Short-dated US government debt rallied on Thursday after data showing the American economy unexpectedly shrunk in the second quarter prompted traders to trim expectations for Federal Reserve rate increases.

Yields on two-year Treasury notes, which are sensitive to monetary policy expectations, dipped 0.12 percentage points to 2.85 per cent as the debt jumped in price.

The fall in yields came after a report from the US Bureau of Economic Analysis showed the world’s biggest economy contracted at a 0.9 per cent annualised rate in the second quarter of this year, much worse than expectations for a 0.5 per cent rise.

The unexpected fall came after gross domestic product declined at a 1.6 per cent rate in the first three months of the year.

Two straight months of contraction meets the technical definition of a recession, although a separate body called the National Bureau of Economic Research will not weigh in until much later to determine if the economic cycle officially turned at the start of this year.

The blue-chip S&P 500 rose 0.3 per cent in early New York trading, while the tech-heavy Nasdaq Composite edged up by the same margin. The weak economic data lent support to equities as investors wagered that the bad news would reduce the odds of aggressive monetary policy tightening.

The GDP report comes a day after the Fed lifted its main interest rate by 0.75 percentage points for the second straight month. However, markets focused on comments from chair Jay Powell, who said the central bank was open to the possibility of smaller increases in the future.

“At some point, it will be appropriate to slow down . . . We might do another unusually large increase [in September], but that’s not a decision that we’ve made at all, we’re going to be guided by the data,” Powell said.

Traders and strategists said Powell’s suggestion that monetary policy decisions would be data-dependent indicated a lower probability of large rate rises going forward.

“This does imply less dramatic increases in the next three [Fed] meetings than in the last two,” said Tai Hui, market strategist at JPMorgan Asset Management, adding that recent readings on “inflation and labour market dynamics . . . currently signal the need for a more cautious approach into next year”.

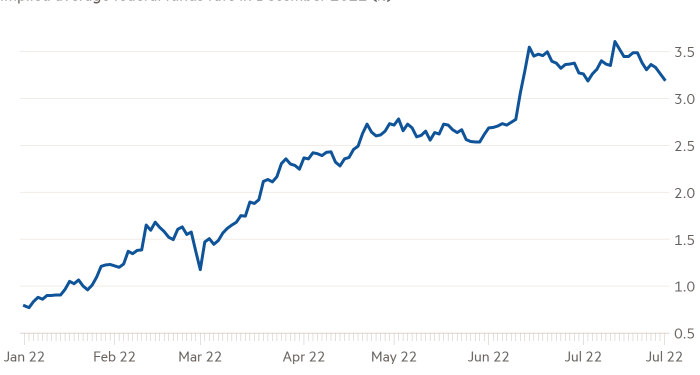

The disappointing data on Thursday further pushed down expectations for Fed rate rises for the remainder of this year, with federal funds futures signalling the central bank’s main interest rate will register an average of 3.2 per cent in December from estimates of 3.265 per cent a day earlier.

Expectations had risen as high as 3.605 per cent just two weeks ago before a string of weak data led market participants to expect a more dovish policy path from the central bank.