US stocks resumed their slide on Wednesday after unexpectedly hot “core” inflation data raised expectations for aggressive policy tightening, pushing the tech-heavy Nasdaq Composite down nearly 30 per cent from its record high.

Growth stocks that are regarded as particularly sensitive to rising rates led the declines, with the Nasdaq falling 3.2 per cent. The blue-chip S&P 500, which had rallied as much as 1.2 per cent earlier in the trading session, ended the day 1.6 per cent lower.

Consumer prices in the world’s largest economy rose at an annual rate of 8.3 per cent in April, down from 8.5 per cent in March but remaining at a historically elevated level. The figure surpassed economists’ expectations for a cool-down to 8.1 per cent. The month-on-month change in core inflation — which excludes food and energy prices and is closely watched by economists — also exceeded forecasts at 0.6 per cent.

Rising costs of new cars, food, airline fares and housing were the biggest drivers of the increase in consumer prices, the US labour department said.

As consumer prices have surged, traders expect the Fed to raise interest rates aggressively for the rest of this year, which has placed short-term US government debt under pressure.

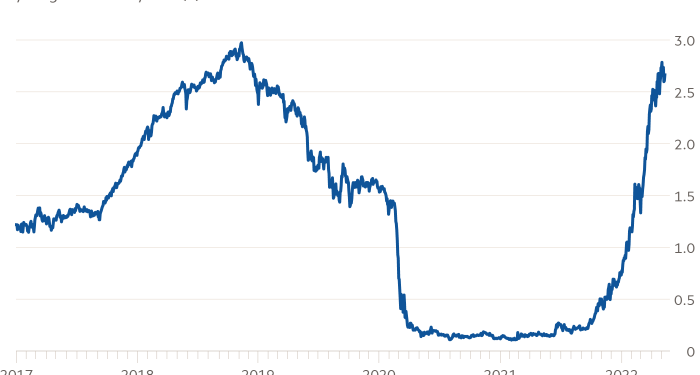

The yield on the two-year Treasury note, which is particularly sensitive to monetary policy, rose 0.03 percentage points to 2.64 per cent, from below 0.2 per cent a year ago. Yields rise when prices fall.

In contrast, the 10-year Treasury yield, which is driven by longer-term economic trends, shed 0.06 percentage points to 2.93 per cent.

Read more on the day’s market moves here.