Tankers loaded with Russian oil and gas are criss-crossing global seas. But with the western boycott on the country’s crude widening, traders and analysts have said it was unclear whether the intended recipients would accept deliveries, as the US and its European partners consider a Russian oil embargo.

Sovcomflot is Russia’s largest shipping company and the world’s biggest owner of medium-sized tankers called Aframaxes, which can carry between 500,000 and 800,000 barrels of oil. It also operates liquefied natural gas (LNG) tankers.

Last week, 77 ships from Sovcomflot’s 172-strong active fleet were at sea, according to data provided by Windward, a maritime intelligence company. One of its vessels, NS Champion, was destined to dock in Orkney, Scotland, but was turned away and was last seen heading to Denmark.

Arthur Richier, lead freight analyst at Vortexa, said it was a “big unknown” if the ships would actually discharge cargo in Europe, but added that he expected more diversions.

“The west are stopping short of targeting energy flows, but when they target the banks they put into jeopardy credit lines and we’ve seen them impact Sovcomflot,” he said. “We’re seeing the entire infrastructure being questioned.”

In the past week, seven Russian-linked LNG carriers have been redirected because of sanctions, according to Paolo Enoizi, chief executive of GasLog, an LNG shipping company.

Global oil prices have already shot higher, as typical buyers turn their back on Russian crude in response to the war in Ukraine. Analysts have said this could quickly clog up the distribution network.

Companies that charter Sovcomflot ships, which sail from ports in the Baltic Sea and Black Sea, include Russian energy groups Lukoil and Gazprom as well as commodity traders Trafigura and Vitol.

Shipping specialists have said it was too early to tell if Sovcomflot was scaling back its operations. Kpler, another company that tracks tanker movements, said there was no large discernible change in the trading patterns of Sovcomflot vessels yet, adding that many ships still had European ports as their self-reported destinations. As a result, the full impact may take some time to show.

“Our hypothesis is these were vessels and cargoes fixed weeks ago,” said Matthew Wright, senior freight analyst at Kpler.

The EU is yet to stop Russian-linked ships from calling at its ports, but the bloc is widely expected to follow the UK in introducing a ban, which was first announced last week.

The global oil market is facing the biggest disruption since the 1990-91 Gulf war. For now, Russian energy exports are largely exempt from sanctions imposed by the US, EU and UK. But banks, insurers, refiners and shipping companies are still avoiding Russia’s oil, including its flagship Urals grade, to reduce legal or reputational risk.

As a result, Russia’s traditional trading partners are scouring the market for alternative sources of supply, a search that on Monday pushed up the price of Brent, the international oil benchmark, to almost $140 a barrel.

Russia typically exports 5mn barrels per day of crude and 2.7mn b/d of refined products. Europe takes about 60 per cent of its crude and is also an important market for Russian diesel, fuel oil and gasoline.

Demand for Russian oil has collapsed since the assault on Ukraine began and rates for tankers calling at Russian ports have spiked by more than 300 per cent.

Energy Aspects, a consultancy, said last week that 70 per cent of Russian crude exports were “struggling to find buyers” even at record discounts. The remaining 30 per cent of the country’s oil is carried by pipelines to Europe and Russia’s far east and appears to be finding buyers.

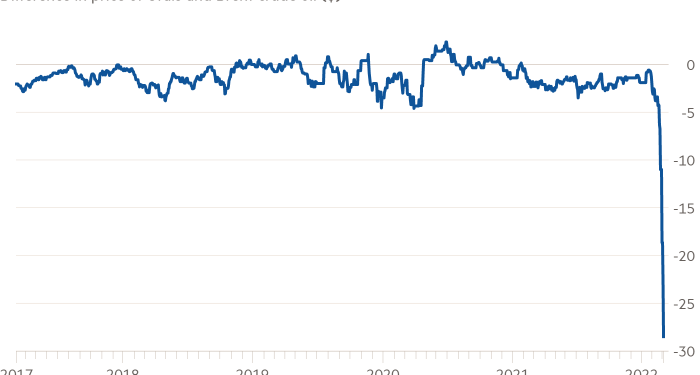

Oil supermajor Shell has been one of the few buyers. The company purchased 725,000 barrels of Urals from Trafigura on Friday at a record discount of $28.50 to Brent.

Livia Gallarati, senior analyst at Energy Aspects, said most of the Russian oil “moving on the water” was bought and paid for before the fighting started in Ukraine.

“But right now, European refiners are not buying Russian oil,” she added, predicting that the impact on vessel movements would be seen later in the month.

According to JPMorgan, preliminary Russian crude oil loadings for March indicated a drop of 1mn barrels a day in loadings from Black Sea ports and a 1mn b/d drop from the Baltics, plus a 500,000 reduction at Kozmino in Russia’s far east. In addition, there is an estimated 2.5mn b/d loss in oil product loadings from the Black Sea.

“Were disruption to Russian volumes to last throughout the year, [the] Brent oil price could exit the year at $185 a barrel,” said JPMorgan analyst Natasha Kaneva.

Sovcomflot could eventually provide a vital lifeline for the Russian oil industry.

“I am sure you will find countries [like China and India] that are willing to take Russian oil especially at the discounts on offer,” said one trader, adding that big Russian producers already appeared to be offering flexible payment terms and skipping credit guarantees in an attempt to lure buyers.

However, Sovcomflot does not have the capacity to lift every barrel of Russian oil. If a western embargo happens, the country’s oil industry would eventually have to cut production.

“We are not there yet,” said Gallarati. “Buyers will have to stay out of the market for much longer for that to happen.”