This time last week, financial markets seemed to be having a moment. Following a new variant-related sell off in travel, energy and financials, speculative tech stocks in the US were collapsing, dragging indices down with them, bond yields were falling and the Vix had spiked to 31 — its highest reading since January. A crypto crash shortly followed in the wee hours of Saturday morning. Like 2018’s infamous December sell-off, it seemed we were heading for a turbulent year-end in markets.

Indeed this one FT Alphavillain was almost certain of it.

And that was the problem. You see, as soon as you feel certain in markets, you’re sure to get caught with your metaphorical trousers down. And so it was with the markets this week, when a reverse kicked into gear. Stocks up, yields up, crypto bounce, and Vix down. The fear left just as fast as it arrived. And, once again, we were wrong.

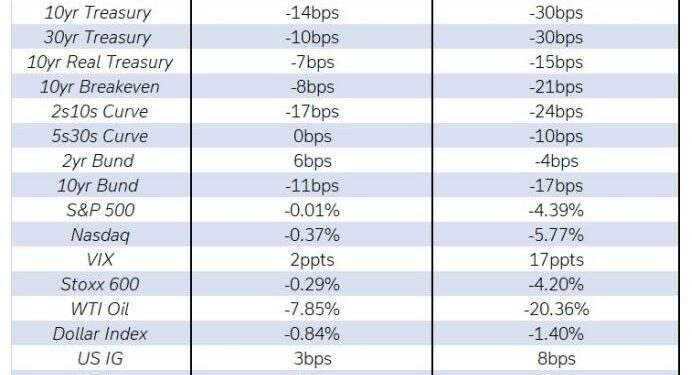

The level of this reversal is neatly surmised by a table that just landed in our inbox from Deustche Bank’s macro master Jim Reid. Just look at the level of reversals in two short weeks:

Not every asset class has been immune from the variant, however. You might note that oil is still down 7 per cent from its November highs, although that might have more to do with Saudi’s recent decision to turn on the faucet than Omicron. (God that word is a pain to spell, anyway).

The same goes for reopening names. For instance, the Stoxx Travel and Leisure index is down 15 per cent this quarter, and 4 per cent over the past fortnight, with the airliners suffering the worst of it. But unless you’ve set up your portfolio to tilt towards these companies that shouldn’t bother you too much.

Anyway, it seems we’re back to business as usual in markets. May the grind higher long continue.