SoftBank sold $550m worth of WeWork debt it had provided the lossmaking property group during its liquidity crisis more than a year ago, agreeing to sell the bonds at a discount to woo investors to the deal.

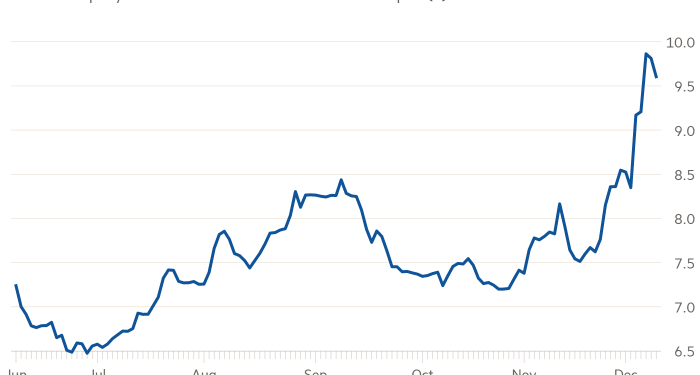

The Japanese telecoms-to-technology business offloaded the debt, which carried a 5 per cent coupon and matures in July 2025, at roughly 86 cents on the dollar, said two people briefed on the matter. The low price pushed up the yield on the bonds to 9.75 per cent, above the yield on WeWork’s existing debt, which underscored the somewhat lacklustre investor reception for the securities. Yields move inversely to prices.

The $550m debt was part of a $2.2bn rescue package WeWork struck with SoftBank in 2019 and drew down last year, as the provider of shared office space struggled with the fallout from its aborted initial public offering that executives warned had brought it to the brink of bankruptcy. The pandemic also hit its business, like much of the commercial property industry, hard.

SoftBank founder Masayoshi Son had bet big on WeWork, plunging billions of dollars into the company. The Japanese conglomerate, which suffered large losses on the investment in WeWork as its valuation tumbled, ultimately provided rescue capital in the form of credit lines and new debt.

In October WeWork finalised its long-awaited flotation, listing its shares on the New York Stock Exchange through a merger with a shell company. That merger and other associated deals raised $1.3bn for the group.

WeWork has reported an uptick in occupancy in recent months compared to the depths of the pandemic, although analysts with S&P Global warned this week that those levels remain below the threshold necessary for it to break even.

“The commitment from a broad set of investors indicates a continued support for WeWork’s long-term vision and an ongoing belief in the success of the business,” the company said in a statement.

The deal came as the sale of new debt has slowed from its breakneck pace as bankers and investors prepare for the end of the year. Nonetheless, bankers continue to test appetite for riskier deals, with a $300m bond for the video game platform Skillz coming to market with an 11 per cent coupon on Thursday, said people familiar with the deal, marking one of the highest interest rates on a new deal to hit the corporate bond market this year.

SoftBank’s sale put pressure on WeWork’s other debt. Its bond maturing in 2025 with a coupon of 7.875 per cent has fallen from 98 cents on the dollar at the start of this month to roughly 95 cents on Thursday, pushing its yield from 8.6 to 9.6 per cent.

The rating agency Fitch assigned a low assessment of triple C minus to the bonds, just one notch above default. The agency said the company should have enough cash to continue operating after previous equity raisings.

“However, a high degree of uncertainty remains surrounding the office market environment, Covid-19 and exogenous shocks including the evolving Omicron coronavirus variant,” Fitch analyst Kevin McNeil said. “WeWork would require additional liquidity sources if the office market remains depressed for an elongated period.”

SoftBank declined to comment.