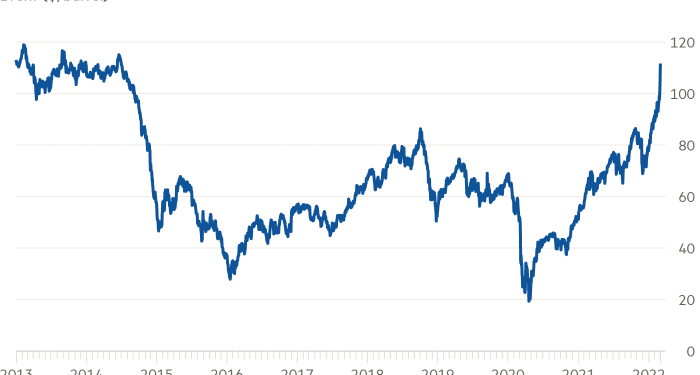

Big energy consumers are boycotting Russian crude following Moscow’s invasion of Ukraine in moves that helped to push oil prices above $113 a barrel on Wednesday.

Opec’s continued resistance to calls to boost oil output added to upward pressure on prices, after the group said it was sticking to a plan agreed last year to only gradually reverse pandemic-linked production cuts.

Demand for Russian oil has collapsed since the assault on Ukraine began as refineries, banks and shipowners shun the country’s vast commodities market. Energy Aspects, a consultancy, said 70 per cent of Russian crude was “struggling to find buyers”.

Energy markets have largely been spared from sanctions deployed by the US, EU and UK on Russia’s financial sector, but typical buyers are effectively self-sanctioning, setting off a race to secure alternative supplies in an already tight market.

“Most European majors are not touching Russian oil, and only a few European refiners and trading firms are still in the market, but spiking freight rates and war insurance premiums are significantly complicating transactions,” Energy Aspects said. “Several shipowners have reportedly been unwilling to make bookings from the Baltic or Black Sea due to the lack of war insurance.”

Despite the disruption to Russian exports, the Opec+ alliance, which includes Russia, said it would not expand a plan agreed last July to increase monthly production by 400,000 barrels a day. As oil prices have rallied since August, rising to an eight-year high, the US and other major oil consumers have repeatedly called on the cartel to boost output more quickly to help calm inflation.

The latest price rally had been caused by “current geopolitical developments” and not by changes in market fundamentals, Opec+ said, confirming that it will continue with the current plan in April.

Brent crude, the international oil marker, rose almost 8 per cent to above $113 a barrel on Wednesday.

In a sign that pressure in commodities was not limited to oil, European natural gas prices surged 50 per cent on Wednesday to an all-time high of €185 a megawatt hour.

Germany’s economy minister Robert Habeck said on Wednesday the worst-case scenario had “not yet materialised” and Russia was still sending gas. But he added the country had to be prepared and might have to keep coal-fired power stations running as back up. Russia supplies about 40 per cent of Europe’s gas.

Russia is the world’s third biggest oil producer behind the US and Saudi Arabia and it typically exports about 7.5mn b/d as well as other energy products. Europe is the largest home for Russian crude oil, with about 53 per cent of it ending up there, according to ING. Asia is another significant buyer, with 39 per cent going into the region.

Russia’s flagship Urals crude is a staple for refiners in north-west Europe and the Mediterranean. Buyers include Germany, Italy, the Netherlands, Poland, Finland, Lithuania, Greece, Romania, Turkey and Bulgaria, according to S&P Global Platts, a commodity price reporting agency.

However, a number of European refiners, including Finland’s Nestlé and Preem of Sweden, are turning away from Russian grades and looking for supplies elsewhere. There are also reports of Indian refiners asking traders to source non-Russian supplies.

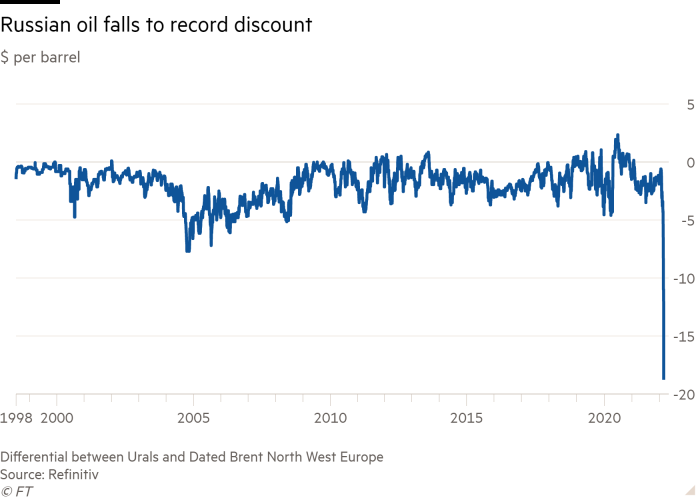

Urals was trading at a discount of more than $18 a barrel on Wednesday to physical Brent in north-west Europe, a record in the post Soviet era.

“Oil price differentials are reflecting a clear unwillingness to take Russian crude, and there continues to be a risk of more sanctions that could indirectly or directly impact oil purchases or supplies,” said Shin Kim, head of oil supply and production analysis at S&P.

Michael Tran, analyst at RBC Capital Markets, said traders were running into difficulty obtaining letters of credit — bank documents used on behalf of a buyer that act as a guarantee of payment to a seller — to purchase Russian oil.

“This will probably remain the case as potential buyers struggle to secure guarantees from banks,” he said. “Tanker rates are [soaring] as consuming countries scramble to secure physical barrels from elsewhere.”

The US and other big energy consuming nations on Tuesday agreed to release 60mn barrels of oil from their emergency stockpiles to address fears over disruption to Russian supplies.

However, traders and analysts said the move was far below the levels needed to calm the market. “As a one-off crude release, it is dwarfed by the extraordinary magnitude of Russia’s export disruptions,” said Ehsan Khoman, head of emerging markets research at MUFG.

“The market’s critically depleted inventories and thinning spare capacity levels in the face of a record long unresolved deficit ultimately leaves one lever to rebalance oil markets — demand destruction.”

Opec and its allies, which include Russia, are due to meet later on Wednesday to discuss production levels. In spite of the turmoil in oil markets the cartel is expected to stick with its plan to increase output by 400,000 b/d in April. Other Russia-centric commodities have also been boosted by conflict in Ukraine with aluminium trading at a record high on Wednesday and grain prices rising.