Turkey’s lira continued its slide towards a record low after President Recep Tayyip Erdoğan vowed once again to cut interest rates despite spiralling inflation.

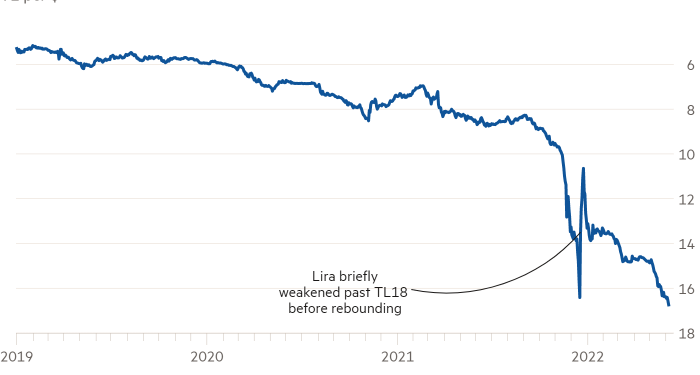

The currency fell to 16.75 against the dollar on Tuesday after Erdoğan, a life-long opponent of high borrowing costs, launched an impassioned tirade against them.

The Turkish president said that the country had “wasted years” with the misguided view that prices should be controlled by using higher borrowing costs to suppress consumption. Such policies, he said, only benefited “those living a charmed existence and filling their pockets with [the proceeds of] high interest”, including foreign investors.

Erdoğan promised to further cut interest rates even though inflation reached a 23-year high of 73.5 per cent last month, saying: “This government will not raise interest rates. On the contrary, we will continue to cut rates.”

The lira fell about 1.2 per cent on Tuesday, bringing its losses for the year to 20 per cent after falling almost 45 per cent in 2021.

The currency’s steady decline in recent weeks has threatened to test the record lows hit in December, when the country was thrust into a currency crisis after Erdoğan ordered the central bank to announce a series of interest rates cuts despite rising inflation. Besides a fleeting decline past TL18 during last year’s rout, the currency has never consistently traded at such weak levels.

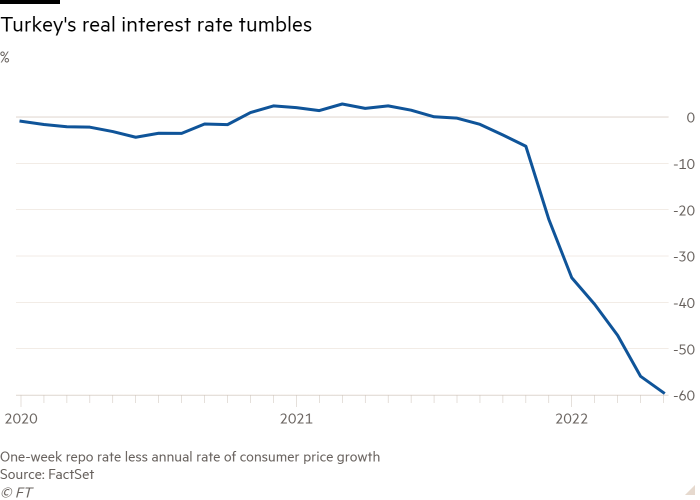

Turkey has one of the world’s lowest interest rates in real terms, standing at minus 59.5 per cent once inflation is taken into account. Negative real interest rates have deterred Turkish citizens from keeping their savings in lira, and have tarnished the allure for foreign investors of holding Turkish assets compared with emerging market rivals.

Erdoğan and senior Turkish officials justified last year’s aggressive rate cuts by arguing that they were pursuing a “new economic model”. They argued that they would be able to tame inflation by harnessing the weak currency to boost exports and investment and eliminate the country’s longstanding trade deficit.

Even before Vladimir Putin’s invasion of Ukraine, critics warned that the plan was a risky economic experiment that was in danger of causing a collapse in the value of the Turkish lira and runaway inflation.

The conflict has compounded the challenges facing Turkey, which imports most of its energy, by pushing up global oil and gas prices and causing a widening current account deficit that has created extra demand for foreign currency.

MUFG analysts Ehsan Khoman and Lee Hardman said in a note to clients this week that it was “unambiguously unsustainable” for Turkey to maintain this approach, warning that the pressure on the currency was “likely to continue in the absence of a policy U-turn”.

The soaring inflation rate has also come with political ramifications for Erdoğan. While Turkey has enjoyed strong growth thanks to loose monetary policy, the escalating cost of living and the pressure on the lira have eroded public support for the Turkish president ahead of elections that must take place before June 2023.

Erdoğan on Monday acknowledged that there was a “cost of living problem” in his country, but insisted that his economic model would soon pay dividends. He said: “We have cast aside the economic prescriptions imposed by imperialist financial institutions that make the rich richer and make the poor poorer by increasing the interest rate.”