The company most associated with the dramatic ups and downs of the US shale patch is taking another gamble, planning to offload prize oil assets and double down on American natural gas.

Chesapeake Energy, a pioneer of the shale revolution that went bankrupt during the coronavirus pandemic crash, said on Tuesday it planned to exit oil altogether and return to its roots as a natural gas producer, instead pinning its future on a wave of demand for US exports of the commodity.

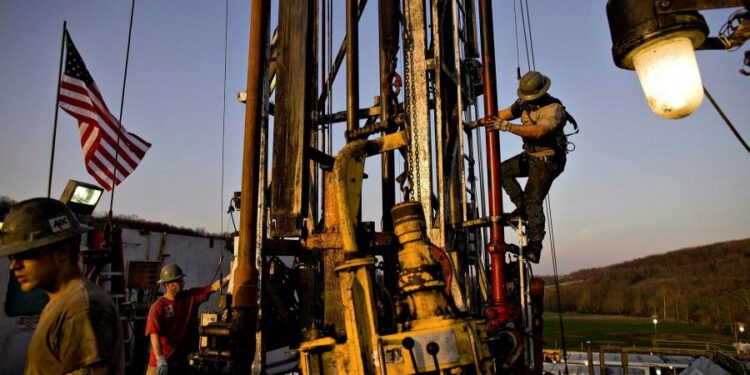

The company — which grew from obscurity in the late 1980s to become the best-known player in the fracking revolution that made America the world’s biggest producer of oil and natural gas — said it would offload oil producing assets in south Texas’s Eagle Ford basin, allowing it to focus solely on gas production from Louisiana’s Haynesville basin and the Marcellus in Appalachia.

Chief executive Nick Dell’Osso said the decision was made due to better returns from its gas assets, where it has had more success driving down costs and improving efficiency compared with oil.

But he said the company also wanted to double down on natural gas production amid surging demand for US liquefied natural gas exports, following a global scramble for the commodity fuelled by the war in Ukraine. Russia’s weaponisation of its exports in the wake of Vladimir Putin’s invasion has created a global shortage and sent prices soaring.

“We stand to help the world through the gas that we deliver as much as anyone else,” said Dell’Osso. “The US is now connected more fully to the rest of the world through LNG exports and that connectivity is going to nearly double over the next five to seven years.”

Chesapeake’s former chief Aubrey McClendon pioneered the widespread use of hydraulic fracturing and horizontal drilling at the turn of the 21st century to become the biggest US gas producer after ExxonMobil.

At its peak in 2008, Chesapeake was valued at $35bn and McClendon became the best-paid executive in the US. He died in a car crash in 2016, a day after he was indicted on charges of rigging bids for drilling rights.

The company was the highest-profile casualty of the 2020 price crash that plunged dozens of debt-saddled oil and gas producers into bankruptcy. It emerged from bankruptcy in February last year vowing — like many other players in the space — to shift from a model of untrammeled growth and drilling to one of capital discipline and higher shareholder returns.

The company has gradually expanded its gas portfolio since its emergence from bankruptcy. It bought gas producer Vine Energy for $2.2bn last August to bolster its position in the Haynesville, which sits close to gas-export facilities on the US Gulf Coast.

And in January, it bought Chief Oil & Gas, a gas operator in north-eastern Pennsylvania’s section of the prolific Marcellus shale field. It also recently offloaded its Wyoming oil business to Continental Resources, the company controlled by shale billionaire Harold Hamm.