A succession of private equity firms are going public. But another group has been raising capital more discreetly — by selling record amounts of debt.

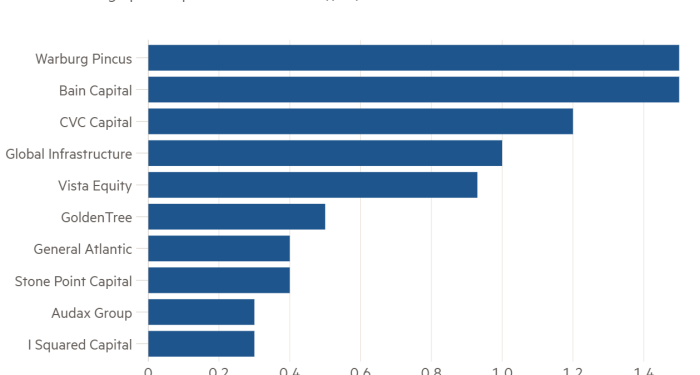

The industry’s biggest privately held firms raised at least $9bn through debt sales last year to invest in their own buyout funds, finance growth or pay dividends to partners, according to industry executives and records obtained by the Financial Times. They include Warburg Pincus, Bain Capital, General Atlantic and Vista Equity Partners.

Private equity firms have traditionally funded their leveraged buyout deals by taking loans against a target company’s assets. But debt taken on by buyout firms themselves, as opposed to their portfolio companies, marks a shift from the past. They have more commonly raised cash by selling minority equity stakes to private investors or through an initial public offering, as TPG did at a valuation of $10bn this month.

Borrowing avoids dilution of ownership and offers tax advantages by deferring some capital gains. The private debt placements do not require registration with the US Securities and Exchange Commission.

“If as a general partnership I want capital for any reason, there are lots of options besides needing to go public,” said Saul D Goodman, head of alternative asset management banking at Evercore.

Several firms said they had taken on new debt ahead of the Federal Reserve’s expected interest rate increases. Many can borrow for a decade or longer at about 3 per cent to invest in their own buyout funds that have historically returned 16 per cent annually, according to a Bain & Co calculation of the industry’s long-term average return.

The firms earn the difference.

“It helps them raise money without it coming out of pocket,” said Joseph Lombardo, head of the private equity general partnership advisory practice at investment bank Houlihan Lokey. “They can make money on the cost of borrowing being less than their expected return.”

The deals can also help firms manage the torrent of cash pouring into the private equity industry.

In 2021, a record $1.2tn in deals were struck and a further $300bn raised in new cash to invest in corporate buyouts, according to PitchBook. But the inflows can create a cash crunch. Pension fund investors ask private equity firms to commit at least 2 per cent of each fund, commitments that can exceed $400m as the industry’s largest funds swell beyond $20bn in size.

“It’s easier to make a commitment of 3 per cent when you have a $100m fund, versus a $20bn fund,” Lombardo said.

The largest such debt offerings were $1.5bn deals done by Warburg Pincus in September and Boston-based Bain Capital in February. Global Infrastructure Partners sold $1bn in debt in November.

In October, Vista Equity Partners borrowed $930m using a private placement of debt it sold to a group of US insurers, raising cash at low rates that the firm will invest in its funds alongside its limited partner investors, according to documents obtained by the FT and sources familiar with the previously unreported offering. The debt carried a AA- rating from Kroll and fixed interest rates hovering at about 3 per cent for borrowings stretching from 10-15 years.

Vista’s first such debt deal came a year after its founder, Robert Smith, settled a criminal investigation in October 2020 with the US Department of Justice in which he admitted to evading $43m in taxes.

Other debt sales below $1bn in size included US-based private equity investors General Atlantic, Stone Point Capital and Audax Group, credit manager GoldenTree Asset Management and real assets investor I Squared Capital, which used some of its $300m in proceeds to pay a dividend to partners.

Insurers and asset managers such as AIG, MetLife, Voya, Allianz, Prudential and Legal & General are among dozens of lenders now willing to lend on advantageous terms with minimal covenants.

Athene, the insurance arm of private equity group Apollo Global Management, has also become a huge lender. It was one of the lenders that bought $1bn in debt sold by Global Infrastructure Partners for between 10 and 20 years that carried coupons ranging from 2.7 to 3.25 per cent.

The market may cool as rates rise. When Warburg Pincus closed its $1.5bn debt offering in late September, the 10-year Treasury yield was just 1.37 per cent. It has since risen by about half a percentage point.

The activity, however, shows that even privately held firms are being treated by debt buyers as A-rated corporations.

“What people have realised is there is staying power in private equity businesses beyond their founders or key men,” said Lombardo of Houlihan Lokey. “It is almost impossible to knock a strong-performing private credit or private equity fund out of business in two or three years.”

Additional reporting by Kaye Wiggins in London