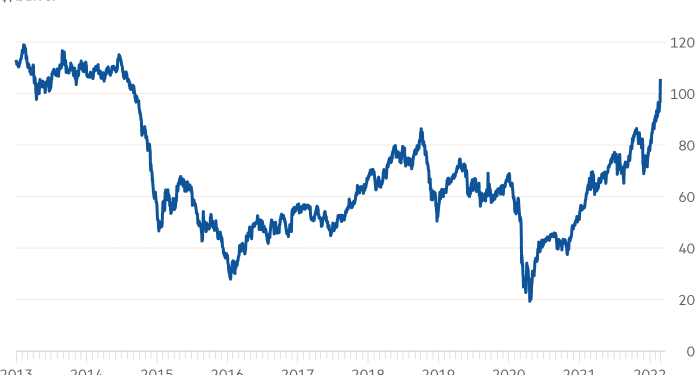

Crude oil burst above $105 a barrel for the first time since 2014 on Thursday while the price of natural gas in Europe jumped more than 30 per cent after Russia attacked Ukraine.

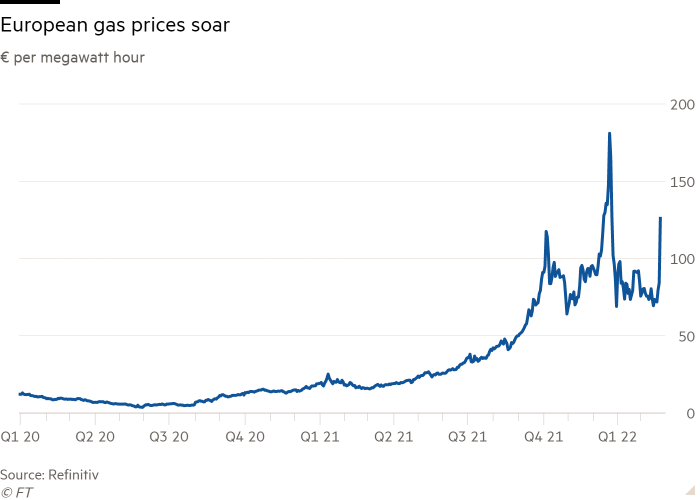

Fears that a war could disrupt global energy supplies sent Brent jumping more than 9 per cent to $105.79 a barrel as futures linked to TTF, Europe’s wholesale gas price, surged 50 per cent to €126 per megawatt hour. The European gas price has jumped from just €16 a year ago.

Russia is a key producer of raw materials, with Europe relying on the nation for about a quarter of its oil and more than a third of its gas. It also the world’s biggest supplier of wheat.

While no new restrictions have been placed on Russian energy companies other than the operator of the Nord Stream 2 gas pipeline, President Biden is meeting G7 leaders later on Thursday to co-ordinate “severe” further sanctions to punish Russia.

Ben Luckock, co-head of oil trading at Trafigura, one of the world’s biggest commodity traders, said the market was waiting to see the extent of further Western sanctions on Russia expected later in the day.

“If there’s a threat to energy flows the oil price can go substantially higher,” he said. “If there’s not we probably don’t come off very far because the risk skew is all to the upside”

Russian crude had already been trading at a discount in the last 48 hours in a sign that buyers, wary of the possible impact of sanctions, had started to avoid Russian cargoes, Luckock added.

Opec, the oil producing cartel, is already struggling to meet its output targets as demand for crude rebounds following the easing of lockdown restrictions. This has already pushed up prices, with analysts warning there is limited capacity to increase supplies if flows from Russia are affected by sanctions. The same is true in gas markets where no single country can replace the kind of volume that Russia can supply.

Gazprom said on Thursday that exports through Ukraine to Europe were continuing. Gas in storage across the continent is already at a five-year low.

“Oil and natural gas prices have become the crisis’ fear barometer,” said Norbert Rücker of Julius Baer. “Any disruption of flows between Russia and Europe, due to damage or sanctions, would drastically add to the already present supply scarcity.”

‘Serious situation’ for agriculture markets

Other commodity markets were also whipsawed by the Russian onslaught in Ukraine.

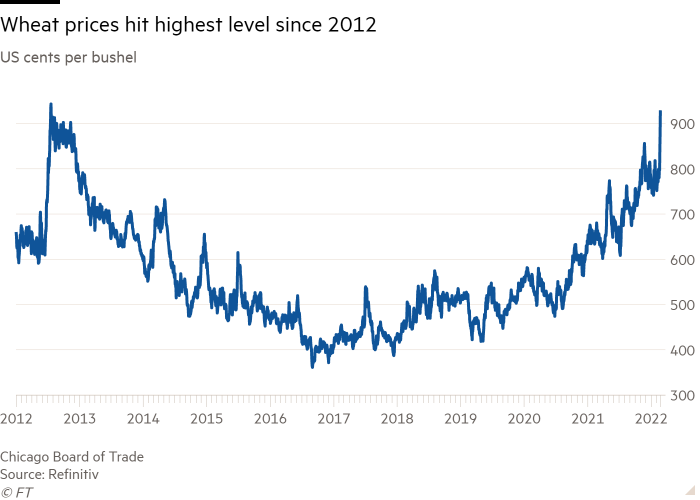

Wheat futures in Chicago jumped almost 6 per cent to $9.26 a bushel, the highest level since July 2012. Russia and Ukraine are leading exporters of grain, producing 14 per cent of global wheat and accounting for just under 30 per cent of all wheat exports. The two countries are also large exporters of corn and sunflower oil.

Fears heightened over supply flows after news that Russia had blocked off the Azov, an inland sea connected to the Black Sea. Both Ukraine and Russia have key loading ports, and the ban on commercial vessels from the Azov to the Black Sea is likely cause havoc on grain and steel markets.

“This is a really serious situation for agricultural markets,” said Dave Whitcomb at commodity specialist Peak Trading Research. “There is fundamental concerns around whether grains will flow out of the Black Sea states, and both wheat and corn markets are just on fire” he added.

Metals prices also rose on Thursday, with aluminium, used in everything from beers cans to cars, rising more than 3.5 per cent to a record high of $3,449 a tonne. Russia is a key producer of aluminium as well as copper, nickel, platinum and palladium.

In 2018, the aluminium market was plunged into turmoil after US slapped sanctions of Rusal and other companies linked to oligarch Oleg Deripaska.

“Russia is a significant producer of commodities so overnight developments in eastern Europe could have material implications for global supply chains,” said JPMorgan analyst Dominic O’Kane.

Elsewhere, gold rose more than 3 per cent to $1,974 a troy ounce, a 17-month high, as nervous investors scoured the market for havens.

The rising gold price, however, offered little support Polymetal. The Russian miner, which is a FTSE 100 constituent, saw 35 per cent sliced off its market value on Thursday as investors dumped the stock on concern about potential sanctions.

“Polymetal believes that targeted sanctions on the company remain unlikely,” the company said in a statement.

Another big loser was Evraz, the steelmaker controlled by Roman Abramovich, the owner of Chelsea football club, and Alexander Abramov. Its shares fell almost 30 per cent.