much-anticipated return. While we’re off, why not read Martin Sandbu’s always interesting Free Lunch or listen to Katie Martin talk about quantitative tightening?

For the next couple weeks I’ll be helping out elsewhere in FT-world. In the meantime, complaints, ramblings and new ideas are always welcome: ethan.wu@ft.com.

The Fed-markets disconnect

Here are some snippets from Federal Reserve officials’ speeches yesterday.

Hard to scream much louder than this:

The Fed is insisting, loudly and repeatedly, that it’s serious about raising interest rates. Markets, as we’ve discussed before, and has been widely noted, are not buying it.

Why the disconnect? I can think of three potential reasons:

-

Markets are optimistic about inflation. They think it will moderate fast enough that the Fed can pivot to slashing rates. Unhedged disagrees, but you can find smart people like the Institute of International Finance’s Robin Brooks or JPMorgan’s Marko Kolanovic making this case.

-

Markets don’t believe the Fed’s commitment to fighting inflation. They think a weakening economy will force the Fed into lowering rates, even if price pressures stay hot.

-

Market pricing, for some reason, isn’t reflecting a fundamental view of the economy. I have no idea how to assess the likelihood of this. But for what it’s worth, the FT reported yesterday that technical factors, such as hedge funds closing out short positions, have been behind the recent equities rally.

Whatever the reason, former Fed vice-chair Bill Dudley argues in an op-ed yesterday that markets’ disbelief is harming the US central bank’s policymaking. It is loosening financial conditions right when the Fed wants them tighter. Dudley wants chair Jay Powell, who will speak publicly next Friday, to ram his message through Mr Market’s thick skull:

Dudley’s point is about messaging. And yes, if markets think the Fed’s inflation-fighting pledge is suspect (reason 2), some tougher talk — perhaps a Bank of England-style promise to prioritise inflation over growth — could scare them straight.

But if, instead, markets believe inflation is about to subside (reason 1), what can Powell say to dispel that? The Fed has no more insight into where the economy is going than investors. And if markets are right, it’s hard to believe the central bank would raise rates in an economy that’s slowing fast while inflation numbers tumble. That is the bind of the Fed being data-dependent: it applies on the way down, too.

Readers reply on credit risk

Wednesday’s newsletter made the point that how scary credit risk looks depends on where you think interest rates are going. A number of readers wrote in to register their thoughts.

Pascal Blanqué of the Amundi Institute noted a few reasons to be optimistic about corporate credit:

Inflation helps debtors, and that’s no less true for corporate debtors. But there is a more pessimistic view — that inflation will stop central banks from intervening when the credit cycle turns down.

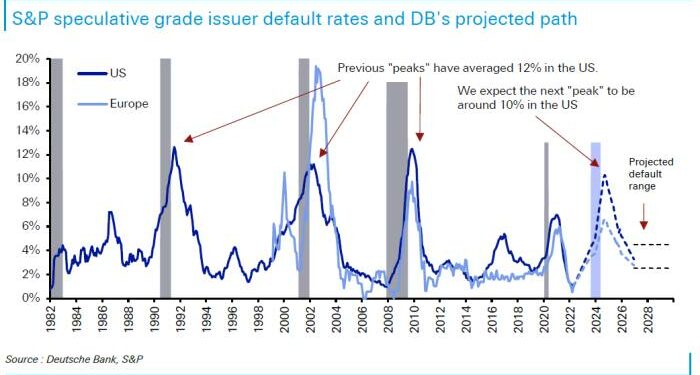

Deutsche Bank’s Jim Reid makes this argument well (thanks to Dec Mullarkey at SLC Management for sending along). Reid argues that structurally higher inflation will limit how much loose monetary policy is possible. If a US recession comes in late-2023, chances are Congress will be controlled by Republicans, likewise limiting fiscal policy. A recession plus little policy support gives you a big rise in defaults:

This view, of course, hinges on the Fed sitting back and watching it happen. Would it do that? Mullarkey adds:

In the end, it’s all about inflation.

One good read

RIP to Pixy, the flying selfie drone.