The writer is chief economist for Asia Pacific at Natixis and a senior research fellow at think-tank Bruegel

If the rule for US markets is “Don’t fight the Fed”, the traditional knee-jerk reflex of investors in China is to always heed Beijing. That was underlined after last week’s move by the country’s top economic official to bolster flagging confidence in Chinese markets.

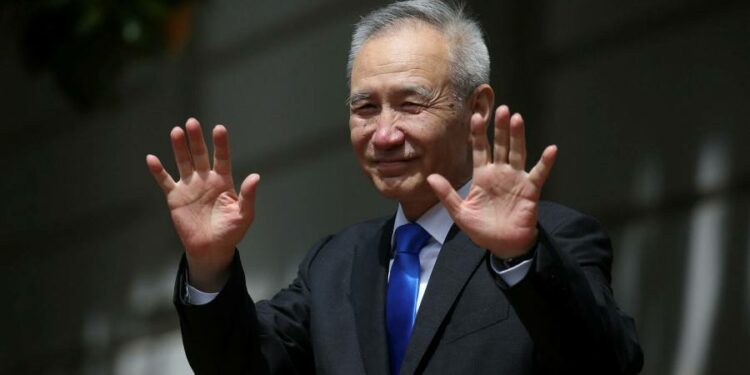

Liu He, vice premier and President Xi Jinping’s close economic adviser, made a rare public intervention to reassure investors. His comments to China’s financial stability and development committee were a long way short of Mario Draghi’s “whatever it takes” speech that turned around the eurozone crisis in 2012. But they had an immediate response.

The CSI 300 index, which tracks the largest listed companies in Shanghai and Shenzhen, has rallied 7 per cent from a low before the comments. Hong Kong’s benchmark Hang Seng index had its best day since 2008 in reaction, rising more than 9.1 per cent.

Clearly Beijing had enough of the drubbing that Chinese stocks have taken since the start of the last year. From highs early last year, the CSI 300 index had fallen about a third before Liu’s intervention.

Investor confidence had been hit by Beijing’s crackdown on the private sector, particularly on high-flying technology companies. A debt crisis at real estate developer Evergrande also raised concerns about the property sector. Sentiment then deteriorated sharply in the first half of March after a rapid increase in Covid cases in major Chinese cities and the start of the Russian invasion of Ukraine.

The problem for investors, though, is that it will be highly challenging for China to follow through on the remedies outlined in vague terms by Liu. His comments were mainly aimed at reminding investors of China’s goal of stability, particularly in a crucial political year in which Xi is expected to be reappointed beyond his second term. But Liu also spelt out the three routes through which Chinese policymakers could help bring capital markets back to a stable path.

They were facilitating Chinese companies’ access to overseas capital markets; offering a “standardised, transparent and predictable” approach to regulation of tech giants; and providing enough stimulus to reach the 5.5 per cent GDP growth target set by Premier Li Keqiang only a couple of weeks ago.

However, there are obstacles to all three routes. On overseas listings, the thorniest point is the US requirement for the disclosure of detailed audit information on listed Chinese companies to regulators following legislation passed in late 2020. The Securities and Exchange Commission warned last week it will start delisting Chinese companies from the US unless they comply. However, there are rumours that regulators in China might be ready to compromise and allow companies to comply with the requirements.

What might not be as easy for Liu is to convince China’s new array of regulators to reduce the pressure they have been imposing upon China’s internet companies to limit their overseas listings. These include the Cyberspace Administration of China, overseeing China’s internet companies, and the State Administration for Market Regulation, China’s antitrust body.

These regulators also hold the key to the second issue that Liu He needs to tackle, namely providing a more predictable regulatory environment for Chinese internet companies at home. This objective, though, may run counter to the overarching “common prosperity” push by Beijing as most of these internet companies are owned by billionaires, which are supposed to continue to pay the price of excessive market power.

Economic stimulus — the other key part of Liu’s pitch — should, in principle, be the easiest to achieve. But the stimulus plans announced so far look very far from what China embarked on in the past, certainly when compared with the 2008 massive fiscal package and even the more modest one in 2016 after the stock market collapse in the summer of 2015. The People’s Bank of China also might feel that more needs to be done by other policymakers before it eases monetary policy further, particularly given that the Federal Reserve is expected to raise rates aggressively.

Against the backdrop, Covid cases continue to pile up in China and lockdowns and other zero Covid-related policies continue to weigh on economic growth. The Ukraine war also will hit global demand for Chinese goods and Beijing’s ambiguous position on the conflict increases the risk of the country being caught up in Russia-related sanctions.

Liu’s pitch can only be commended for its immediate effectiveness but the longer-term outcomes will be difficult to achieve.