China’s renminbi is heading for its worst weekly drop since before the pandemic as the country’s deteriorating economic outlook and rising returns on US debt undermine the draw of Chinese securities.

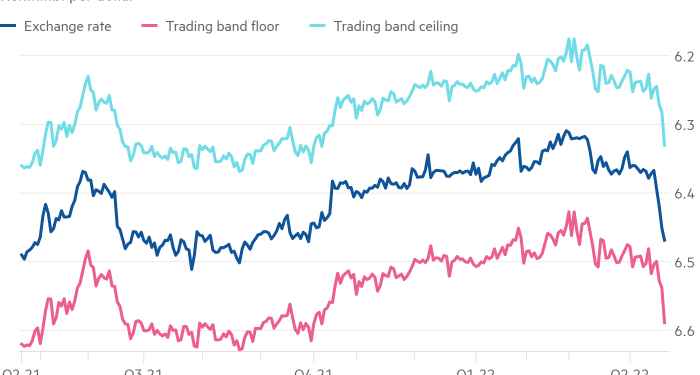

The renminbi was trading at about Rmb6.47 against the dollar on Friday, reflecting a drop of about 1.5 per cent this week and marking its biggest fall since August 2019.

The tumble for the Chinese currency marked the end of a roughly half-year stretch of stability and comes after the People’s Bank of China on Wednesday set the daily midpoint for the renminbi’s dollar trading band lower than markets expected.

Analysts have grown increasingly bearish on the renminbi, but markets had not reacted significantly until this week when the PBoC lowered its trading band and the yield advantage offered by Chinese bonds vanished as a result of rising US rates.

A weaker currency would help bolster Chinese exports and shore up economic growth that has been badly disrupted by Covid-19 lockdowns in cities including Shanghai.

“It’s clear markets are beginning to price in a change in China’s policy,” said Mansoor Mohi-uddin, chief economist at Bank of Singapore. He said a weaker exchange rate was one option available to Beijing as it simultaneously seeks to maintain tough zero-Covid policies, cap excessive leverage in the financial system and ensure annual economic growth of about 5.5 per cent.

“It seems as if the authorities realise these goals are difficult to achieve with their current settings,” Mohi-uddin said. “If you want to hit that GDP target, one way to do that may be to have a weaker currency.”

Rising returns offered by US dollar debt are also weighing on the renminbi. Throughout the pandemic, global investors have tapped Chinese bonds as a crucial source of fixed-income returns as central banks elsewhere employed loose monetary policy to keep lending costs down.

But with the US Federal Reserve embarking on a series of interest rate rises, yields on dollar bonds recently jumped above those on Chinese debt for the first time in 12 years. That vanishing yield advantage has spurred foreign investors to dump a record Rmb193bn worth of renminbi-denominated bonds over the past two months.

“The renminbi now appears to be responding to the sharp narrowing of the yield spread between China and the US,” said Lee Hardman, a currency analyst at MUFG Bank, adding that recent losses could also reflect “the deteriorating outlook for China’s economy”.

Foreign selling of Chinese stocks has added to outflows and dragged on shares listed in Shanghai and Shenzhen, with the benchmark CSI 300 index down almost 20 per cent this year.

On Thursday evening, China’s securities regulator called on domestic financial institutions including banks and insurers to step up support for the stock market, stating the country’s long-term economic trajectory had not changed and that its capital market still offered “important strategic opportunities”.