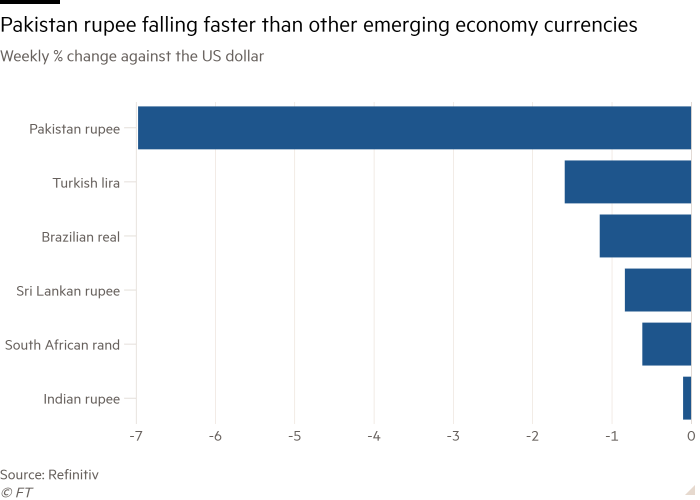

Pakistan’s currency is on track for its worst week in more than two decades, reflecting investors’ worries that the country risks following Sri Lanka to become the next emerging economy to default on foreign repayments.

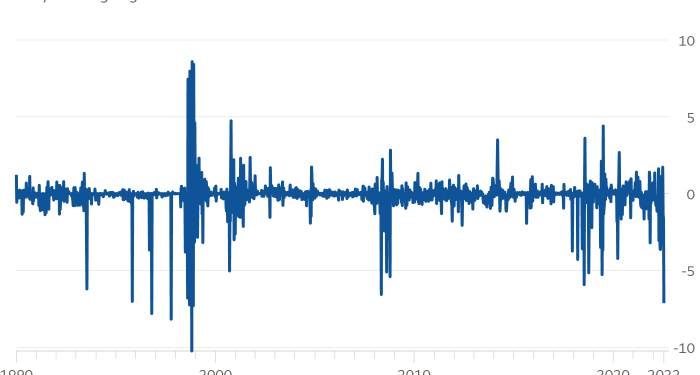

The nearly 7 per cent tumble of the Pakistani rupee to Rs226 to the dollar by Thursday marked the latest setback for the currency, which has fallen sharply this year. If there is no recovery on Friday, it would be the rupee’s sharpest weekly fall since November 1998.

The latest slide reflected mounting concerns that a $1.2bn loan disbursement from the IMF agreed last week might not be enough to avert a balance of payments crisis. Pakistan’s bonds have been among the worst performers in emerging markets this year.

Sri Lanka’s economic collapse and default on its foreign debt in May led to a full-blown political crisis last week, forcing then-president Gotabaya Rajapaksa to flee mass protests into exile.

Sri Lanka’s fall was one of the most stark manifestations yet of a broader fragility in emerging markets, which are feeling the brunt of greater risk aversion among investors and higher commodity prices and interest rates.

However, Pakistan’s larger population, strategic location, and nuclear-armed status mean that a financial crisis there would have more serious implications, analysts said.

“The international fallout from Pakistan’s internal collapse would be much bigger than Sri Lanka,” said Hasan Askari Rizvi, a Pakistani commentator on national and security affairs. “I think there are many outside [powers] who would want to avoid an outright disaster in Pakistan created by an economic collapse.”

Fitch Ratings this week downgraded its country outlook to negative from stable, noting what it called a “significant deterioration in Pakistan’s external liquidity position and financing conditions” this year.

The rating agency said the central bank’s forex reserves had declined to about $10bn by June 2022, down from $16bn a year previously and equivalent to just over one month’s worth of current external payments.

Pakistan’s central bank raised its main policy interest rate 125 basis points to 15 per cent on July 7 in an effort to stem demand for foreign currencies and reduce inflation.

As in Sri Lanka, Pakistan’s growing financial distress is having political repercussions. To meet the terms of a $6bn lending package agreed with the IMF in 2019, Prime Minister Shehbaz Sharif’s government has withdrawn fuel and energy subsidies, causing prices to soar. The subsidy withdrawals have added to the impact of world market price increases caused by the war in Ukraine.

Public anger at soaring prices has already fuelled an electoral upset. On Sunday, voters in Punjab province, Pakistan’s most populous region, handed victory to the party of former prime minister Imran Khan, who was ousted in April. Khan this week called for early elections, and on Wednesday said Pakistan was teetering toward an “economic collapse”.

“We do expect political risk and political volatility to remain quite heightened in the run-up to the next election,” said Grace Lim, analyst with Moody’s, which downgraded its outlook for Pakistan to negative last month. In a research note last week, the credit agency said the country’s ability to complete its current IMF programme “remains highly uncertain”.