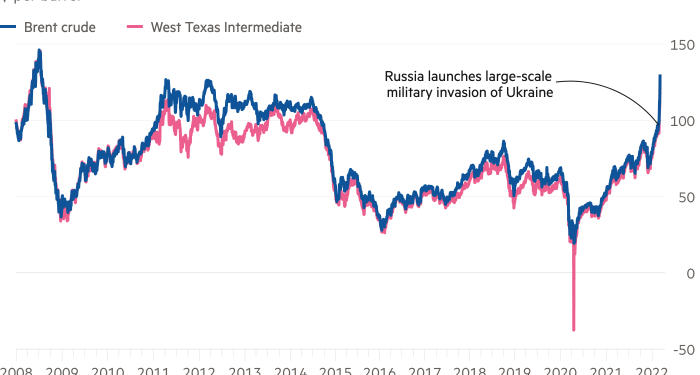

The price of Brent oil soared to almost $140 a barrel, its highest price since 2008, in early trading on Monday, after reports that western countries were discussing a possible embargo on crude supplies from Russia, the world’s second-biggest exporter.

The price spike came after US secretary of state Antony Blinken said on Sunday that Washington was in “very active discussions” with European allies about a ban on Russian oil exports.

The move would signify a new escalation in the west’s efforts to punish Russia — whose economy remains heavily dependent on oil and gas exports — for its invasion of Ukraine. It also marks a reversal for the White House, which has repeatedly said new sanctions would not target Russian oil and gas flows.

Russia exports almost 5m barrels a day of crude, or about 5 per cent of total world demand, and is a crucial supplier of refined petroleum products to Europe and elsewhere.

Analysts have said the loss of Russian supplies could push prices to record highs by removing barrels from an oil market that has been left exceptionally tight by rising post-pandemic consumption and tepid supply growth.

“This rocket ride for crude shows that despite the rhetoric by a few that the world can go without some or all Russian crude in the near term, the market disagrees,” said Jamie Webster, a fellow at Columbia University’s Center on Global Energy Policy.

Blinken told NBC on Sunday that he had spoken to US president Joe Biden and the cabinet about the possible new sanctions on Russia’s oil.

International benchmark Brent hit $139.13 a barrel in early trading on Monday, almost 20 per cent above its settlement price on Friday, as traders reacted to Blinken’s remarks. Brent’s surge took it to within about $6 of its all-time high in July 2008. US crude oil futures also soared, trading above $130. Both benchmarks pared some of their gains later, with Brent falling back beneath $130.

Banning imports of Russian oil into the US and allies could be less significant than a move to impose a blanket international embargo on Russian supplies through secondary sanctions, say analysts. But uncertainty about the severity or range of new measures, amid a growing political clamour in the US for more punitive sanctions, has spooked global crude markets.

Shippers of Russian crude were last week forced to sell at steep discounts in an effort to secure buyers that are now concerned about counterparty risk and legal jeopardy. Oil supermajor Shell was among the buyers taking advantage of the discount last week.

The US and other International Energy Agency member countries last week announced that they would release more than 60mn barrels of oil stored in emergency stockpiles in a bid to prevent oil supply shortages and cool prices. The US and other countries are also negotiating a nuclear pact with Iran that could lift sanctions on Iranian crude oil exports.

Slower-than-expected progress in talks with Iran over the weekend also helped push up oil prices on Monday morning.

Petrol prices have surged in consumer countries in the recent weeks on the back of the spiking oil price, with the average price paid in the US now above $4 a gallon, close to the record high set in 2008.