Investors are starting to worry again about high levels of government debt in the eurozone, as the prospect of rising interest rates revives concerns that have largely lain dormant in recent years.

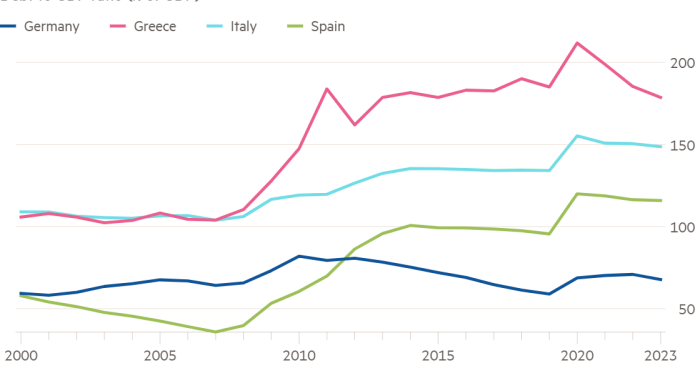

Borrowings by debt-laden countries including Italy, Greece and Spain have increased in the decade since the region’s sovereign debt crisis — in part because of the coronavirus pandemic’s drain on government finances.

Markets were more willing to fund those large debt piles while borrowing costs were ultra-low and the European Central Bank was continuing with its massive bond-buying programme. But the ECB’s plans to withdraw such stimuli — with an end to asset purchases and a quarter-point rate rise planned for July — mean the bonds of these southern European nations are once again under pressure.

Borrowing costs for Italy and Greece have climbed sharply, with Italy’s 10-year yield hitting its highest level since 2014 on Friday — although they remain far below the heights scaled in 2012. Still, the worry for many investors is that a sustained rise may reignite concerns over how manageable Rome’s or Athens’ debt loads are.

“I think the situation’s worrying but not critical,” said Antoine Bouvet, senior rates strategist at ING. “Sometimes the markets can talk themselves into a frenzy and lose confidence,” he said, adding that it becomes a “self- fulfilling prophecy”.

He said that if the gap between the Italian and benchmark German yields hits 2.5 per cent, then “some alarm bells will start ringing at the ECB”. The spread rose to about 2.25 per cent on Friday.

“So far [the widening] has been relatively orderly but it might lull the ECB into a false sense of security,” Bouvet added.

In a policy statement this week, the ECB said it planned to raise interest rates by 0.25 percentage points in July and that “if the medium-term inflation outlook persists or deteriorates, a larger increment will be appropriate at the September meeting”.

The bank last raised rates in 2011, and its deposit rate currently stands at minus 0.5 per cent.

On fears over fragmentation — the notion that tightening monetary conditions might impact eurozone countries differently — ECB president Christine Lagarde said on Thursday that if it is necessary, “we will deploy either existing adjusted instruments or new instruments that will be made available”.

“Obviously we need to make sure there is no fragmentation that would prevent the adequate monetary policy transmission,” she added.

Additional reporting by Tommy Stubbington