Russian stocks plummeted in turbulent trading on Monday, on mounting concern that Moscow could soon launch an invasion of Ukraine.

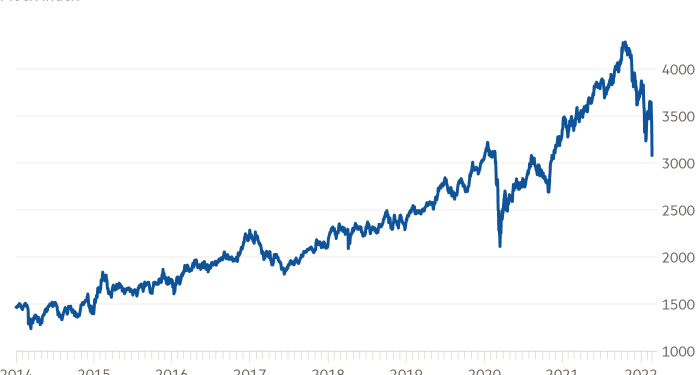

The Moex index plunged as much as 14.2 per cent after Moscow claimed that it had destroyed two Ukrainian military vehicles that entered Russian territory, in an unconfirmed incident that would be the first direct clash with Ukrainian forces since Moscow mobilised 190,000 troops on its border.

The index closed the main trading session down 10.5 per cent in the biggest one-day fall since Russia seized Crimea in 2014, according to Refinitiv data.

Vladimir Putin, Russia’s president, also on Monday convened his top security advisers and agreed to recognise two Moscow-backed separatist regions in eastern Ukraine.

“It does feel like the market isn’t quite panicking but that it has moved into a stronger form of risk aversion,” said Altaf Kassam, head of investment strategy and research at State Street. “There’s a feeling that Russia could yet escalate and take us over a cliff edge, [when] before it felt like Russia was as incentivised as the west to calm things down.”

Shares in Rosneft, Russia’s leading oil producer, were down almost 20 per cent in Moscow on Monday and have shed close to 30 per cent of their value since the start of this year. State-owned gas producer Gazprom declined almost 16 per cent, before trimming some of its losses, taking its fall for 2022 to 19 per cent. Shares in gas producer Novatek were trading 12 per cent lower.

The sell-off in Russian assets has also hit the likes of food group Magnit, down more than a tenth, and bank VTB, shares in which fell about 19 per cent on Monday.

Joe Biden, US president, and Putin on Monday agreed “in principle” to hold a summit which it is hoped could lead to a de-escalation of tensions on the Ukraine border. Yet hours later, Russia’s army said it had destroyed the two Ukrainian infantry fighting vehicles, killing five people.

Over the weekend, Boris Johnson, UK prime minister, vowed to impose economic sanctions and stop Russian companies raising money on UK markets in the event that Moscow moved to invade Ukraine.

Monday’s share price declines were evidence that proposed western sanctions on Russian companies “would clearly be problematic” for investors, said Charles Hall, head of research at UK-based investment bank Peel Hunt.

Even so, many of Russia’s biggest energy groups “don’t need to raise money right now as they’re doing very well from a profitability point of view”, added Hall. “Russian billionaires might now get a slightly less warm welcome in London than they’re used to, however.”

Russian government bond prices also tumbled on Monday, pushing yields to their highest level of the current crisis. The yield on Russia’s dollar bond maturing in 2030 climbed three-quarters of a percentage point to 5.14 per cent, up from just above 2 per cent at the start of the year.

Ukrainian yields also surged, with the yield on a dollar bond maturing in 2032 up more than half a percentage point at 11.1 per cent.

In currency markets, the rouble fell 3 per cent to trade at 79.6 to the dollar, its weakest level since October 2020.

The risk of tougher western sanctions was weighing on Russian assets and the rouble, according to Natalia Lavrova, senior economist at BCS Global Markets in Moscow.

Following Biden’s comments about an imminent Russian invasion of Ukraine, “the volume of capital outflow may grow significantly, hence, the rouble will remain under pressure”, said Lavrova.