Sterling’s muted reaction to the crisis engulfing Boris Johnson is a sign that the UK currency may be starting to lose some of its sensitivity to the twists and turns of politics, investors and analysts say.

The prime minister is facing calls to resign over allegations of lockdown parties in Downing Street, while MPs in his own party are plotting to remove him from Number 10. But the saga has so far not spilled into financial markets, with the pound — which over the past half decade has frequently served as a barometer of political instability — barely wavering.

Sterling enjoyed a strong start to the year, buoyed by the Bank of England, which in December became one of the first major central banks to raise interest rates following the pandemic and is expected to do so again next month. The currency climbed to its strongest level against the euro in nearly two years, while also hitting a near three-month high of more than $1.37 to the US dollar.

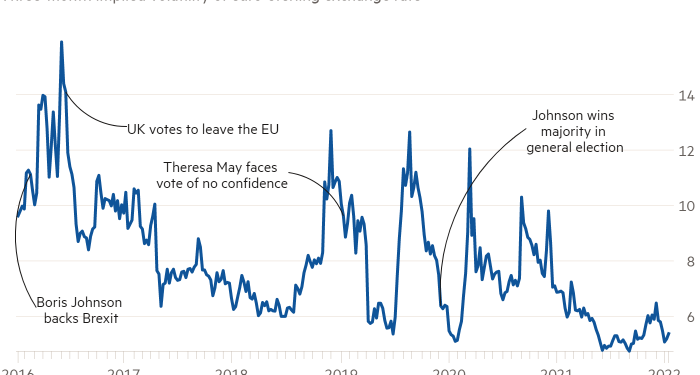

Although the pound has given back some of those gains over the past week, there is little evidence that currency markets are bracing for a political shock. Option prices show that the premium being paid by investors to protect themselves against swings in sterling has fallen sharply since the BoE surprised markets by keeping interest rates on hold in November and is close to an all-time low.

The situation contrasts with numerous occasions since the 2016 Brexit referendum when this premium — known as implied volatility — spiked ahead of Brexit deadlines or unpredictable elections. In October of that year, HSBC analysts said the currency had become the “de facto opposition to the UK government”.

“I haven’t seen much evidence that sterling has reacted to politics this year,” said Ugo Lancioni, head of currency management at Neuberger Berman. “Volatility is at an exceptionally low level.”

Lancioni thinks that a change of prime minister would knock the pound in the short term, but argues that prospect is difficult for investors to act on today.

“Political uncertainty is a negative, but what’s the right time for the market to focus on that?”, said Lancioni. “Very few people are willing to take bets with so many other factors driving things up and down.”

According to some analysts, the stakes of the current political row are lower in economic terms compared with upheavals during Theresa May’s time as prime minister. When May faced repeated threats to her leadership, for example, the terms of Britain’s departure from the EU were still up for grabs.

“We would get 1 per cent moves in sterling from Theresa May having a cough,” said Jordan Rochester, a currency strategist at Nomura. “But that’s because we knew if she fell it would lead to a harder Brexit and potentially a very different economic outcome.”

“I’m not sure that’s as true today. If we see Liz Truss or Rishi Sunak take over I don’t think they’ll be leading us back into the EU customs union.”

Johnson has form when it comes to stirring up currency markets. His decision to back Brexit in February 2016, handing the leave campaign a popular figurehead, sparked a 2 per cent decline in the pound which drove it to a seven-year low against the dollar. The currency fell further following the June 2016 referendum.

Sterling’s failure to recover most of those losses is in part a sign that investors have grown used to UK political instability over the past half decade, according to Jane Foley, head of foreign exchange strategy at Rabobank.

“The fact that we haven’t reclaimed those levels suggests investors are used to political noise, and there’s a fair amount of anxiety regarding the post-Brexit environment baked into the price,” Foley said. Trying to profit from Johnson’s precarious position is risky, given that he could be replaced by a less controversial or more pro-business figure who would enjoy the safety of the Conservatives’ solid majority in parliament, she argues.

“If we were to return to a more strong and stable government you could actually see sterling rally from here,” Foley said.

In any case, investors’ attention is elsewhere. Markets are now pricing in four UK interest rate increases by the end of 2022, with the chance of a fifth. Investors say the main driver of the pound’s performance is likely to be whether the BoE makes good on those expectations — rather than Johnson’s travails.

“Political developments very often have shorter and less impact on markets than economic developments and we think that the main influencing factors for the pound are the behaviour of the BoE, the inflation and interest rate developments and the expectation of a peak in the Omicron wave,” said Andreas Koenig, head of global FX at Amundi, who is positioned for a weakening of sterling against the dollar.

“These factors will remain in focus and will be far more important than political uncertainties.”