Two things to start:

-

Energy traders in Europe want government cash to keep commodity markets running smoothly.

-

Myles had the scoop on the SEC forcing Occidental Petroleum, one of the US’s largest oil producers, to face an activist shareholder vote over its climate plans.

Welcome back to another Energy Source.

Oil prices continued their recent downward push again on Wednesday, with Brent crude dipping below $98 a barrel, off more than $40 a barrel from its high a little more than a week ago.

Prices dropped on the FT’s reporting that “significant progress on a tentative peace plan” had been made between Russia and Ukraine, signalling a potential off-ramp for the conflict was being constructed. The US Energy Information Administration also showed a surprisingly big increase in crude storage levels on Wednesday, adding to the downward pressure on prices.

In our first item, Derek has more on the state of oil. The International Energy Agency is warning of the “biggest supply crisis in decades” as the fallout from Russia’s invasion of Ukraine upends energy markets.

Next, America’s solar industry says a course correction is badly needed to get the sector back on track. I reported on how it is taking a page out of the fossil fuel industry’s book, using “energy independence” rhetoric to push for incentives that can kick-start growth.

Finally in Data Drill, Amanda has a survey of America’s oil patch, where the surging price of crude has turned the mood optimistic again and brought growth back to the top of the agenda.

Don’t forget to register for our Energy Source Live Summit in Houston (and online) on April 7, when we will take a deep dive into the issues set to reshape the US energy industry in the years to come.

Thanks for reading! — Justin Jacobs

IEA lays out effects of oil market turmoil

Russia’s invasion of Ukraine, subsequent sanctions, and China’s Covid-19 outbreak have injected a fresh wave of volatility into oil markets. The latest report from the IEA, not historically an alarmist forecaster, spells out some of the perils — with both deeply bullish and deeply bearish implications. Here are some of the main takeaways.

Russia’s invasion of Ukraine could trigger a price shock

From April onward, Russian oil production could fall by 3mn barrels a day — 3 per cent of the world’s market — as sanctions bite and buyers shun the country’s supply, the IEA believes. Exports would fall by 2.5mn b/d. It means “a global oil supply shock” is now plausible, with “lasting changes to energy markets” including a faster transition from oil.

Iran and Venezuela barrels can help, but not quickly

Sanctions relief on Venezuela and Iran could help replace the Russian losses — but not quickly. The IEA says Iran could increase supply by “more than 1mn b/d within six months”. Venezuela could add 200,000-300,000 b/d in three to four months. In total, extra oil from the two countries could plug about half of the gap left by Russian losses, according to the IEA.

“Only Saudi Arabia and the UAE hold substantial spare capacity that could immediately help offset a Russian shortfall,” the agency notes. Neither appears minded to do so yet.

Refiners will struggle at the wrong time

The loss of Russian barrels will leave refiners, especially in Europe, “scrambling to source alternative supplies and risk having to reduce activity just as very tight oil product markets hit consumers”. Diesel supplies are already thin — and will be stretched even further. According to the IEA:

The rich world’s stock of stored oil is draining fast

The upshot of all this is a rapid depletion of global oil inventories — the underlying reason for $100 a barrel oil, and a huge reversal from the glut of two years ago. At January’s end, OECD stocks were already well below the five-year average, and at their lowest level since April 2014, says the IEA. Preliminary data showed that supplies depleted quickly again in February.

The crisis could hit global GDP growth and oil demand

The resulting commodity price surge and economic hit from sanctions “are expected to appreciably depress global economic growth”, says the IEA, which has cut almost 1mn b/d from its oil demand forecast this year. Consumption will still rise, but by just 2.1mn b/d, to average 99.7mn b/d in 2022 — still below the pre-pandemic annual peak.

Opec, by contrast, is sanguine. Russia’s invasion has “added more downside risk” to the global economy in 2022, it acknowledges. But Opec’s demand outlook remains unchanged at 4.2mn b/d, double the IEA’s.

Russia and China are big demand risks of their own

The IEA believes Russian oil consumption could plunge by 315,000 b/d this year — about 9 per cent. Offsetting this, is its forecast for Chinese oil demand to rise by 360,000 b/d. But that assumes China brings the latest Covid outbreak rapidly under control. “If this is not the case . . . Chinese economic activity (and the world supply chain) could be severely disrupted,” the IEA notes. (Derek Brower)

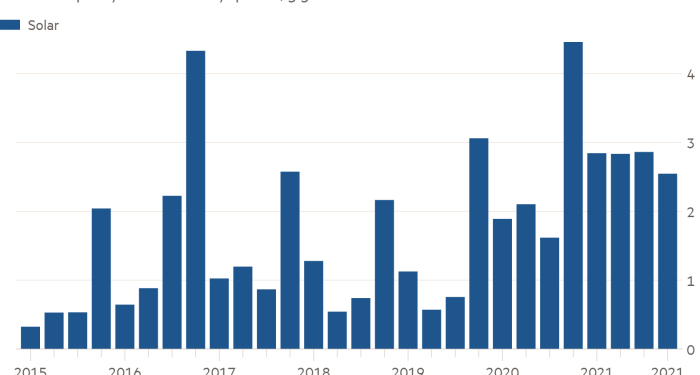

Slow growth plagues US solar industry

America’s solar industry is raising the alarm bells about slowing growth just as the Joe Biden administration is pushing for a massive expansion of the nation’s renewable power.

Solar capacity installations in the fourth quarter last year were about 2.5 gigawatts, the lowest quarter of the year and down 43 per cent year-on-year, according to data from S&P Global Market Intelligence. Now, the slowdown is stretching into 2022.

The industry has been slammed by a supply chain crunch, soaring commodity prices, tariffs and the Biden administration’s trade restrictions on panels and other equipment suspected of coming from the Xinjiang region of China — a big cog in the sector’s supply line.

Costs for new large-scale solar projects were up 18 per cent last year, breaking a long run of significant cost declines, and more than 10 per cent of projects due online this year have been delayed or called off as problems for the sector have piled up, the Solar Energy Industries Association, an industry lobby group, said in a recent report.

The industry is arguing that a course correction is badly needed to get on track to meet the US administration’s ambitious renewables targets — including a carbon-pollution free grid by 2035.

“It’s a story about an industry that is growing. It’s also one that needs to grow at four times its current pace if we are to hit climate targets,” said Abigail Ross Hopper, the SEIA’s president.

“A difficult trade environment, ruptured supply chains and the failure of Congress to pass legislation, is slowing what could be a massive success story.”

The industry wants Congress to pass long-term tax credits for solar projects and support domestic manufacturing to reduce the industry’s reliance on China. Both initiatives were central to the Build Back Better legislation that has all but collapsed in the Senate.

One solar company chief executive told me they saw a path through Congress using the current energy crisis to push for broad legislation that included incentives for renewables and carrots for the oil and gas industry like easier pipeline permitting. “Don’t call it a climate bill, call it an energy bill to get broader support and get it passed,” they said.

A recent report from the consultancy Wood Mackenzie found that with the long-term tax incentives in place, solar installations could rise to 70GW a year by 2030, compared to 11GW last year. That is more than six times higher than a scenario in which the tax incentives are not passed.

Hopper tied the pace of solar expansion to the US’s quest for energy independence, echoing similar arguments from the oil and gas industries.

“We can no longer rely on hostile nations that don’t have our best interests in mind. The United States needs to invest in a diversity of energy resources, and solar and storage represent the best opportunity we have to power our country with clean, local, and reliable energy,” she argued. (Justin Jacobs)

Data Drill

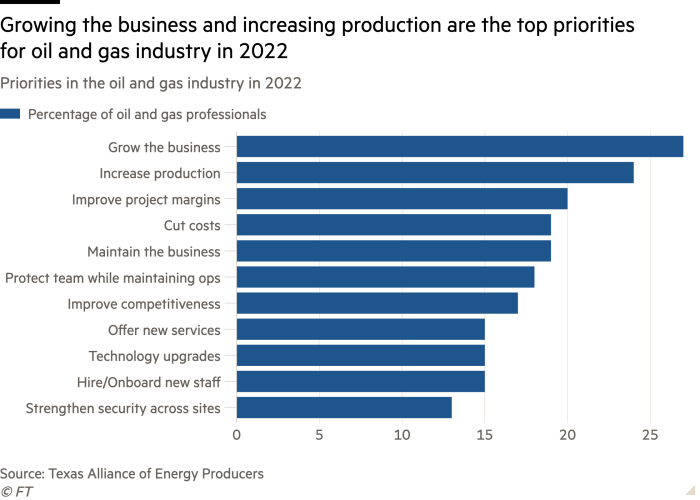

The US oil and gas industry is feeling optimistic about 2022. Over half of oil and gas professionals report feeling “very positive” or “positive” about this year’s business outlook, up from 34 per cent in 2021, according to a new survey conducted by the Texas Alliance of Energy Producers.

“Growing the business” was the top priority among oil and gas respondents, followed by priorities to increase production. Nearly half of oil and gas respondents said their companies would increase drilling in 2022, according to the survey.

It also found that a quarter of oil and gas professionals cited “public opinion” and “environmental activism/over-reach” as one of their top concerns in 2022. The survey comes as energy prices surge worldwide and Big Oil comes under greater scrutiny about its role in facilitating the climate crisis. (Amanda Chu)

Power Points

-

Conceived by Soviet leaders in 1958, the Druzhba pipeline keeps Europe hooked on Moscow’s oil.

-

Schlumberger, Baker Hughes, and Halliburton, the three largest western oilfield services companies, are quietly continuing their operations in Russia.

-

An environmental shareholder group is taking legal action against Shell for its alleged failure to combat climate change.

-

The increasing risk of wildfires is exposing the inadequacies of home insurance. (The Atlantic)

-

New York’s Bank of America Tower, once touted for its green design, is coming under scrutiny for flunking climate law. (Bloomberg)