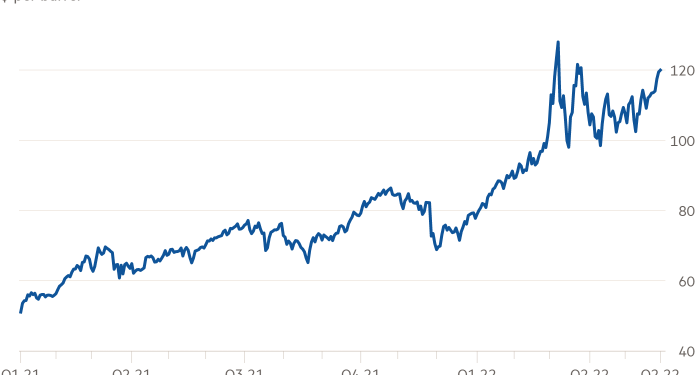

Oil rose higher than $120 a barrel on Monday as increasing prices for fuels, such as gasoline and diesel, combined with lingering concerns over supplies from Russia to propel crude to its highest level in two months.

Brent crude, the international benchmark, hit $120.50 a barrel, up 1 per cent ahead of the July contract’s expiry on Tuesday. US benchmark West Texas Intermediate rose by a similar amount to more than $116 a barrel.

The rally in crude oil comes as supplies of refined products, such as gasoline, remain tight at major delivery hubs at a time when demand is expected to pick up steam in many countries, including the US.

Lower exports of diesel from Russia, which many western companies are shunning or cutting back on following the invasion of Ukraine, have tightened markets even more so than crude.

The gas oil contract in Europe, a proxy for diesel and other distillates, is trading close to record levels near $1,200 a tonne.

Sky-high product prices mean that motorists in many countries are paying record prices for diesel and gasoline despite crude being well below its all-time high of $147.50 a barrel, which it hit in 2008. The key US summer driving season kicked off on Monday with the Memorial Day holiday.

An easing of Covid-19 restrictions and government subsidies have both helped to support demand, said Keshav Lohiya at consultancy Oilytics.

“Despite record high prices in local currencies, political decisions like subsidies continue to distort the market,” said Lohiya. “In addition, post-Covid demand continues to keep mobility very high in Europe, especially with the run-up to summer.”

In a sign of pressures on the market, traders are willing to pay a premium to secure supplies immediately because of tightness in the market. Brent for delivery in July is trading at a roughly $4 premium compared with August.

Analysts are also monitoring any EU decision on restrictions or an outright embargo on Russian oil purchases in the coming days. Bloc members are due to meet on Monday and Tuesday. A full ban on Russian oil purchases has been opposed by some members such as Hungary, but the EU is keen to increase pressure on Russia.

An EU leader’s summit starting on Monday evening is expected to vow to include oil and petroleum products in a sanctions package, but will allow a “temporary” exemption for crude delivered by pipeline, according to draft conclusions seen by the Financial Times.

Reticence from the Opec+ group to accelerate oil production increases is also supporting prices. The group meets on Thursday and is widely expected to stick with its plan of raising production by about 400,000 barrels a month, a target that has been in place since last year.

Concerns about shipping through the Strait of Hormuz, through which a third of seaborne oil exports pass every day, after Iran seized two Greek-flagged tankers on Friday, have added to factors boosting the price.

Greece, which has more supertankers sailing under its flag than any other country, has warned Greek oil tankers and other vessels to avoid sea waters close to Iran.